Financial yield calculation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Dive into the world of finance as we explore the intricate process of calculating financial yields with a fresh perspective.

Get ready to unravel the mysteries behind financial yield calculation and discover its significance in the realm of investment analysis.

What is Financial Yield Calculation?

Financial yield calculation refers to the process of determining the return on an investment over a specific period of time. It is a crucial metric used in investment analysis to evaluate the profitability and performance of an investment. By calculating the financial yield, investors can assess the effectiveness of their investment decisions and compare different investment opportunities.

Importance of Financial Yield Calculation

- Helps investors make informed decisions: By calculating the financial yield, investors can analyze the potential returns of an investment and make more informed decisions.

- Assesses risk and return: Financial yield calculation allows investors to evaluate the risk associated with an investment in relation to the potential return.

- Compares investment options: Investors can use financial yield calculation to compare different investment options and choose the one that offers the best return on investment.

Examples of Scenarios

- Real estate investments: Investors use financial yield calculation to determine the return on investment for rental properties or real estate developments.

- Stock market investments: Financial yield calculation is used to evaluate the performance of stocks and assess the profitability of investing in specific companies.

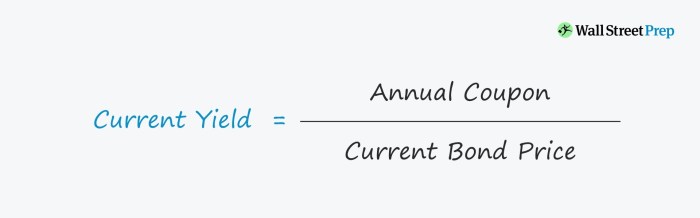

- Bond investments: Investors calculate the financial yield of bonds to understand the annual return they can expect from investing in fixed-income securities.

Methods of Financial Yield Calculation

When it comes to calculating financial yield, there are several methods and formulas that analysts use to determine the returns on investments. Let’s explore the different methods and compare their pros and cons.

Simple Yield Calculation

The simple yield calculation is the most basic method used to determine the return on an investment. It is calculated by dividing the income generated from the investment by the initial investment amount. The formula for simple yield is:

Simple Yield = (Income Generated / Initial Investment) x 100%

Pros:

– Easy to calculate and understand.

– Provides a quick snapshot of the return on investment.

Cons:

– Does not take into account the time value of money.

– Ignores compounding effects.

Real-life Example:

If an investor receives $500 in income from a $10,000 investment, the simple yield would be 5%.

Annual Percentage Rate (APR)

APR is another method used to calculate the yield on an investment. It takes into account the effect of compounding on the investment return. The formula for APR is:

APR = ((Income + Capital Gains) / Initial Investment) x 100%

Pros:

– Considers the effect of compounding on returns.

– Offers a more accurate representation of the actual return on investment.

Cons:

– May not account for other factors affecting the investment return.

– Does not consider the timing of cash flows.

Real-life Example:

If an investor receives $500 in income and $200 in capital gains from a $10,000 investment, the APR would be 7%.

Internal Rate of Return (IRR)

IRR is a more complex method used to calculate the yield on an investment. It considers the time value of money and the timing of cash flows. The formula for IRR involves solving for the discount rate that makes the net present value of all cash flows equal to zero.

IRR is the discount rate that makes the net present value of all cash flows equal to zero.

Pros:

– Accounts for the time value of money.

– Considers the timing of cash flows.

Cons:

– Requires more complex calculations.

– May be difficult to interpret for those unfamiliar with financial analysis.

Real-life Example:

If an investor expects to receive $1,000 annually for five years from a $5,000 investment, the IRR can be calculated to determine the annualized rate of return.

In conclusion, each method of financial yield calculation has its advantages and limitations. Analysts must consider the specific characteristics of the investment and their analysis goals when choosing the appropriate method for calculating yield.

Factors Influencing Financial Yield Calculation

When calculating financial yield, there are several key factors that play a crucial role in determining the final outcome. These factors can significantly impact the overall yield and provide valuable insights into the financial performance of an investment.

Time

Time is a critical factor that influences financial yield calculation. The longer the duration of an investment, the higher the potential yield. This is due to the compounding effect, where the interest or returns earned on the initial investment are reinvested, leading to exponential growth over time. Adjusting the time horizon can have a substantial impact on the overall yield, making it essential to consider the investment’s timeframe carefully.

Risk

Risk is another significant factor that affects financial yield calculation. Investments with higher levels of risk typically offer higher potential returns to compensate for the increased uncertainty. However, this also means that the actual yield can vary significantly depending on market conditions and other external factors. Understanding the risk profile of an investment is crucial for accurately assessing its potential yield and making informed decisions.

Market Conditions

Market conditions play a vital role in determining the financial yield of an investment. Fluctuations in interest rates, inflation, and economic outlook can impact the overall performance of an investment and influence the yield calculation. Changes in market conditions can lead to variations in returns, making it essential to monitor and adapt to the prevailing economic environment.

Adjusting these factors can have a direct impact on the outcome of yield calculations, affecting the overall profitability and risk associated with an investment. By carefully analyzing and understanding the influence of time, risk, and market conditions, investors can make informed decisions and optimize their financial yield potential.

Interpreting Financial Yield

When interpreting financial yield calculations, it’s essential to understand what the results signify in terms of returns on investment. The yield percentage obtained from the calculations indicates the rate of return or profit generated from an investment over a specific period. This information is crucial for investors to evaluate the performance of their investment and make informed decisions.

Significance of High or Low Yields

- High Yields: A high yield typically indicates that the investment is generating significant returns relative to the initial investment. This can be a positive sign for investors, suggesting that the investment is performing well.

- Low Yields: Conversely, a low yield may suggest that the investment is not generating substantial returns or may even be underperforming. It could indicate that adjustments or changes need to be made to improve the investment’s performance.

Yield Interpretations in Investment Decisions

- Example 1: An investor calculates the yield on two different bonds and finds that Bond A has a higher yield than Bond B. This information can guide the investor to choose Bond A as it offers a better return on investment.

- Example 2: A real estate investor analyzes the rental yield on two properties and discovers that Property X has a lower yield compared to Property Y. This insight can help the investor decide to invest in Property Y, which promises higher returns.