Get ready to dive into the world of credit repair strategies, where we unravel the mysteries of financial health and creditworthiness. From understanding credit scores to mastering effective repair techniques, this guide has got you covered.

In the following paragraphs, we’ll explore the ins and outs of building a positive credit history, navigating legal aspects, and much more. So, buckle up and let’s embark on this credit repair journey together.

Importance of Credit Repair Strategies

Having good credit is crucial for maintaining financial health. It affects your ability to secure loans, rent an apartment, and even get a job. Poor credit scores can lead to high interest rates, denial of credit, and difficulty in obtaining essential services like utilities.

Consequences of Poor Credit Scores

- Higher interest rates on loans and credit cards

- Difficulty securing a mortgage or car loan

- Limited access to credit cards and financial services

- Higher insurance premiums

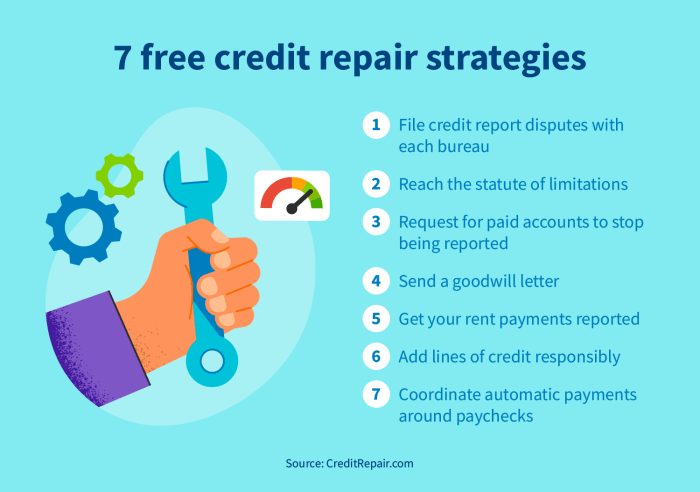

Credit Repair Strategies to Improve Creditworthiness

By implementing credit repair strategies, individuals can take steps to improve their credit scores and overall financial well-being.

- Reviewing credit reports for errors and inaccuracies

- Paying bills on time and reducing outstanding debt

- Negotiating with creditors to remove negative marks

- Building a positive credit history over time

Understanding Credit Scores

Credit scores are numerical representations of an individual’s creditworthiness, used by lenders to assess the risk of borrowing money to them. These scores are calculated based on various factors and play a crucial role in determining the interest rates and terms of loans or credit cards.

What is a Credit Score and How is it Calculated?

A credit score is a three-digit number that ranges from 300 to 850 in most scoring models, with higher scores indicating better creditworthiness. The most widely used credit scoring model is the FICO score, developed by the Fair Isaac Corporation. This score is calculated based on five main factors:

- Payment history (35%): This includes your history of making payments on time and any past delinquencies.

- Amounts owed (30%): This looks at the total amount of debt you owe, compared to your available credit.

- Length of credit history (15%): This considers how long your credit accounts have been open.

- New credit (10%): This factor looks at how many new credit accounts you have opened recently.

- Credit mix (10%): This considers the types of credit accounts you have, such as credit cards, mortgages, and loans.

It’s important to note that different credit scoring models may weigh these factors differently, leading to variations in credit scores.

Factors Influencing Credit Scores

Various factors can influence a person’s credit score, including:

- Payment history: Late payments or defaults can significantly impact credit scores negatively.

- Debt levels: High credit card balances relative to credit limits can lower credit scores.

- Length of credit history: Longer credit histories tend to result in higher credit scores.

- New credit: Opening multiple new credit accounts in a short period can lower credit scores.

- Credit mix: Having a diverse mix of credit accounts, like credit cards and loans, can positively impact credit scores.

Comparison of Different Credit Scoring Models

There are several credit scoring models used by lenders, with FICO being the most popular. Other models, like VantageScore, may use different algorithms and weightings to calculate credit scores. Understanding the differences between these models can help individuals tailor their credit repair strategies effectively.

Effective Credit Repair Techniques

When it comes to improving your credit score, there are several effective techniques you can utilize. Whether you choose to tackle the process on your own or seek professional help, understanding the common methods for repairing credit can make a significant difference in your financial health.

DIY Credit Repair vs Hiring Professionals

Repairing your credit on your own can be a cost-effective option, but it requires time, effort, and knowledge of the credit reporting system. On the other hand, hiring professionals such as credit repair agencies or credit counselors can provide expertise and guidance throughout the process, but it comes with a price tag. Consider the pros and cons of each approach before making a decision.

- DIY Credit Repair:

- Pros:

- Cost-effective

- Empowers you with knowledge about your credit

- Cons:

- Time-consuming

- Requires a deep understanding of credit laws and regulations

- Hiring Professionals:

- Pros:

- Expert guidance and support

- Convenience and time-saving

- Cons:

- Costly

- Dependence on external help

Negotiating with Creditors

One effective strategy in credit repair is negotiating with creditors to remove negative items from your credit reports. By communicating with creditors and offering to settle debts or arrange payment plans, you may be able to convince them to remove negative marks from your credit history.

Remember, creditors want to get paid, and they may be willing to work with you to find a solution that benefits both parties.

Building a Positive Credit History

Building a positive credit history is crucial for financial success. It can open doors to better interest rates on loans, higher credit limits, and more opportunities for financial growth. Here are some key strategies to help you build and maintain a positive credit history:

Responsibly Manage Credit Accounts

- Pay your bills on time: Late payments can have a significant negative impact on your credit score. Make sure to pay at least the minimum amount due by the due date to avoid late fees and negative marks on your credit report.

- Keep credit card balances low: Aim to keep your credit card balances below 30% of your available credit limit. High credit card balances can indicate financial strain and lower your credit score.

- Avoid opening too many new accounts: Opening multiple new credit accounts in a short period of time can raise red flags for lenders and potentially lower your credit score. Only open new accounts when necessary.

Impact of Credit Activities on Credit Scores

- Hard inquiries: Applying for new credit can result in a hard inquiry on your credit report, which can temporarily lower your credit score. Try to limit the number of hard inquiries you have within a short timeframe.

- Length of credit history: The longer you have a positive credit history, the better it reflects on your credit score. It shows lenders that you have a track record of responsible credit management.

- Credit mix: Having a diverse mix of credit accounts, such as credit cards, auto loans, and mortgages, can positively impact your credit score. It demonstrates your ability to manage different types of credit responsibly.

Legal Aspects of Credit Repair

When it comes to credit repair, understanding the legal aspects is crucial. Various laws and regulations govern the credit repair process to protect consumers and ensure fair practices.

Consumer Rights and Credit Reporting

- The Fair Credit Reporting Act (FCRA) gives consumers the right to access their credit reports for free once a year from each of the major credit bureaus.

- Consumers have the right to dispute inaccurate information on their credit reports and have it investigated and corrected by the credit bureaus.

- Under the FCRA, credit bureaus must investigate disputes within 30 days and remove any inaccurate information from the credit report.

Role of Credit Bureaus

- Credit bureaus play a significant role in the credit repair process by collecting and maintaining credit information on individuals.

- They provide credit reports to lenders, employers, and other authorized entities to assess an individual’s creditworthiness.

- It is essential to regularly review your credit report from each of the major credit bureaus to ensure accuracy and address any discrepancies promptly.