How to calculate net worth sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Get ready to dive into the world of financial calculations and learn the ropes of determining your net worth like a pro.

Understanding Net Worth

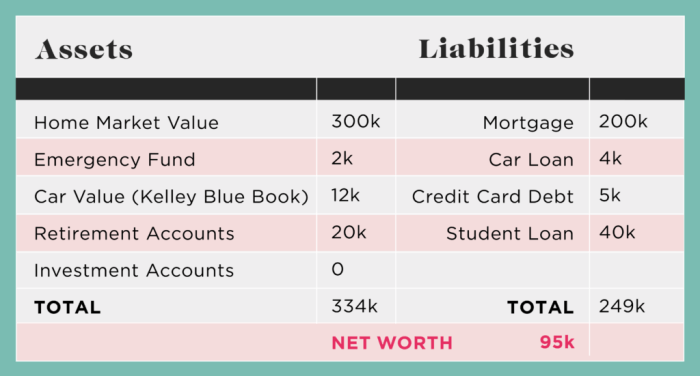

Net worth is a financial metric that represents the difference between an individual’s assets and liabilities. In simple terms, it is the value of what you own minus what you owe, providing a snapshot of your overall financial health.

Comparison to Assets and Liabilities

Assets are anything of value that you own, such as cash, investments, real estate, or personal belongings. Liabilities, on the other hand, are your financial obligations or debts, like mortgages, loans, or credit card balances. Net worth takes into account both your assets and liabilities to give you a comprehensive view of your financial standing.

Importance of Calculating Net Worth

Calculating your net worth is crucial for financial planning as it helps you track your progress towards your financial goals. By understanding your net worth, you can identify areas where you may need to increase assets or reduce liabilities to improve your overall financial position. It also serves as a benchmark to measure your financial growth over time and make informed decisions about investments, savings, and debt management.

Calculating Assets

When calculating your net worth, it’s essential to consider both your assets and liabilities. Assets are what you own that have value, and they play a crucial role in determining your overall financial health. Here’s how to calculate your assets for an accurate net worth assessment.

Types of Assets

- Cash and Cash Equivalents: This includes actual cash, savings accounts, and certificates of deposit.

- Investments: Stocks, bonds, mutual funds, and retirement accounts fall into this category.

- Real Estate: The value of your home, rental properties, or land you own should be included.

- Personal Property: Vehicles, jewelry, collectibles, and valuable belongings count as assets.

- Business Ownership: If you own a business or have equity in a company, this is considered an asset.

Liquid vs. Non-liquid Assets

Assets can be classified as liquid or non-liquid based on how easily they can be converted into cash:

- Liquid Assets: These are assets that can be quickly converted into cash without significant loss in value. Examples include cash, savings accounts, and stocks.

- Non-liquid Assets: These are assets that may take time to sell or convert into cash and could potentially lose value in the process. Real estate and certain investments fall into this category.

Determining Asset Value

When calculating your net worth, it’s crucial to determine the accurate value of your assets. Here’s how you can do it:

- For cash and cash equivalents, simply use the face value of the amount you have.

- For investments, use the current market value or the value at which you can sell them.

- For real estate, consider the current market value or get a professional appraisal for an accurate assessment.

- For personal property, estimate the fair market value based on similar items’ prices or get a professional appraisal for valuable items.

- For business ownership, calculate your share’s value based on the company’s overall worth or recent transactions involving similar businesses.

Accounting for Liabilities

When calculating net worth, it’s crucial to consider liabilities, which are debts or financial obligations that an individual or entity owes to others. Liabilities play a significant role in determining overall net worth as they represent the amount that needs to be paid off using assets.

Types of Liabilities

- Credit Card Debt: This includes outstanding balances on credit cards that need to be repaid. High credit card debt can significantly reduce net worth.

- Loans: These can be student loans, personal loans, auto loans, or mortgages. The remaining balance on these loans is considered a liability.

- Outstanding Bills: Unpaid bills for utilities, services, or rent are also liabilities that need to be settled.

Short-term vs. Long-term Liabilities

- Short-term liabilities are debts that are due within a year, such as credit card payments, utility bills, or short-term loans.

- Long-term liabilities are obligations that extend beyond a year, like mortgage payments, long-term loans, or retirement account loans.

Examples and Impact on Net Worth

- Example 1: If you have $10,000 in credit card debt, this amount is subtracted from your total assets when calculating net worth, reducing the overall net worth.

- Example 2: A mortgage of $200,000 is a long-term liability that decreases net worth by the outstanding loan amount.

Net Worth Calculation

To calculate your net worth, you need to subtract your total liabilities from your total assets. This will give you a clear picture of your financial standing at a specific point in time.

Importance of Updating Asset and Liability Values

Regularly updating the values of your assets and liabilities is crucial to getting an accurate net worth calculation. Fluctuations in the value of your assets, such as investments or real estate, can impact your overall net worth. Similarly, changes in your liabilities, like outstanding loans or credit card debt, can also affect your financial health.

- Keep track of your assets and liabilities by updating their values at least once a year.

- Changes in the market value of assets or the amount of debt owed should be reflected in your calculations.

- Regular updates ensure that your net worth calculation remains relevant and reflective of your current financial situation.

Step-by-Step Guide to Calculate Net Worth

- List all your assets, including cash, investments, real estate, and personal property.

- Assign a value to each asset based on its current market worth.

- Add up the total value of all your assets.

- List all your liabilities, such as mortgages, loans, and credit card debt.

- Assign a value to each liability representing the amount owed.

- Add up the total value of all your liabilities.

- Subtract the total liabilities from the total assets to determine your net worth.