Diving into the world of Understanding the Federal Reserve, buckle up as we explore the ins and outs of this crucial entity in the US economy. Get ready to uncover the mysteries behind the Federal Reserve with a fresh, engaging perspective that will keep you hooked from start to finish.

In the next section, we will delve deeper into the key aspects of the Federal Reserve, shedding light on its role, structure, functions, and more.

Overview of the Federal Reserve

The Federal Reserve, often referred to as the Fed, plays a crucial role in the United States economy by overseeing monetary policy, regulating financial institutions, and maintaining financial stability.

Role and Purpose of the Federal Reserve

The primary purpose of the Federal Reserve is to promote maximum employment, stable prices, and moderate long-term interest rates. It aims to achieve these goals through the implementation of monetary policy.

Structure of the Federal Reserve System

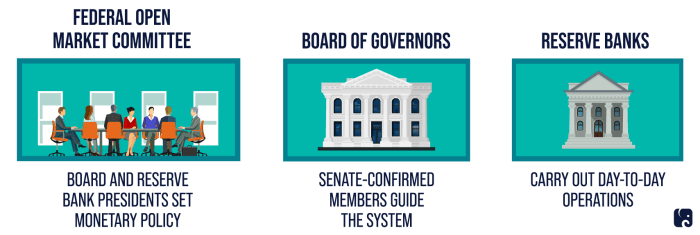

The Federal Reserve System is composed of the Board of Governors, 12 regional Federal Reserve Banks, and the Federal Open Market Committee (FOMC). Each component plays a specific role in the operation of the system.

Functions of the Federal Reserve

- The Federal Reserve conducts monetary policy by adjusting interest rates and controlling the money supply to achieve its dual mandate of stable prices and maximum employment.

- It regulates and supervises financial institutions to ensure the safety and soundness of the banking system.

- The Fed also provides financial services to depository institutions, the U.S. government, and foreign official institutions.

History of the Federal Reserve

The Federal Reserve, often referred to as the Fed, was established on December 23, 1913, in response to financial panics that plagued the United States in the late 19th and early 20th centuries. It was created to provide the country with a more stable monetary and financial system.

Establishment of the Federal Reserve

- The Federal Reserve Act of 1913 was signed into law by President Woodrow Wilson, creating the Federal Reserve System as the central banking authority of the United States.

- It was established to address issues of bank panics, financial instability, and lack of a central regulatory body in the American financial system.

Key Events and Milestones

- In 1933, during the Great Depression, the Federal Reserve was given additional powers to conduct monetary policy and stabilize the economy.

- The Bretton Woods Agreement of 1944 established the U.S. dollar as the world’s primary reserve currency, solidifying the Fed’s role in the global economy.

- In 2008, the Federal Reserve played a crucial role in responding to the financial crisis by implementing unconventional monetary policies to stabilize the economy.

Impact of Historical Events on Policies

- The Great Depression led to the creation of the Federal Open Market Committee (FOMC) in 1933, which is responsible for setting monetary policy in the U.S.

- The Bretton Woods Agreement shaped the Fed’s focus on maintaining stable prices and full employment as part of its dual mandate.

- The 2008 financial crisis prompted the Fed to implement quantitative easing and other unconventional policies to support economic recovery.

Monetary Policy

Monetary policy refers to the actions taken by a central bank, such as the Federal Reserve, to manage and regulate the money supply and interest rates in the economy. It plays a crucial role in influencing economic activity, controlling inflation, and promoting overall financial stability.

Tools and Mechanisms of Monetary Policy

- The Federal Reserve sets the target for the federal funds rate, which is the interest rate at which banks lend reserve balances to other banks overnight. By adjusting this rate, the Fed can influence borrowing and spending in the economy.

- Open Market Operations involve the buying and selling of government securities by the Federal Reserve. When the Fed buys securities, it injects money into the banking system, leading to lower interest rates and increased lending. Conversely, selling securities decreases the money supply.

- Reserve Requirements are the minimum amount of funds that banks must hold in reserve against deposits. By changing these requirements, the Fed can impact the amount of money banks can lend out, thus affecting the overall money supply.

Impact of Monetary Policy Decisions

-

Monetary policy decisions can impact inflation by influencing the cost of borrowing and spending. Lower interest rates encourage borrowing and investment, which can lead to higher inflation. Conversely, higher rates can help control inflation by reducing spending.

- Changes in interest rates resulting from monetary policy can affect consumer spending, business investment, and overall economic growth. Lower rates typically stimulate economic activity, while higher rates can slow down growth to prevent overheating.

Role in Banking and Financial System

The Federal Reserve plays a crucial role in the banking and financial system by regulating and supervising banks and financial institutions, promoting financial stability, and ensuring the efficiency of the payment system.

Regulating and Supervising Banks

The Federal Reserve oversees banks to ensure they comply with regulations, maintain adequate capital reserves, and operate in a safe and sound manner. This regulatory oversight helps prevent financial crises and protects depositors’ funds.

Promoting Financial Stability

Through its oversight and regulatory functions, the Federal Reserve works to promote financial stability by monitoring systemic risks, identifying potential threats to the financial system, and taking necessary actions to mitigate risks and maintain stability.

Ensuring Efficient Payment System

The Federal Reserve plays a key role in ensuring a safe and efficient payment system by providing payment services to banks, facilitating the clearing and settlement of transactions, and implementing policies to enhance the overall efficiency and security of the payment system.

Economic Indicators and Data Analysis

The Federal Reserve closely monitors various economic indicators to evaluate the health of the economy and make informed policy decisions based on data analysis.

Key Economic Indicators

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in the country, indicating economic growth.

- Unemployment Rate: Reflects the percentage of people actively seeking employment, providing insights into labor market conditions.

- Inflation Rate: Tracks changes in the prices of goods and services, influencing purchasing power and overall economic stability.

- Consumer Confidence Index: Indicates the sentiment of consumers regarding the economy, impacting spending and investment decisions.

Federal Reserve’s Data Analysis

The Federal Reserve utilizes economic data to assess current economic conditions, identify trends, and predict future developments. By analyzing key indicators like GDP, unemployment, and inflation, the Fed gains valuable insights into the state of the economy. This data-driven approach enables the Federal Reserve to adjust monetary policy effectively to achieve its dual mandate of stable prices and maximum employment.

Importance of Data Analysis

Data analysis plays a crucial role in forecasting economic trends and guiding monetary policy decisions. By examining a wide range of economic indicators, the Federal Reserve can anticipate potential challenges or opportunities in the economy. This proactive approach helps the Fed to implement timely and appropriate policy measures to support sustainable economic growth and stability.