Loan application process explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From understanding the steps involved to diving into the different types of loans available, this guide aims to equip you with the knowledge needed to navigate the world of loan applications with confidence.

Get ready to uncover the secrets behind eligibility criteria, application submission tips, and the review and approval process. By the end of this journey, you’ll be well-versed in loan disbursement and ready to take on the financial world like a boss.

Overview of Loan Application Process

When it comes to applying for a loan, there are several steps involved in the process. From gathering the necessary documentation to waiting for approval, it’s essential to understand what to expect along the way.

Steps in the Loan Application Process

- 1. Application Submission: The first step is to fill out the loan application form provided by the lender. This form typically requires information about your personal details, employment status, income, and the loan amount you are requesting.

- 2. Document Submission: Along with the application form, you will need to submit certain documents such as proof of identity, proof of income, bank statements, and any other relevant financial information requested by the lender.

- 3. Credit Check: The lender will conduct a credit check to assess your creditworthiness and determine the risk involved in lending to you. This step is crucial in determining the terms of the loan.

- 4. Approval Decision: Once all the necessary information has been submitted and reviewed, the lender will make a decision on whether to approve or deny your loan application. If approved, you will receive the terms of the loan for your review.

- 5. Loan Disbursement: If you accept the terms of the loan, the funds will be disbursed to you either through a check, direct deposit, or another agreed-upon method. Make sure to adhere to the repayment schedule to avoid any penalties or late fees.

Documentation Required

- • Proof of Identity (such as driver’s license or passport)

- • Proof of Income (pay stubs, tax returns, or bank statements)

- • Employment Details (employer’s contact information, length of employment)

- • Financial Statements (assets, liabilities, debts)

Importance of Thorough Application Process

- • For Lenders: A thorough application process helps lenders assess the risk involved in lending to a borrower, leading to better decision-making and reducing the chances of defaults.

- • For Borrowers: Providing accurate and complete information in the application process increases the likelihood of loan approval and favorable terms. It also helps borrowers understand their financial situation better.

Types of Loans

When it comes to applying for a loan, there are various types available to suit different financial needs. Understanding the differences between these loan types can help you make an informed decision on which one is best for you.

Secured vs. Unsecured Loans

Secured loans require collateral, such as a car or a house, to secure the loan amount. This collateral acts as a guarantee for the lender that they will be able to recoup their funds if the borrower defaults on the loan. On the other hand, unsecured loans do not require collateral and are based solely on the borrower’s creditworthiness.

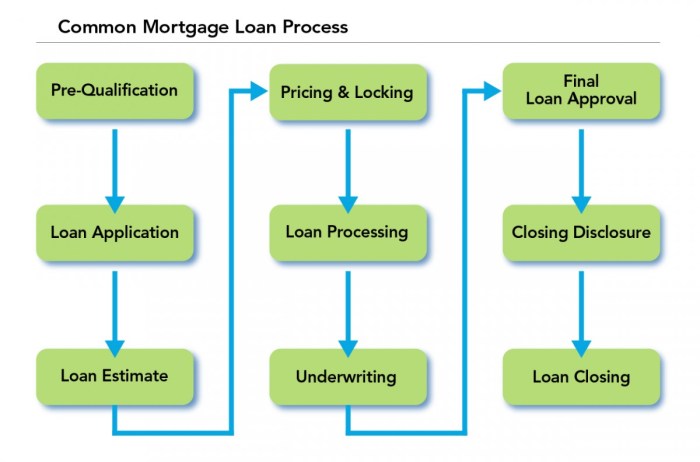

Mortgage Loans vs. Personal Loans

Mortgage loans are specifically designed for purchasing real estate and typically have lower interest rates compared to other types of loans. To qualify for a mortgage loan, borrowers must meet strict requirements related to income, credit score, and debt-to-income ratio. Personal loans, on the other hand, can be used for various purposes and are typically easier to qualify for, but may come with higher interest rates.

Eligibility Criteria

To qualify for a loan, individuals must meet certain eligibility criteria set by lenders. These criteria typically include factors such as credit scores, credit history, income verification, and employment history. Let’s break down the key elements that determine loan eligibility.

Credit Scores and Credit History

Credit scores play a crucial role in the loan approval process. Lenders use credit scores to assess an individual’s creditworthiness and determine the risk associated with lending money. A higher credit score indicates a lower risk for the lender, making it easier to qualify for a loan with favorable terms. On the other hand, a low credit score may result in higher interest rates or even rejection of the loan application.

Income Verification and Employment History

Income verification and employment history are also important factors in determining loan eligibility. Lenders require proof of a stable income to ensure that borrowers have the financial means to repay the loan. This may involve providing pay stubs, tax returns, or bank statements to demonstrate a consistent source of income. Additionally, a solid employment history with steady employment can bolster a borrower’s chances of loan approval, as it indicates a reliable source of income.

Application Submission

When it comes to submitting a loan application, there are various methods available to choose from. Whether you prefer the convenience of applying online or the personal touch of submitting your application in-person, the choice is yours.

Methods of Submission

- Online: Many lenders offer the option to apply for a loan online through their website. This method is convenient and allows you to complete the application at your own pace.

- In-person: If you prefer a face-to-face interaction, you can visit a physical branch of the lender to submit your application. This option allows you to ask any questions you may have and receive assistance in filling out the application.

- By phone: Some lenders also accept loan applications over the phone. This method is convenient for those who prefer verbal communication or have questions they want to clarify before submitting their application.

Tips for Successful Application

- Gather all necessary documents: Before submitting your application, make sure you have all the required documents such as identification, proof of income, and any other relevant paperwork.

- Double-check your information: Ensure that all the information you provide on the application is accurate and up-to-date. Mistakes or inconsistencies could delay the processing of your application.

- Write a strong cover letter: Consider including a cover letter with your application to explain your financial situation, any special circumstances, or reasons why you are applying for the loan.

Processing and Approval Timeline

After submitting your loan application, the processing and approval timeline can vary depending on the lender and the type of loan you are applying for. In general, it may take anywhere from a few days to a few weeks to receive a decision on your application. Be patient and follow up with the lender if you have not heard back within the expected timeframe.

Review and Approval Process

When your loan application is submitted, it goes through a thorough review and approval process to determine if you qualify for the requested funds.

Steps in Review and Approval

- Verification of Information: The lender will verify all the information provided in your application, such as income, employment status, credit history, and debt-to-income ratio.

- Credit Check: A credit check will be conducted to assess your creditworthiness and determine the risk of lending to you.

- Collateral Evaluation: If you are applying for a secured loan, the lender will assess the value of the collateral you are offering.

- Decision Making: Based on the information gathered, the lender will make a decision on whether to approve or reject your loan application.

Factors Influencing Decision-making

- Income Stability: Lenders prefer borrowers with a stable source of income to ensure timely repayment.

- Credit History: A good credit score and history increase your chances of loan approval.

- Debt-to-Income Ratio: Lenders evaluate how much of your income goes towards debt repayment to determine if you can afford the loan.

- Collateral: For secured loans, the value and type of collateral offered can impact the approval decision.

Common Reasons for Rejection

- Low Credit Score: A poor credit history or low credit score may lead to rejection of your loan application.

- Insufficient Income: If your income is not enough to cover the loan amount, your application may be denied.

- High Debt Levels: Having too much existing debt can make lenders hesitant to approve additional borrowing.

- Unstable Employment: Lenders look for stable employment as a sign of financial stability and may reject applications from those with inconsistent work history.

Loan Disbursement

Once your loan application is approved, the next step is the disbursement of funds. This process involves releasing the loan amount to the borrower so they can use it for the intended purpose.

Disbursement Methods

- Direct Deposit: The loan amount is transferred directly to the borrower’s bank account, providing quick access to funds.

- Check: Some lenders still offer the option of sending a physical check to the borrower, which can then be deposited or cashed.

- Wire Transfer: In certain cases, the loan amount can be sent via a wire transfer to the borrower’s account, ensuring immediate availability.

Understanding Terms and Conditions

Before accepting the disbursed loan amount, it is crucial for borrowers to carefully review and understand the terms and conditions associated with the loan. This includes interest rates, repayment schedules, fees, and any other relevant details. By fully understanding these terms, borrowers can make informed decisions and avoid any surprises down the line.