Diving into the world of secured vs unsecured loans, this introduction sets the stage for an informative and eye-opening discussion on the nuances of borrowing money. Get ready to explore the ins and outs of these two loan types and how they can impact your financial decisions.

As we delve deeper, you’ll gain a clear understanding of the advantages, disadvantages, and considerations that come into play when deciding between secured and unsecured loans.

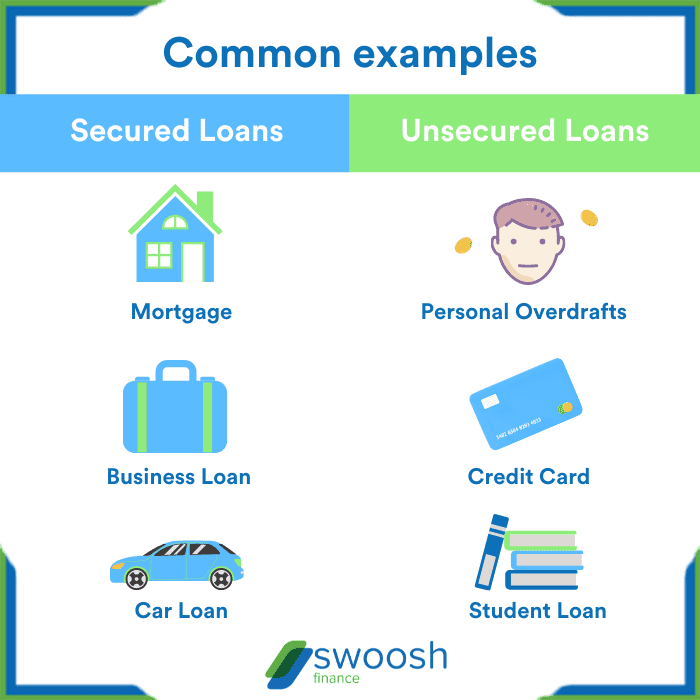

Secured Loans

Secured loans are a type of loan that is backed by collateral, which is an asset that the borrower owns. This collateral acts as security for the lender in case the borrower fails to repay the loan.

Examples of Assets Used as Collateral for Secured Loans:

- Real estate properties

- Automobiles

- Investment accounts

- Jewelry

Advantages and Disadvantages of Secured Loans:

- Advantages:

- Lower interest rates compared to unsecured loans

- Higher borrowing limits

- Easier approval process

- Disadvantages:

- Risk of losing the collateral if unable to repay the loan

- Longer processing time due to valuation of collateral

- Limited flexibility in terms of loan use

Comparison of Interest Rates for Secured Loans with Unsecured Loans:

Secured loans generally have lower interest rates compared to unsecured loans due to the lower risk for the lender. The collateral provided by the borrower reduces the risk of default, allowing lenders to offer more favorable interest rates for secured loans.

Unsecured Loans

Unsecured loans are loans that are not backed by collateral, unlike secured loans which require assets such as a house or car to secure the loan. This means that if the borrower defaults on the loan, the lender cannot automatically take possession of any of the borrower’s assets.

Common Types of Unsecured Loans

- Credit cards: A popular form of unsecured credit that allows borrowers to make purchases up to a certain credit limit.

- Personal loans: These are loans that can be used for various purposes without the need for collateral.

- Student loans: Loans taken out to finance education expenses without requiring collateral.

Eligibility Criteria for Unsecured Loans

- Good credit score: Lenders rely heavily on the borrower’s credit score to determine eligibility for unsecured loans.

- Income stability: Demonstrating a consistent income stream can increase the chances of approval for an unsecured loan.

- Debt-to-income ratio: Lenders assess the borrower’s debt-to-income ratio to ensure they can afford the loan payments.

Risks Associated with Unsecured Loans

- Higher interest rates: Due to the lack of collateral, unsecured loans typically come with higher interest rates compared to secured loans.

- Credit score impact: Defaulting on an unsecured loan can negatively impact the borrower’s credit score and financial future.

- Limited loan amounts: Unsecured loans generally have lower borrowing limits compared to secured loans.

Collateral

Collateral plays a crucial role in securing a loan by providing a form of security for the lender in case the borrower defaults on the loan. It is an asset that the borrower pledges to the lender to reduce the risk associated with the loan.

Impact on Loan Terms

When collateral is used to secure a loan, lenders are more willing to offer lower interest rates and higher loan amounts since they have an asset to recover their money in case of default. This can result in more favorable loan terms for the borrower compared to unsecured loans.

Consequences of Defaulting

If a borrower defaults on a secured loan, the lender has the right to seize the collateral to recover the outstanding debt. This could lead to the loss of the pledged asset, such as a car or a house, depending on the terms of the loan agreement.

Acquiring a Secured Loan with and without Collateral

When applying for a secured loan with collateral, the borrower needs to provide documentation and details about the asset being pledged. The approval process may be quicker, and the borrower may have access to better loan terms. On the other hand, obtaining a secured loan without collateral may be more challenging, as lenders may require a higher credit score and offer less favorable terms due to the increased risk.

Credit Score

When applying for a loan, one of the key factors that lenders consider is your credit score. Your credit score is a numerical representation of your creditworthiness, indicating how likely you are to repay borrowed money based on your credit history.

Importance of Credit Scores in Loan Application

- A high credit score demonstrates responsible financial behavior and increases your chances of loan approval.

- Lenders use credit scores to assess the risk of lending you money and determine the interest rate you qualify for.

- A low credit score may result in loan denial or higher interest rates due to perceived higher risk.

Influence of Credit Scores on Secured and Unsecured Loans

- For secured loans, a higher credit score can lead to lower interest rates and larger loan amounts, as the collateral reduces the lender’s risk.

- Unsecured loans rely heavily on credit scores, with higher scores typically resulting in lower interest rates and better loan terms.

Tips for Improving Credit Scores

- Pay bills on time and in full to establish a positive payment history.

- Keep credit card balances low and avoid maxing out credit limits.

- Regularly check your credit report for errors and address any discrepancies promptly.

Impact of Credit Scores on Interest Rates

- A higher credit score generally leads to lower interest rates for both secured and unsecured loans.

- Lenders view borrowers with higher credit scores as less risky, offering them more favorable terms.

- Individuals with lower credit scores may face higher interest rates to compensate for the perceived risk of default.