Peer-to-peer lending sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. Get ready to explore the world of lending in a whole new light.

As we delve deeper, we uncover the inner workings of peer-to-peer lending, shedding light on its benefits, risks, and everything in between.

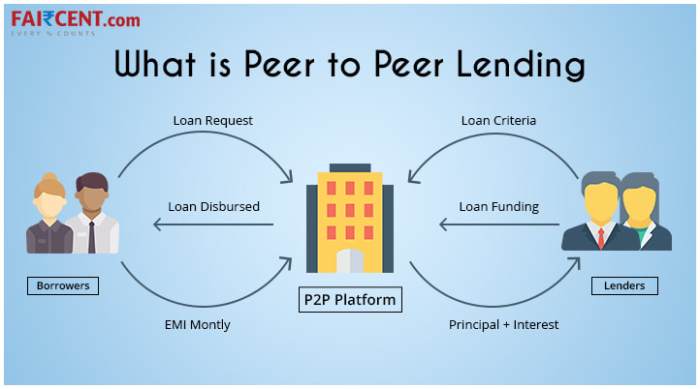

What is Peer-to-peer lending?

Peer-to-peer lending is a form of lending where individuals or businesses can borrow money directly from other individuals or investors without involving a traditional financial institution like a bank. This type of lending is usually done through online platforms that connect borrowers with lenders.

Examples of popular peer-to-peer lending platforms

- LendingClub: One of the largest peer-to-peer lending platforms that offers personal loans, business loans, and patient financing.

- Prosper: Another well-known platform that provides personal loans for various purposes.

- Upstart: Focuses on personal loans for younger borrowers or those with limited credit history.

How peer-to-peer lending differs from traditional lending

- In peer-to-peer lending, borrowers can often get lower interest rates compared to traditional banks, as there are fewer overhead costs involved.

- Peer-to-peer lending offers more flexibility in terms of loan approval criteria, making it easier for individuals with less-than-perfect credit to borrow money.

- Traditional lending institutions like banks have stricter regulations and processes in place, which can make it harder for some borrowers to access loans.

Benefits of Peer-to-peer lending

Peer-to-peer lending offers several advantages for both borrowers and investors. Let’s dive into the benefits of this alternative lending method.

Advantages for Borrowers:

- Lower Interest Rates: Peer-to-peer lending platforms often offer lower interest rates compared to traditional banks, making it more affordable for borrowers.

- Faster Approval Process: Borrowers can get approved for loans more quickly through peer-to-peer lending, as the process is streamlined and less bureaucratic.

- Flexible Terms: Borrowers have access to a variety of loan options with flexible terms, allowing them to choose the best fit for their financial needs.

- Accessibility: Peer-to-peer lending provides opportunities for borrowers who may have difficulty obtaining loans from traditional financial institutions due to credit history or other factors.

Benefits for Investors:

- Higher Returns: Investors can potentially earn higher returns through peer-to-peer lending compared to traditional investment options like savings accounts or CDs.

- Diversification: Peer-to-peer lending allows investors to diversify their investment portfolio by spreading their funds across multiple loans, reducing risk.

- Control: Investors have the freedom to choose which loans to fund based on risk levels, loan terms, and borrower profiles, giving them more control over their investment strategy.

- Passive Income: Peer-to-peer lending offers investors the opportunity to generate passive income through interest payments from borrowers, providing a steady stream of cash flow.

Comparison of Interest Rates:

Peer-to-peer lending platforms typically offer competitive interest rates for both borrowers and investors, often lower than those provided by traditional banks. This makes peer-to-peer lending an attractive option for individuals looking to borrow money or grow their wealth.

Risks associated with Peer-to-peer lending

Peer-to-peer lending, while offering attractive returns to investors and easy access to loans for borrowers, also comes with its fair share of risks that participants should be aware of.

Default Risk

- One of the primary risks in peer-to-peer lending is default risk, where borrowers fail to repay their loans.

- Investors may face losses if a significant number of borrowers default on their loans.

- To mitigate this risk, investors should diversify their investments across multiple loans to spread out the risk.

Interest Rate Risk

- Changes in interest rates can impact the returns generated by peer-to-peer lending investments.

- If interest rates rise, existing loans with lower rates may become less attractive, affecting investor returns.

- Investors can mitigate interest rate risk by diversifying their investments across loans with varying interest rates.

Platform Risk

- Peer-to-peer lending platforms are intermediaries between borrowers and investors, and their financial stability is crucial.

- If a platform goes bankrupt or faces regulatory issues, investors may face challenges in recovering their funds.

- Investors should research and choose reputable platforms with strong track records to reduce platform risk.

Regulatory Challenges

- The peer-to-peer lending industry is subject to evolving regulatory frameworks that vary by jurisdiction.

- Regulatory changes can impact the operations and profitability of peer-to-peer lending platforms.

- For example, some jurisdictions may impose restrictions on the types of loans that can be offered or set limits on interest rates.

Peer-to-peer lending process

Peer-to-peer lending process involves the steps borrowers take to access funding and how investors select loans to invest in on peer-to-peer lending platforms. The platform plays a crucial role in facilitating transactions between borrowers and investors.

Steps involved in borrowing money through a peer-to-peer lending platform

- Create an account on the peer-to-peer lending platform.

- Submit your loan application, providing details such as the amount needed, purpose of the loan, and repayment terms.

- The platform assesses your creditworthiness and assigns you an interest rate based on your risk profile.

- Once approved, your loan request is listed on the platform for investors to review and potentially fund.

- Investors fund your loan by contributing small amounts that collectively cover the total loan amount.

- You receive the funded amount in your bank account and start making repayments according to the agreed-upon terms.

How investors can select loans to invest in on peer-to-peer lending platforms

- Investors can browse through the available loan listings on the platform, each detailing the borrower’s profile, loan purpose, amount, and interest rate.

- Investors can diversify their investments by spreading their money across multiple loans to minimize risk.

- They can use filters and search options to narrow down loan listings based on criteria such as credit score, loan term, and risk level.

- Investors can review the historical performance of borrowers to gauge their repayment behavior and make informed decisions.

- Once an investor selects a loan to fund, they contribute a portion of the total amount and start earning returns as the borrower repays the loan.

Role of the platform in facilitating transactions between borrowers and investors

- The platform acts as a marketplace where borrowers and investors can connect without involving traditional financial institutions.

- It provides a secure and transparent environment for loan transactions, handling payments, communications, and loan servicing.

- The platform uses algorithms to match borrowers with suitable investors based on their preferences and risk profiles.

- It ensures compliance with regulations, verifies borrower information, and facilitates the transfer of funds between parties.