Diving into Financial tools for budgeting, this introduction immerses readers in a unique and compelling narrative, with American high school hip style that is both engaging and thought-provoking from the very first sentence. From tracking expenses to setting financial goals, we’ll explore the world of financial tools and how they can revolutionize your budgeting game.

Let’s take a look at the different types of financial tools available, best practices for effective budgeting, and how to integrate these tools with your long-term financial plans. Get ready to level up your financial game!

Importance of Financial Tools for Budgeting

Budgeting is like the MVP of managing your money game, whether you’re balling on a personal level or running a business empire. It’s all about keeping your finances in check, making sure you’re not blowing all your cash on unnecessary stuff, and setting yourself up for financial success in the long run.

Financial tools are like your trusty sidekicks in this money-saving mission. They help you track your expenses, set financial goals, and even give you a heads up on where you can save or invest your hard-earned dough. It’s like having a personal financial advisor in your pocket, guiding you every step of the way.

Popular Financial Tools for Budgeting

- Mint: This handy app lets you track your spending, set budgets, and even get alerts when you’re going overboard.

- YNAB (You Need A Budget): As the name suggests, this tool helps you create a budget that works for you and your financial goals.

- Personal Capital: Perfect for those looking to invest, this tool helps you manage your investments while also keeping an eye on your spending.

How Financial Tools Help in Tracking Expenses and Identifying Savings

Financial tools are like the Sherlock Holmes of your money world, helping you sleuth out where your cash is going and where you can cut back. By tracking your expenses, you can see patterns in your spending habits and identify areas where you might be overspending. This knowledge empowers you to make smarter financial decisions, save more, and even invest for the future.

Types of Financial Tools for Budgeting

Budgeting is crucial for financial stability, and there are various tools available to help individuals manage their finances effectively.

1. Budgeting Apps

Budgeting apps like Mint, YNAB (You Need a Budget), and PocketGuard are popular choices for tracking expenses, setting financial goals, and creating budgets. These apps often sync with bank accounts and credit cards to provide real-time updates on spending habits.

2. Financial Software

Financial software such as Quicken and QuickBooks offer more advanced features for budgeting, including the ability to generate detailed financial reports, automate bill payments, and track investments. These software programs are ideal for individuals with complex financial portfolios.

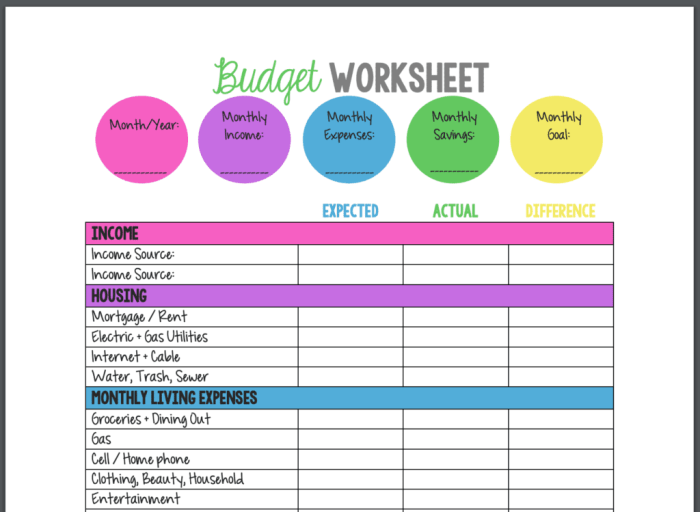

3. Spreadsheets

Spreadsheets like Microsoft Excel or Google Sheets are versatile tools for budgeting, allowing users to create customized budgets and analyze spending patterns. While they require manual data entry, spreadsheets offer a high level of flexibility and customization.

4. Envelope System

The envelope system is a traditional budgeting method where individuals allocate cash into different envelopes labeled for specific spending categories. This method helps individuals visualize their budget and control spending in each category.

5. Automated Bill Payment Services

Automated bill payment services like Bill.com or Prism streamline the bill payment process by automatically deducting funds from a designated account to pay bills on time. These services help individuals avoid late fees and maintain a consistent payment schedule.

6. Online Banking Tools

Many banks offer online tools that allow customers to track spending, set budget goals, and receive notifications for upcoming bills. These tools provide a convenient way to manage finances without the need for external apps or software.

Best Practices for Budgeting with Financial Tools

Setting up a budget effectively using financial tools is essential for managing your finances and reaching your financial goals. Here are some best practices to follow:

Categorize Expenses

- Use financial tools to categorize your expenses into essential categories like housing, utilities, groceries, transportation, and discretionary spending.

- Assign a budgeted amount to each category based on your income and financial goals.

- Regularly review your expenses to ensure they align with your budget and make adjustments as needed.

Set Financial Goals

- Define short-term and long-term financial goals, such as saving for a vacation, paying off debt, or buying a home.

- Use financial tools to track your progress towards these goals and make necessary changes to your budget to stay on track.

- Regularly revisit and revise your financial goals as your priorities and financial situation evolve.

Monitor Progress

- Utilize financial tools to track your income, expenses, savings, and investments regularly.

- Review your budget and financial goals monthly to assess your progress and make adjustments as necessary.

- Stay disciplined with your budgeting practices and celebrate milestones along the way to stay motivated.

Integrating Financial Tools with Other Financial Management Strategies

Financial tools play a crucial role in complementing other financial management strategies such as savings plans or investment portfolios. By integrating these tools with other strategies, individuals can enhance their overall financial planning and decision-making process.

Financial Tools and Financial Goals Setting

- One example of integrating financial tools with financial goals setting is using budgeting apps that allow users to set specific financial goals, such as saving a certain amount for a vacation or paying off debt.

- These tools can provide real-time tracking of progress towards these goals, offering insights into spending habits and areas where adjustments can be made to stay on track.

Financial Tools in Long-Term Financial Planning

- Financial tools play a crucial role in long-term financial planning by helping individuals create and maintain a comprehensive financial roadmap for the future.

- For example, retirement planning calculators can be used to estimate how much needs to be saved each month to achieve retirement goals, considering factors like inflation and investment returns.

- Investment tracking tools can also be integrated into long-term planning to monitor the performance of investment portfolios and make informed decisions about asset allocation.