Diving into the world of dividend stocks strategies, this passage invites readers on a journey filled with valuable insights and expert advice. Get ready to explore the exciting realm of investment opportunities and learn how to maximize your returns like a pro.

In the following paragraphs, we will delve into the key aspects of selecting dividend stocks, the importance of dividend reinvestment plans, and the significance of diversification in your investment portfolio.

Introduction to Dividend Stocks

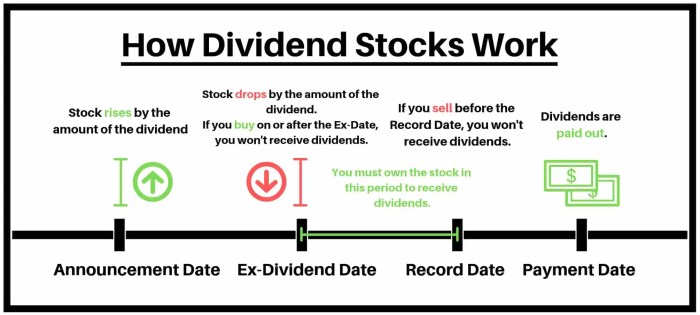

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders on a regular basis. These payments are known as dividends and are typically paid quarterly. Investing in dividend stocks can provide investors with a steady stream of income and the potential for long-term growth.

Benefits of Investing in Dividend Stocks

- Steady Income: Dividend stocks provide investors with a reliable source of income, which can be especially beneficial for retirees or those looking for passive income.

- Portfolio Stability: Companies that pay dividends tend to be more stable and mature, making them less volatile during market fluctuations.

- Potential for Growth: Reinvesting dividends can accelerate the growth of your investment over time through the power of compounding.

Examples of Well-Known Dividend-Paying Companies

- Apple Inc. (AAPL): Apple is a technology giant that has consistently paid dividends and has a track record of increasing its payouts over time.

- Johnson & Johnson (JNJ): A multinational healthcare company known for its strong dividend history and stable business model.

- The Coca-Cola Company (KO): Coca-Cola is a leading beverage company that has been paying dividends for over a century, making it a reliable choice for income investors.

Strategies for Selecting Dividend Stocks

When it comes to choosing dividend stocks, there are a few key criteria to consider. These can help you identify companies that offer consistent payouts and potential for growth. Let’s dive into the strategies for selecting dividend stocks.

Criteria for Selecting Dividend Stocks

- History of Dividend Payments: Look for companies with a strong track record of paying dividends consistently over the years.

- Dividend Yield: Consider the dividend yield, which is the annual dividend payment divided by the stock price. A higher yield indicates a potentially better return.

- Financial Health: Evaluate the company’s financial stability and performance to ensure they can sustain dividend payments.

- Growth Potential: Analyze the company’s growth prospects to see if they can continue to increase dividends in the future.

Approaches to Identifying High-Yield Dividend Stocks

- Screening Tools: Use online screening tools to filter stocks based on dividend yield, payout ratio, and other key metrics.

- Dividend Aristocrats: Consider investing in companies that are part of the Dividend Aristocrats index, which includes companies with a history of increasing dividends for at least 25 years.

- Sector Analysis: Evaluate different sectors to find industries with a tradition of high dividend payouts.

Researching and Analyzing Dividend-Paying Companies

- Financial Statements: Dive into the company’s financial statements to assess their revenue, earnings, and cash flow.

- Management Team: Look at the company’s management team and their strategies for sustaining dividend payments.

- Industry Trends: Stay informed about industry trends and how they might impact the company’s ability to pay dividends.

Importance of Dividend Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans, commonly known as DRIPs, are investment programs offered by companies that allow shareholders to automatically reinvest their cash dividends into additional shares of the company’s stock. This means that instead of receiving cash payouts, investors receive more shares, which can help accelerate the growth of their investment over time.

What are DRIPs and How Do They Work?

DRIPs work by providing shareholders the option to reinvest their dividends directly back into the company’s stock, often at a discounted price. This process is usually done through the company’s transfer agent or a third-party administrator. As dividends are paid out, the funds are used to purchase additional shares on behalf of the investor, helping to compound the investment over time.

Advantages of Participating in DRIPs for Long-Term Investors

- Compound Growth: By reinvesting dividends, investors can benefit from compounding returns, as the additional shares purchased through the DRIP can generate more dividends in the future.

- Cost Averaging: DRIPs allow investors to dollar-cost average their investments, as shares are purchased at regular intervals regardless of market conditions.

- Tax Efficiency: Reinvested dividends through DRIPs are generally not subject to taxes until shares are sold, providing tax advantages for long-term investors.

Examples of Companies Offering DRIPs and Their Benefits

- Company: The Coca-Cola Company

- Benefits: The Coca-Cola Company offers a DRIP that allows investors to reinvest dividends at a discounted price, with the option to purchase additional shares without paying commissions.

- Company: Johnson & Johnson

- Benefits: Johnson & Johnson’s DRIP provides shareholders the opportunity to reinvest dividends to acquire additional shares, promoting long-term wealth accumulation through compounding.

Diversification in Dividend Stock Portfolios

Diversification is a key strategy when it comes to building a dividend stock portfolio. By spreading your investments across different sectors and industries, you can reduce risk and protect your portfolio from the potential downturn of any single sector.

Importance of Diversifying Across Sectors and Industries

- Investing in various sectors such as healthcare, technology, finance, and consumer goods helps in minimizing the impact of a downturn in any one sector.

- Each sector may perform differently based on economic conditions, so diversifying ensures your portfolio remains resilient.

- By including industries like energy, real estate, and utilities, you can further enhance the stability of your dividend stock holdings.

Strategies for Managing Risk Through Diversification

- Allocate your investments across different sectors to reduce concentration risk.

- Research and select dividend stocks from industries with varying levels of sensitivity to economic factors.

- Consider investing in both domestic and international dividend-paying companies to diversify geographically.