Diving into the world of Mutual funds vs. ETFs opens up a realm of financial possibilities, each with its own unique structure and investment approach. Get ready to explore the differences between these two popular investment options as we break down the essentials in a way that’s both informative and engaging.

Introduction

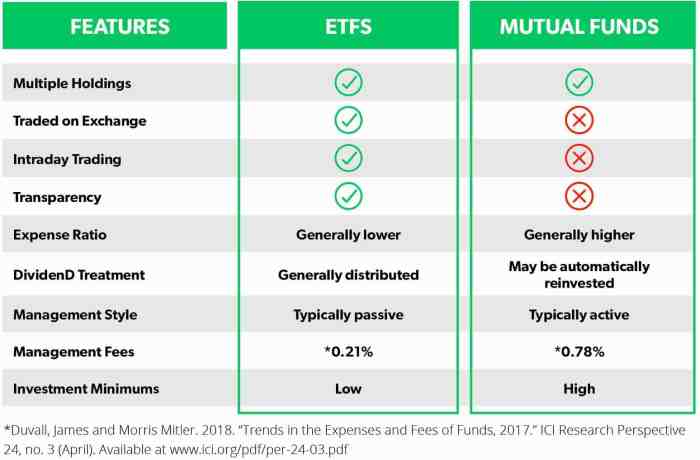

Mutual funds and ETFs are both popular investment options for individuals looking to diversify their portfolios and grow their wealth. Mutual funds are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. On the other hand, ETFs, or exchange-traded funds, are similar to mutual funds but trade on an exchange like a stock.

Brief History of Mutual Funds and ETFs

Mutual funds have been around for over a century, with the first modern mutual fund established in the 1920s. These funds have evolved over time to offer investors a wide range of investment options, from index funds to actively managed funds. ETFs, on the other hand, are a relatively newer investment vehicle, first introduced in the early 1990s. Since then, ETFs have gained popularity due to their lower fees and tax efficiency compared to mutual funds.

Importance of Understanding the Differences

It is crucial for investors to understand the differences between mutual funds and ETFs in order to make informed investment decisions. While both options offer diversification and professional management, they have distinct characteristics that can impact an investor’s overall portfolio. Factors such as fees, tax implications, liquidity, and investment strategies vary between mutual funds and ETFs, making it essential for investors to carefully evaluate their financial goals and risk tolerance before choosing between the two.

Structure

When it comes to the structure of mutual funds and ETFs, there are some key differences to be aware of.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are actively managed by professional portfolio managers who make decisions on which assets to buy and sell.

- Mutual funds are priced once a day after the market closes, based on the net asset value (NAV) of the fund.

- Investors buy and sell mutual fund shares directly from the fund company.

- They are typically designed for long-term investors looking for a hands-off approach to investing.

ETFs

ETFs, or exchange-traded funds, are similar to mutual funds in that they also pool money from investors to invest in a basket of securities. However, ETFs are traded on stock exchanges like individual stocks.

- ETFs can be bought and sold throughout the trading day at market prices.

- They often have lower expense ratios compared to mutual funds.

- ETFs are usually passively managed, tracking a specific index or asset class.

Key Difference: Mutual funds are priced once a day and bought/sold directly from the fund company, while ETFs are traded on exchanges throughout the day at market prices.

Investment Approach

When it comes to the investment approach of mutual funds and ETFs, there are some key differences to consider.

Mutual Funds

Mutual funds are actively managed by professional fund managers who make decisions on buying and selling securities within the fund. These managers aim to outperform the market and achieve a specific investment objective. They rely on in-depth research and analysis to make investment decisions, with the goal of generating higher returns for investors.

ETFs

On the other hand, ETFs typically track a specific index or benchmark and aim to replicate its performance. This passive management style means that ETFs do not require active decision-making by fund managers. Instead, they aim to match the performance of the underlying index, providing investors with exposure to a diversified portfolio of securities.

Comparison

When comparing the investment strategies of mutual funds and ETFs, it’s important to note that mutual funds have the potential for higher returns due to active management. However, this also comes with higher fees and expenses. On the other hand, ETFs generally have lower fees due to their passive management style, but they may not outperform the market like actively managed mutual funds.

Overall, the investment approach of mutual funds focuses on active management and potential outperformance, while ETFs aim to replicate the performance of an index with lower costs. Investors should consider their investment goals and risk tolerance when choosing between mutual funds and ETFs.

Cost

When it comes to investing in mutual funds or ETFs, it’s essential to consider the costs involved. These costs can impact your overall returns and should be carefully evaluated before making any investment decisions.

Cost Breakdown of Mutual Funds

- Mutual funds typically charge expense ratios, which are annual fees that cover the fund’s operating expenses.

- Some mutual funds may also have sales loads, which are commissions paid to brokers when buying or selling fund shares.

- Additionally, mutual funds may charge redemption fees for selling shares within a certain time frame.

Cost Breakdown of ETFs

- ETFs generally have lower expense ratios compared to mutual funds, as they are passively managed and have lower operating costs.

- There are no sales loads associated with ETFs, making them a cost-effective option for investors.

- ETFs also offer tax efficiency, as they have lower turnover rates compared to actively managed mutual funds.

Analyzing Cost Differences

- Overall, ETFs tend to be more cost-effective than mutual funds, especially for long-term investors looking to minimize expenses.

- Investors should consider the impact of fees on their investment returns and choose the option that aligns with their financial goals and risk tolerance.

Liquidity

When it comes to investing in mutual funds, liquidity works differently compared to ETFs. Mutual funds are only traded at the end of the trading day at the net asset value (NAV) price. This means that investors cannot buy or sell mutual fund shares throughout the trading day as they would with individual stocks. Instead, transactions are processed at the closing price of the day.

Mutual Funds Liquidity

- Mutual funds are bought and sold at the end of the trading day at the NAV price.

- Investors cannot trade mutual fund shares during the trading day.

- Transactions are processed at the closing price of the day.

ETFs Liquidity

When it comes to ETFs, liquidity works differently. ETFs are traded on exchanges throughout the trading day, just like individual stocks. This means that investors can buy and sell ETF shares at market prices during market hours. The liquidity of ETFs is determined by supply and demand in the market.

- ETFs are traded on exchanges throughout the trading day.

- Investors can buy and sell ETF shares at market prices during market hours.

- Liquidity of ETFs is determined by supply and demand in the market.

Comparing Liquidity of Mutual Funds and ETFs

ETFs offer greater liquidity compared to mutual funds due to their ability to be traded throughout the trading day on exchanges.

- ETFs provide investors with more flexibility to enter and exit positions quickly.

- Mutual funds may be less liquid since transactions are processed only at the end of the trading day.

- Investors looking for more immediate liquidity may prefer ETFs over mutual funds.

Tax Efficiency

When it comes to investing in mutual funds and ETFs, understanding the tax implications is crucial. Let’s dive into how these two types of investments differ in terms of tax efficiency.

Tax Implications of Investing in Mutual Funds

Investing in mutual funds can have tax consequences for investors. One key factor to consider is capital gains taxes. When a mutual fund manager sells securities within the fund that have increased in value, investors may be subject to capital gains taxes on those profits. Additionally, mutual fund investors may also be responsible for taxes on dividends and interest income generated by the fund.

Tax Implications of Investing in ETFs

ETFs are known for their tax efficiency compared to mutual funds. One reason for this is the structure of ETFs, which allows for in-kind redemptions. This means that when investors sell ETF shares, they do not trigger capital gains taxes for the fund. Additionally, ETFs typically have lower portfolio turnover compared to mutual funds, resulting in fewer capital gains distributions and potentially lower tax liabilities for investors.

Differences in Tax Efficiency

Overall, ETFs are generally more tax-efficient than mutual funds due to their unique structure and the way they are traded. This can result in lower tax liabilities for investors in ETFs compared to those in mutual funds. However, it’s essential for investors to consult with a tax professional to fully understand the tax implications of their investment decisions and how they may impact their overall tax situation.

Flexibility

Investors value flexibility when choosing between mutual funds and ETFs. Both investment options offer different levels of flexibility, catering to various investor needs and preferences.

Flexibility of Mutual Funds

Mutual funds provide investors with the flexibility to invest in a diverse portfolio of securities, managed by professional fund managers. Investors can easily buy and sell mutual fund shares at the end of the trading day based on the net asset value (NAV) calculated at the market close. Additionally, mutual funds offer various share classes, such as load and no-load funds, providing investors with options based on their investment goals and risk tolerance.

Flexibility of ETFs

ETFs offer investors intraday trading flexibility, allowing them to buy and sell shares throughout the trading day at market price. This real-time trading feature provides investors with the opportunity to react quickly to market movements and news events. ETFs also offer flexibility in terms of investment strategies, as there are various types of ETFs available, including equity, fixed income, commodity, and sector-specific ETFs.

Comparison of Flexibility

When comparing the flexibility of mutual funds and ETFs, it ultimately depends on the investor’s trading preferences and investment objectives. Mutual funds are more suitable for long-term investors looking for a hands-off approach, while ETFs are ideal for active traders seeking intraday trading opportunities. Both investment options offer flexibility in terms of diversification, liquidity, and investment strategies, allowing investors to tailor their portfolios based on their unique financial goals.