Yo, peep this dope guide on compound interest calculator! We’re diving into how this tool can level up your financial game and help you stack that paper.

So, you ready to learn how compound interest can make your money work harder for you? Let’s break it down real smooth.

Introduction to Compound Interest Calculator

Compound interest is the interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. It plays a crucial role in financial planning as it allows your money to grow exponentially over time.

The compound interest calculator is a useful tool that helps individuals estimate the future value of their investments or loans based on different variables such as the initial amount, interest rate, compounding frequency, and time period. By inputting these factors, users can determine how their money will grow over time and make informed financial decisions.

Scenarios where a compound interest calculator can be helpful

- Planning for retirement: By inputting your current savings, expected contributions, and average rate of return, you can use the compound interest calculator to see how your retirement fund will grow over the years.

- Comparing investment options: When considering different investment opportunities, the calculator can help you compare the potential returns and choose the option that aligns with your financial goals.

- Paying off debt: If you have a loan or credit card debt, the calculator can show you how much you need to pay each month to clear the debt within a specific timeframe, taking into account the interest accrued.

How Compound Interest Calculators Work

Compound interest calculators are essential tools for determining the growth of an investment over time. By utilizing a specific formula, these calculators can provide accurate projections based on the initial investment amount, interest rate, compounding frequency, and time period.

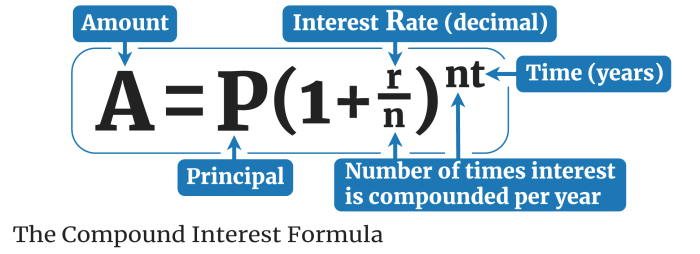

Formula Breakdown

Compound Interest = Principal Amount × (1 + (Interest Rate / Compounding Frequency)) ^ (Compounding Frequency × Time Period) – Principal Amount

The formula involves multiplying the principal amount by the compound interest factor raised to the power of the total compounding periods.

Variables in Compound Interest Calculations

- Principal Amount: The initial sum of money invested or borrowed.

- Interest Rate: The percentage rate applied to the principal amount.

- Compounding Frequency: How often interest is added to the principal (e.g., annually, semi-annually, quarterly).

- Time Period: The duration for which the investment is held or the loan is outstanding.

These variables play a crucial role in determining the final amount accrued through compound interest.

Example Calculation

Let’s consider an example where $1,000 is invested at an annual interest rate of 5% compounded quarterly for 5 years.

- Principal Amount: $1,000

- Interest Rate: 5%

- Compounding Frequency: Quarterly (4 times a year)

- Time Period: 5 years

Using the compound interest formula, we can calculate the final amount accumulated after 5 years.

Final Amount = $1,000 × (1 + (0.05 / 4)) ^ (4 x 5) – $1,000

Final Amount = $1,000 × (1.0125) ^ 20 – $1,000

Final Amount = $1,000 × 1.282037 – $1,000

Final Amount = $282.04

Therefore, the investment of $1,000 would grow to $1,282.04 after 5 years with compound interest.

Types of Compound Interest Calculators

Compound interest calculators come in various types, each offering unique features to help users calculate their earnings accurately. Let’s compare and contrast different types of compound interest calculators available online and explore the features they offer.

Online Compound Interest Calculators

Online compound interest calculators are easily accessible tools that allow users to input their principal amount, interest rate, and time period to calculate compound interest. These calculators typically provide a detailed breakdown of the total amount accrued over time, including the interest earned. Some online calculators also offer customization options, allowing users to adjust the compounding frequency to see how it affects their earnings.

Graphical Compound Interest Calculators

Graphical compound interest calculators provide users with visual representations of how their investment grows over time. These calculators often display graphs or charts showing the growth of the principal amount and the interest earned. Graphical calculators can help users better understand the power of compound interest and the impact of different compounding frequencies on their investments.

Comparison with Simple Interest Calculators

Simple interest calculators only take into account the initial principal amount and the interest rate, without considering the effects of compounding. In contrast, compound interest calculators factor in the interest earned on both the principal amount and the accumulated interest, leading to higher returns over time. By using compound interest calculators, users can get a more accurate estimate of their earnings compared to simple interest calculators.

Benefits of Using Compound Interest Calculators

Using compound interest calculators for financial planning has numerous advantages. These calculators help individuals make informed decisions about their investments and savings, leading to better financial outcomes in the long run.

Increased Accuracy in Financial Planning

Compound interest calculators provide accurate projections of how investments or savings will grow over time. This allows individuals to plan their finances more effectively and set realistic goals for the future.

Comparison of Different Investment Options

By inputting different variables into compound interest calculators, individuals can compare the potential returns of various investment options. This helps in choosing the most suitable investment strategy based on financial goals and risk tolerance.

Encourages Regular Saving Habits

Compound interest calculators demonstrate the power of compounding, encouraging individuals to start saving early and consistently. Seeing how small, regular contributions can grow significantly over time motivates people to prioritize saving for the future.

Real-Life Example

For example, using a compound interest calculator to compare the returns of investing in a high-interest savings account versus a low-interest CD helped Sarah make an informed decision. She realized that the savings account would yield higher returns over time, leading her to choose that option and ultimately grow her savings more effectively.