Ready to take control of your finances? Buckle up as we dive into the world of budgeting, breaking down the essentials in a way that’s easy to grasp and implement. From setting financial goals to managing debt, we’ve got you covered with all the tips and tricks you need to create a budget like a pro.

Introduction to Budgeting

Budgeting is a financial tool that helps individuals or organizations plan and track their income and expenses. It is crucial for managing money effectively and achieving financial goals. By creating a budget, one can gain control over their finances, avoid debt, and save for the future.

Benefits of creating a budget

- Allows for better financial decision-making

- Helps in identifying spending patterns

- Aids in setting and achieving financial goals

- Provides a sense of security and peace of mind

Basic principles of budgeting

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

- Track income and expenses: Know how much money is coming in and going out.

- Set financial goals: Define short-term and long-term objectives to work towards.

- Create spending categories: Allocate funds for essentials, savings, and discretionary expenses.

- Review and adjust: Regularly monitor your budget and make changes as needed.

Setting Financial Goals

Setting financial goals is a crucial step in creating a budget as it provides a clear direction and purpose for your financial planning. By establishing goals, you can prioritize your spending, save for the future, and track your progress towards financial stability.

Short-term and Long-term Financial Goals

- Short-term financial goals: These are goals that you aim to achieve in the near future, typically within a year. Examples include building an emergency fund, paying off credit card debt, or saving for a vacation.

- Long-term financial goals: These are goals that you work towards over an extended period, usually five years or more. Examples include saving for retirement, buying a home, or funding a child’s education.

Importance of Financial Goals in Budget Planning

Setting financial goals helps in budget planning by providing a roadmap for your financial decisions. It allows you to allocate your resources effectively, prioritize expenses that align with your goals, and stay motivated to stick to your budget. By having clear objectives, you can measure your progress, make adjustments when necessary, and ultimately achieve financial success.

Tracking Income and Expenses

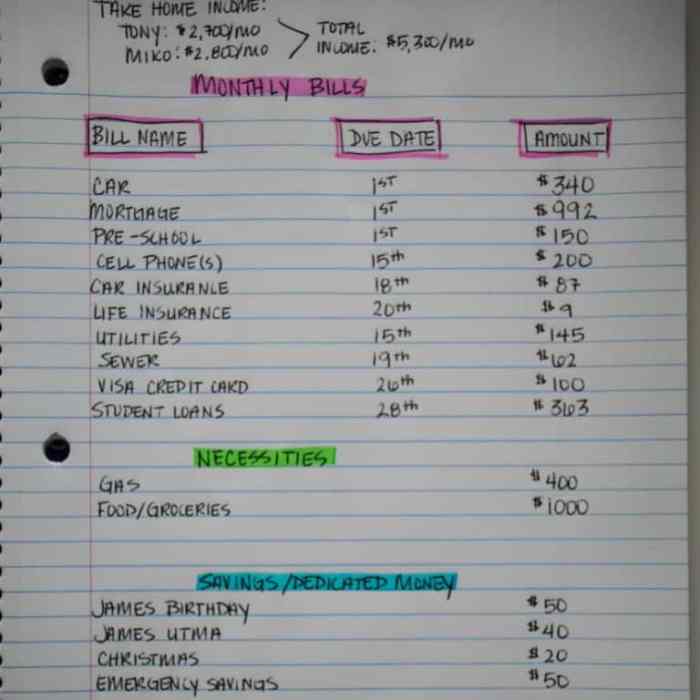

Tracking your income and expenses is crucial for effective budgeting. By accurately monitoring your finances, you can make informed decisions to reach your financial goals.

Tracking Income Sources

- Create a comprehensive list of all your income sources, including your salary, bonuses, side hustles, and any other sources of revenue.

- Use tools like spreadsheets or budgeting apps to record and categorize your income, making it easier to track and analyze.

- Regularly update your income records to ensure accuracy and stay on top of any changes.

Categorizing Expenses for Better Tracking

- Organize your expenses into categories such as housing, utilities, groceries, transportation, entertainment, and savings.

- Assign a budget to each category based on your financial goals and priorities.

- Review and adjust your expense categories regularly to reflect changes in your spending habits and financial situation.

Importance of Monitoring Expenses Regularly

- Tracking your expenses allows you to identify areas where you may be overspending and make necessary adjustments to stay within your budget.

- Regular monitoring helps you stay accountable to your financial goals and ensures you are on track to achieve them.

- By analyzing your spending patterns, you can make informed decisions on where to cut costs or increase savings to improve your overall financial health.

Creating a Budget Plan

Creating a budget plan is essential for managing your finances effectively. It helps you allocate your income wisely and ensures that you are not overspending. Here are the steps involved in creating a budget plan:

Allocating Funds to Different Expense Categories

When creating a budget plan, it is important to allocate funds to different expense categories based on priority. Here is a general guideline for allocating your funds:

- Essential Expenses: Allocate a portion of your income to cover essential expenses such as rent, utilities, groceries, and transportation.

- Savings: Set aside a percentage of your income for savings and emergency funds. It is recommended to save at least 20% of your income.

- Debt Repayment: If you have any outstanding debts, allocate a portion of your income to repay them. It is important to prioritize high-interest debts.

- Discretionary Expenses: Allocate a portion of your income for discretionary expenses such as entertainment, dining out, and shopping. It is important to set a limit on these expenses to avoid overspending.

Adjusting the Budget When Necessary

It is important to regularly review and adjust your budget plan to ensure that it aligns with your financial goals and current situation. Here are some strategies for adjusting your budget when necessary:

- Track Your Expenses: Monitor your spending regularly to identify areas where you are overspending. Adjust your budget to reallocate funds to more essential categories.

- Review Your Income: If your income changes, adjust your budget plan accordingly. This could include seeking additional sources of income or cutting back on expenses.

- Set Realistic Goals: If you find that you are consistently overspending in certain categories, reassess your budget and set more realistic goals for those expenses.

Saving and Emergency Funds

When it comes to budgeting, saving money is a crucial component for financial stability and security. It allows you to be prepared for unexpected expenses and helps you work towards your long-term financial goals.

Allocating Funds for Emergency Savings

Setting aside funds specifically for emergencies is essential to avoid going into debt when unexpected situations arise. Here’s how you can allocate funds for your emergency savings:

- Calculate your monthly expenses: Determine how much you need to cover your essential expenses for a certain period (e.g., 3-6 months).

- Set a savings goal: Aim to save a specific amount that would cover your living expenses in case of emergencies, such as medical bills or car repairs.

- Automate your savings: Set up automatic transfers from your checking account to your emergency fund to ensure consistent contributions.

Tips for Building an Emergency Fund

Building an emergency fund takes time and discipline, but it’s worth the effort for financial peace of mind. Here are some tips to help you build your emergency fund:

- Start small and increase gradually: Begin by saving a small percentage of your income and gradually increase the amount as you get more comfortable with your budget.

- Cut back on non-essential expenses: Identify areas where you can reduce spending, such as dining out or subscription services, and allocate those savings to your emergency fund.

- Use windfalls wisely: If you receive unexpected income, like a tax refund or bonus, consider putting a portion of it towards your emergency fund.

- Revisit and adjust your goals: Regularly review your budget and savings goals to ensure they align with your current financial situation and adjust as needed.

Managing Debt

Managing debt is a crucial aspect of budgeting that can have a significant impact on your financial well-being. By carefully managing and reducing debt, you can work towards achieving financial stability and reaching your goals.

Including Debt Payments in a Budget

When creating a budget, it is essential to include debt payments as a fixed expense. Prioritizing debt repayment ensures that you are making progress towards reducing your overall debt burden. By allocating a specific amount towards debt payments each month, you can stay on track and gradually eliminate your debts.

- Make a list of all your debts, including credit cards, loans, and other obligations.

- Determine the minimum payments required for each debt.

- Allocate additional funds towards high-interest debts to reduce them faster.

- Consider debt consolidation or refinancing options to lower interest rates and simplify payments.

By including debt payments in your budget, you can actively work towards becoming debt-free and improving your financial health.

Prioritizing Debt Repayment

Prioritizing debt repayment involves focusing on high-interest debts first to minimize the amount of interest paid over time. By strategically paying off debts with the highest interest rates, you can save money and accelerate your journey towards financial freedom.

- Identify debts with the highest interest rates.

- Allocate extra funds towards these debts while making minimum payments on others.

- Consider the snowball or avalanche method to pay off debts systematically.

- Track your progress and celebrate small victories along the way.

By prioritizing debt repayment, you can effectively reduce your debt load and move closer to achieving your financial goals.