Get ready to dive into the world of bond investment tips where we unravel the secrets to building a successful portfolio. From understanding the importance of bonds to exploring different strategies, this journey will equip you with the knowledge needed to make informed investment decisions.

Importance of Bond Investments

When it comes to building a solid investment portfolio, bond investments play a crucial role in providing stability and consistent returns. Let’s dive into why bonds are an essential component of a well-rounded investment strategy.

Diversification Benefits of Bonds

- Bonds offer diversification benefits by balancing out the risk of a portfolio that also includes stocks and other assets. This helps to reduce overall volatility and protect against market downturns.

- Having a mix of stocks and bonds can help investors achieve a more balanced and stable return over the long term, especially during periods of market turbulence.

Steady Income Streams from Bonds

- One of the key advantages of investing in bonds is the predictable income stream they provide through regular interest payments. This can be particularly attractive for investors looking for a steady source of income to supplement their earnings.

- Bond coupons offer a fixed rate of return, making them a reliable source of income that can help meet financial goals and obligations, such as retirement expenses or education costs.

Risk Management with Bonds

- Bonds are considered less risky than stocks due to their fixed income nature and priority in repayment in case of a company’s default. This makes bonds a valuable asset for managing risk in an investment portfolio.

- By including bonds in a diversified portfolio, investors can mitigate the impact of market fluctuations and economic uncertainties, providing a cushion against potential losses and preserving capital.

Types of Bonds to Consider

Government, corporate, and municipal bonds are some of the common types of bonds to consider when investing in the bond market. Each type has its own characteristics and risks that investors should be aware of before making investment decisions.

Government Bonds

Government bonds are issued by the government to finance its operations and projects. They are considered low-risk investments because they are backed by the government’s ability to tax its citizens. Examples of government bonds include U.S. Treasury bonds and municipal bonds.

Corporate Bonds

Corporate bonds are issued by corporations to raise capital for their business activities. They typically offer higher yields than government bonds but come with higher risks. Corporate bonds are rated based on the creditworthiness of the issuing company. Examples of high-yield corporate bonds include junk bonds, which are considered riskier due to the higher likelihood of default.

Municipal Bonds

Municipal bonds are issued by state and local governments to fund public projects such as infrastructure development. They are exempt from federal taxes and sometimes from state and local taxes, making them attractive to investors in higher tax brackets. Municipal bonds are generally considered safer than corporate bonds but may offer lower yields.

Treasury Bonds vs Corporate Bonds

Treasury bonds are issued by the U.S. government and are considered the safest investment option because they are backed by the full faith and credit of the government. They are typically lower in yield compared to corporate bonds but offer more stability and security. On the other hand, corporate bonds offer higher yields but carry more risk due to the creditworthiness of the issuing company.

Factors to Consider Before Investing in Bonds

When considering investing in bonds, there are several key factors that you should take into account to make informed decisions and maximize your returns. These factors can impact the performance and risk associated with your bond investments.

Interest Rates Impact

Interest rates play a significant role in determining bond prices and yields. When interest rates rise, bond prices tend to fall, and vice versa. This inverse relationship is crucial to understand as it affects the value of your bond investments. Keep an eye on interest rate movements to anticipate potential changes in bond prices and yields.

Credit Ratings Importance

Credit ratings are an essential factor to consider when selecting bonds to invest in. These ratings provide an evaluation of the issuer’s creditworthiness and the likelihood of default. Bonds with higher credit ratings are typically considered less risky but may offer lower yields. On the other hand, bonds with lower credit ratings may provide higher yields but come with increased risk. It’s important to strike a balance between risk and reward based on your investment objectives and risk tolerance.

Strategies for Successful Bond Investing

When it comes to successful bond investing, having the right strategies in place is crucial for maximizing returns and managing risks effectively. Let’s explore some key strategies that can help you build a strong bond portfolio.

Balanced Bond Portfolio

Creating a balanced bond portfolio involves diversifying your investments across different types of bonds to spread out risks. This can include investing in government bonds, corporate bonds, municipal bonds, and other fixed-income securities. By diversifying your portfolio, you can reduce the impact of any one bond defaulting or underperforming.

- Allocate your investments based on your risk tolerance and investment goals.

- Consider the duration and credit quality of bonds to ensure a mix that aligns with your risk profile.

- Regularly review and rebalance your portfolio to maintain diversification and adjust to changing market conditions.

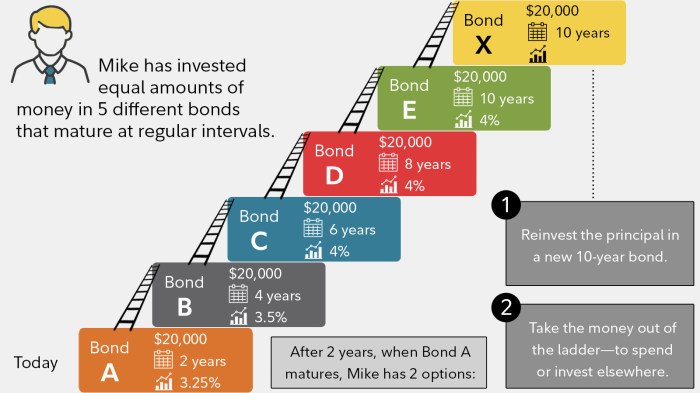

Bond Laddering

Bond laddering is a strategy where you invest in bonds with staggered maturity dates to balance the trade-off between yield and reinvestment risk. By spreading out the maturity dates of your bonds, you can minimize the impact of interest rate fluctuations and reinvest the proceeds from maturing bonds at prevailing rates.

By laddering your bond investments, you can benefit from both short-term and long-term interest rate movements, optimizing your overall returns.

- Start by purchasing bonds with different maturity dates, such as short-term, intermediate-term, and long-term bonds.

- As each bond matures, reinvest the proceeds in new bonds with different maturity dates to maintain the ladder.

- Adjust the ladder over time to reflect changes in interest rates and market conditions.

Reinvesting Bond Income

Reinvesting bond income is a key strategy for maximizing returns on your investments. Instead of withdrawing the interest payments from your bonds, consider reinvesting them to compound your earnings over time. This can help accelerate the growth of your bond portfolio and enhance your overall investment returns.

- Set up a dividend reinvestment plan (DRIP) to automatically reinvest your bond income without incurring additional fees.

- Reinvesting your bond income can help you take advantage of compounding returns and increase the value of your portfolio over the long term.

- Consider reinvesting your bond income in bonds with higher yields or in other investment opportunities to further diversify your portfolio.