Getting that credit history on point is key to financial success. In this guide, we’ll break down the ins and outs of improving your credit history, so you can level up your financial game like a boss.

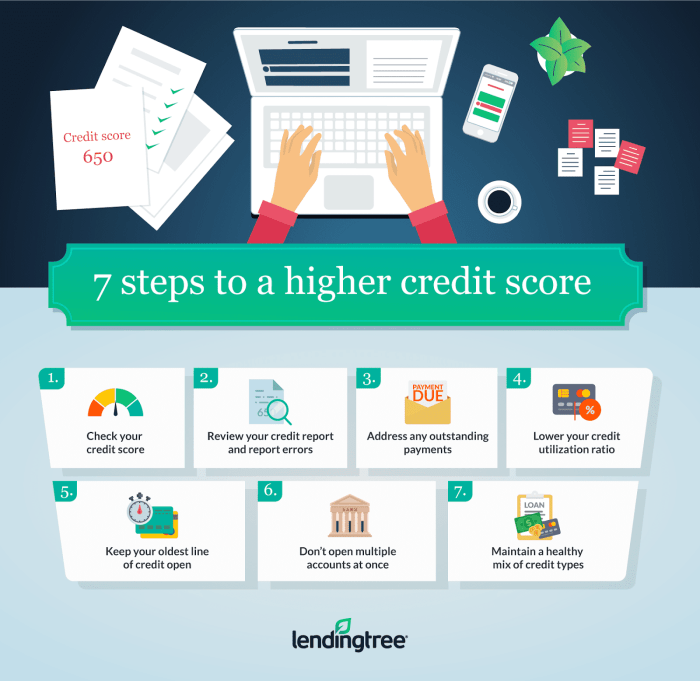

Now, let’s dive into the nitty-gritty details of how to boost that credit score and secure a bright financial future.

Understand Credit History

Understanding credit history is crucial for making informed financial decisions and accessing various opportunities like loans, credit cards, and mortgages. It reflects your past financial behavior and helps lenders assess your creditworthiness.

How Credit History is Calculated

Credit history is calculated based on several factors, including payment history, amounts owed, length of credit history, new credit, and types of credit used. These factors contribute to your overall credit score, which ranges from 300 to 850.

- Payment History: This accounts for the largest portion of your credit score and shows how consistently you have paid your bills on time.

- Amounts Owed: This considers the total amount of debt you owe and your credit utilization ratio.

- Length of Credit History: The longer your credit history, the better it is for your score as it demonstrates a track record of responsible credit management.

- New Credit: Opening multiple new accounts in a short period can negatively impact your credit score.

- Types of Credit Used: Having a mix of credit accounts like credit cards, loans, and mortgages can positively impact your credit score.

Credit Reports vs. Credit Scores

Your credit report is a detailed record of your credit history, including your payment history, credit utilization, and accounts. On the other hand, your credit score is a numerical representation of the information in your credit report. While credit reports provide a comprehensive view of your credit history, credit scores offer a quick summary that lenders often use to make decisions.

Monitoring Credit Reports

Regularly checking your credit reports is crucial to maintaining a healthy credit history. It allows you to spot any errors or fraudulent activity early on and take the necessary steps to address them.

Obtaining a Free Credit Report

- By law, you are entitled to one free credit report each year from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

- You can obtain your free credit report by visiting AnnualCreditReport.com, the only authorized website for free credit reports.

- Make sure to review each report carefully for any discrepancies or inaccuracies.

Impact of Errors on Credit History

- Errors on your credit report can negatively impact your credit score and overall creditworthiness.

- Common errors include incorrect personal information, accounts that don’t belong to you, and inaccurately reported payment history.

- To dispute errors on your credit report, you can contact the credit bureau in writing with supporting documents to prove the inaccuracies.

Paying Bills on Time

Paying bills on time is crucial for maintaining a good credit history. Late payments can have a negative impact on your credit score and make it harder to secure loans or credit in the future.

Setting Up Automatic Payments

Setting up automatic payments is a great way to ensure that you never miss a bill payment. By linking your bank account to your bills, you can have the peace of mind that payments will be made on time every month. Just make sure to regularly monitor your accounts to ensure that there are enough funds to cover the automatic payments.

Impact of Late Payments on Credit Scores

Late payments can significantly lower your credit score and stay on your credit report for up to seven years. This can make it harder to qualify for loans, credit cards, or even impact your ability to rent an apartment. It’s important to prioritize timely bill payments to maintain a positive credit history.

Managing Credit Card Usage

Managing your credit card usage is crucial for improving your credit history and maintaining a good credit score. By understanding how credit card utilization affects your credit history and implementing strategies to lower credit card balances, you can reap the benefits of maintaining a low credit utilization ratio.

Strategies to Lower Credit Card Balances

- Make more than the minimum payment: By paying more than the minimum amount due each month, you can reduce your credit card balance faster and save money on interest charges.

- Create a budget: Establish a budget that allocates a specific amount for credit card payments each month. This will help you avoid overspending and keep your balances in check.

- Avoid new purchases: Try to refrain from making new purchases on your credit cards until you have paid off existing balances. This will prevent your debt from increasing further.

Benefits of Maintaining a Low Credit Utilization Ratio

- Improved credit score: Keeping your credit card balances low relative to your credit limits shows lenders that you are responsible with credit, which can boost your credit score.

- Lower interest rates: Lenders may offer you lower interest rates on loans and credit cards if you maintain a low credit utilization ratio, saving you money in the long run.

- Higher credit limits: By demonstrating good credit habits, you may be eligible for higher credit limits, giving you more financial flexibility in the future.

Building a Credit History

Establishing a positive credit history is crucial for individuals with limited credit. It allows them to demonstrate their ability to manage credit responsibly and opens up opportunities for better financial options in the future.

Ways to Establish a Positive Credit History

- Apply for a secured credit card: A secured credit card requires a cash deposit as collateral, making it easier to qualify for individuals with limited credit.

- Become an authorized user: Being added as an authorized user on someone else’s credit card can help build credit history, as long as the primary account holder makes timely payments.

- Take out a credit-builder loan: Credit-builder loans are designed to help individuals establish credit by making small monthly payments that are reported to credit bureaus.

Benefits of Diversifying Credit Accounts

Diversifying credit accounts by having a mix of different types of credit, such as credit cards, loans, and a mortgage, can positively impact a credit score. It shows lenders that an individual can manage various types of credit responsibly, leading to a stronger credit history.

Tips for Responsibly Using Credit to Build Credit History

- Make timely payments: Paying bills on time is crucial for building a positive credit history and avoiding late fees or negative marks on credit reports.

- Keep credit card balances low: Aim to keep credit card balances below 30% of the credit limit to demonstrate responsible credit utilization.

- Avoid opening multiple accounts at once: Opening several new credit accounts in a short period can signal financial instability to lenders, potentially hurting credit scores.