Debt-to-income ratio explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality.

Understanding how debt-to-income ratio plays a crucial role in financial decisions is key to building a strong financial foundation. As we dive into the intricacies of this ratio, you’ll uncover the secrets behind managing your finances like a pro.

What is Debt-to-Income Ratio?

Debt-to-Income Ratio is a financial term that measures the percentage of a person’s monthly gross income that goes towards paying debts. This ratio is crucial in determining an individual’s financial health and ability to manage additional debt responsibly.

Calculation of Debt-to-Income Ratio

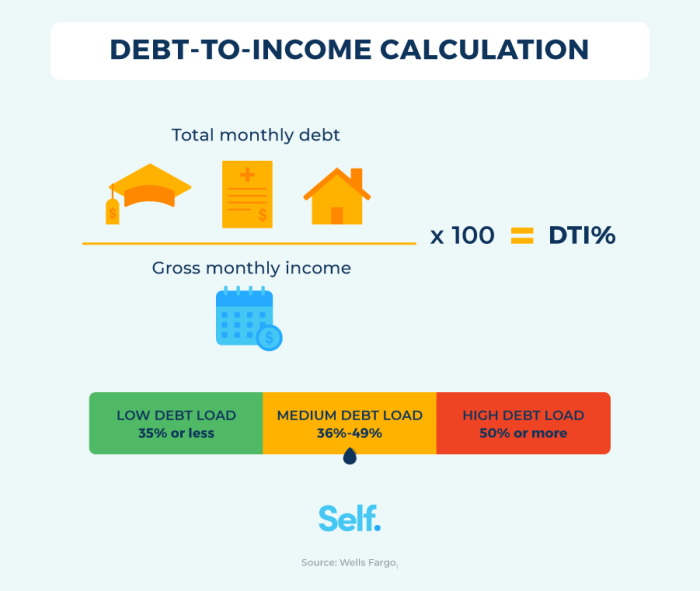

To calculate the Debt-to-Income Ratio, you need to add up all your monthly debt payments and divide that number by your gross monthly income. The formula looks like this:

Debt-to-Income Ratio = (Total Monthly Debt Payments / Gross Monthly Income) x 100

Importance of Debt-to-Income Ratio

Having a low Debt-to-Income Ratio is essential for financial stability. Lenders use this ratio to determine if an individual can afford to take on additional debt, such as a mortgage or car loan. A high ratio indicates that a person may be overextended and at risk of defaulting on their payments.

Types of Debt-to-Income Ratios

When it comes to debt-to-income ratios, there are two main types that lenders look at to assess a borrower’s financial health: front-end and back-end ratios.

Front-End Debt-to-Income Ratio

The front-end debt-to-income ratio, also known as the housing ratio, looks at the percentage of a borrower’s gross income that goes towards housing expenses such as mortgage payments, property taxes, and insurance. Lenders use this ratio to determine if a borrower can afford the costs associated with owning a home.

- The formula for calculating the front-end ratio is:

Front-End Ratio = (Total Monthly Housing Costs / Gross Monthly Income) x 100

- For example, if a borrower has a gross monthly income of $5,000 and their total monthly housing costs are $1,500, their front-end ratio would be 30%.

Back-End Debt-to-Income Ratio

The back-end debt-to-income ratio, also known as the total debt ratio, takes into account all of a borrower’s monthly debt obligations, including housing expenses. Lenders use this ratio to assess a borrower’s overall financial situation and determine their ability to manage additional debt.

- The formula for calculating the back-end ratio is:

Back-End Ratio = (Total Monthly Debt Payments / Gross Monthly Income) x 100

- For example, if a borrower has total monthly debt payments of $2,000 and a gross monthly income of $6,000, their back-end ratio would be 33.33%.

Ideal Debt-to-Income Ratio

When it comes to your debt-to-income ratio, there is a sweet spot that is considered ideal for financial stability. Let’s dive into what this ratio should look like and how it can impact your overall financial health.

What is a Good Debt-to-Income Ratio?

Having a debt-to-income ratio below 36% is generally considered good. This means that your total monthly debt payments should not exceed 36% of your gross monthly income.

How Different Ratios Affect Financial Stability

Having a high debt-to-income ratio can make it difficult to qualify for loans or credit cards, as lenders may see you as a higher risk borrower. It can also limit your ability to save for the future or handle unexpected expenses.

Insights on Improving Debt-to-Income Ratio

- Reduce your debt: Pay off outstanding balances on credit cards or loans to lower your overall debt amount.

- Increase your income: Consider ways to boost your income through a side hustle, freelance work, or seeking a higher-paying job.

- Create a budget: Track your expenses and create a budget to ensure you are living within your means and not accumulating more debt.

Factors Influencing Debt-to-Income Ratio

When it comes to the debt-to-income ratio, several key factors play a crucial role in determining an individual’s financial health. Understanding these factors can help you manage your finances effectively.

Income Levels

Income is a significant factor that directly impacts your debt-to-income ratio. As your income increases, your ability to manage debt also improves. On the other hand, a decrease in income can lead to a higher ratio, making it challenging to meet financial obligations.

Debt Levels

The amount of debt you owe is another critical factor affecting your debt-to-income ratio. High levels of debt relative to your income can result in a higher ratio, indicating financial strain. Managing and reducing debt is essential to maintaining a healthy ratio.

Interest Rates

The interest rates on your debts can also influence your debt-to-income ratio. Higher interest rates mean more money goes towards paying off debt, impacting your overall financial situation. Refinancing or consolidating debt at lower rates can help lower the ratio.

Fixed Expenses

Fixed expenses such as mortgage payments, car loans, and insurance premiums can impact your debt-to-income ratio. These expenses reduce the amount of income available to pay off debt, potentially increasing the ratio. Evaluating and reducing fixed expenses can help improve your ratio.

Spending Habits

Your spending habits play a significant role in determining your debt-to-income ratio. Overspending and living beyond your means can lead to higher levels of debt, ultimately affecting the ratio. Adopting a budget and cutting unnecessary expenses can help manage the ratio effectively.

Strategies to Manage Debt-to-Income Ratio

To effectively manage your debt-to-income ratio, consider the following strategies:

- Increase Income: Look for opportunities to boost your income through side hustles or career advancement.

- Reduce Debt: Focus on paying off high-interest debt and avoid taking on new debt whenever possible.

- Create a Budget: Track your expenses and create a budget to ensure you’re living within your means.

- Seek Professional Help: Consider consulting a financial advisor for personalized advice on managing debt.

By understanding and addressing these factors, you can take control of your debt-to-income ratio and improve your overall financial well-being.