Diving into the world of finance management apps opens up a realm of possibilities for individuals and businesses alike. From budgeting to investment tracking, these apps offer a streamlined approach to handling financial matters. Let’s explore the key aspects that make finance management apps a game-changer in today’s fast-paced world.

Importance of Finance Management Apps

Using finance management apps is crucial for both personal and business finances as they provide a convenient and efficient way to keep track of financial activities. These apps offer a wide range of features that can help in budgeting, expense tracking, and investment monitoring.

Budgeting and Expense Tracking

- Finance management apps allow users to create and customize budgets based on their income and expenses.

- Users can track their spending in real-time, categorize expenses, and set spending limits to stay within budget.

- These apps provide detailed reports and insights on where money is being spent, helping users identify areas for savings and cut down unnecessary expenses.

Investment Monitoring

- Finance management apps enable users to link their investment accounts and track the performance of their portfolios.

- Users can set financial goals, track progress, and receive alerts on market changes or investment opportunities.

- These apps provide analysis tools, investment calculators, and performance metrics to help users make informed decisions about their investments.

Convenience and Efficiency

- Having all financial information in one place allows users to have a comprehensive view of their financial health and make informed decisions.

- Users can access their financial data anytime, anywhere, and from any device, making it easy to manage finances on the go.

- Finance management apps often sync with bank accounts and credit cards, automating data entry and reducing manual effort in tracking expenses and income.

Features to Look for in Finance Management Apps

When choosing a finance management app, it is important to consider key features that will help you effectively manage your finances. Look for apps that offer expense tracking, budgeting tools, bill payment reminders, and investment tracking to stay on top of your financial goals.

Expense Tracking

- Allows you to categorize expenses

- Provides real-time updates on spending

- Generates reports for better insight into your financial habits

Budgeting Tools

- Helps in creating and managing budgets

- Offers goal-setting features for savings targets

- Provides alerts when you are close to exceeding budget limits

Bill Payment Reminders

- Sends notifications for upcoming bills

- Allows you to schedule payments in advance

- Tracks payment history for reference

Investment Tracking

- Monitors stock performance and portfolio value

- Offers analysis tools for informed investment decisions

- Provides alerts on market changes affecting your investments

User-Friendly Interfaces and Customization Options

Having a user-friendly interface and customization options is essential for a finance management app. It allows you to personalize the app according to your preferences and make navigating through the features much easier. Look for apps that offer flexibility in design and layout to suit your needs.

Security Measures

- End-to-end encryption to protect sensitive financial data

- Two-factor authentication for added security

- Regular updates to patch security vulnerabilities

Popular Finance Management Apps in the Market

When it comes to managing your finances, there are several popular apps in the market that can help you stay on top of your budget and financial goals. Let’s take a look at some of the most well-known finance management apps available today.

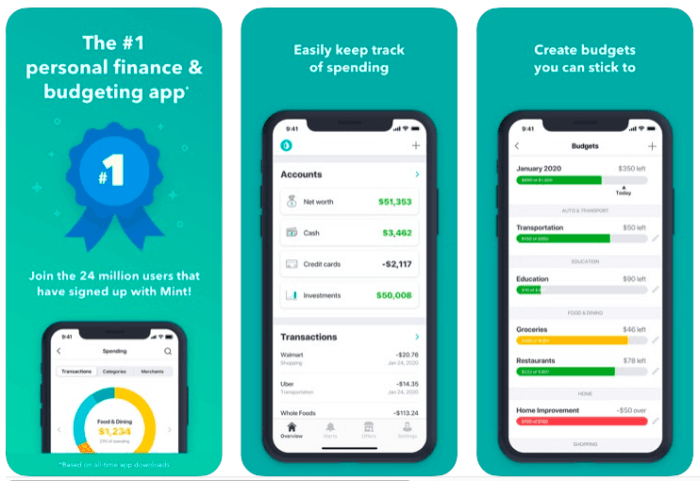

Mint

Mint is a comprehensive finance management app that allows users to track their spending, create budgets, and monitor their investments all in one place. It offers features such as bill tracking, credit score monitoring, and personalized financial insights. Mint is free to use and is targeted towards individuals looking to take control of their finances.

YNAB (You Need a Budget)

YNAB is a budgeting app that focuses on helping users allocate their income towards specific goals and expenses. It uses a zero-based budgeting approach, where every dollar is assigned a job. YNAB offers features like goal tracking, debt payoff tools, and detailed reports to help users stay on track with their financial objectives. YNAB has a subscription-based pricing model and is geared towards individuals who want a proactive approach to budgeting.

Personal Capital

Personal Capital is an investment-focused finance management app that provides users with tools to track their net worth, analyze their investment portfolios, and plan for retirement. It offers features like portfolio rebalancing, fee analyzer, and retirement planner to help users optimize their investments. Personal Capital is free to use, with optional paid advisory services, and is aimed at individuals looking to grow and manage their wealth effectively.

Comparison of Features and Pricing

- Mint: Free to use, focused on overall financial management and budgeting.

- YNAB: Subscription-based, emphasizes zero-based budgeting and goal tracking.

- Personal Capital: Free with optional paid services, tailored towards investment management and retirement planning.

User Reviews and Ratings

When it comes to user reviews and ratings, Mint is praised for its user-friendly interface and comprehensive financial tracking capabilities. YNAB receives high marks for its effective budgeting tools and proactive approach to financial planning. Personal Capital is lauded for its investment analysis features and retirement planning tools. However, some users may find Mint’s ads intrusive, YNAB’s subscription fee a barrier, and Personal Capital’s advisory services costly. Overall, the choice of finance management app depends on individual preferences and financial goals.

Tips for Using Finance Management Apps Effectively

Effective use of finance management apps can significantly improve your financial health. By following best practices and utilizing the features of these apps properly, you can gain valuable insights and make informed decisions about your money.

Setting Up Accounts, Categorizing Transactions, and Creating Budgets

- When setting up accounts in finance management apps, ensure that you link all your bank accounts, credit cards, and investment accounts for a comprehensive view of your finances.

- Take the time to categorize transactions accurately to track your spending habits and identify areas where you can cut back or save more.

- Create realistic budgets based on your income and expenses. Regularly review and adjust your budget to stay on track with your financial goals.

Utilizing Reports and Insights

- Take advantage of the reports generated by finance management apps to analyze your spending patterns, identify trends, and pinpoint areas for improvement.

- Use the insights provided by these apps to make informed decisions about saving, investing, and planning for the future.

- Regularly review your financial reports to track your progress, make adjustments to your financial strategy, and stay on top of your financial goals.

Regularly Updating and Reviewing Financial Information

- Make it a habit to regularly update your financial information in the app to ensure that you have an accurate picture of your financial status.

- Set aside time each week or month to review your transactions, budgets, and reports to stay informed and in control of your finances.

- By staying proactive and engaged with your finance management app, you can make better financial decisions and work towards achieving your financial goals.