How to invest in gold sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In a world where financial stability is key, gold investment shines as a beacon of opportunity for savvy investors looking to diversify their portfolios and secure their wealth. Let’s dive into the glittering world of gold investment and unlock the secrets to success in this timeless market.

Understanding Gold Investment

Investing in gold refers to purchasing physical gold or gold-related financial products with the expectation of generating a return on the investment. It is a popular form of investment due to its historical value, stability, and ability to act as a hedge against economic uncertainties.

Why People Choose to Invest in Gold

- Historical Value: Gold has been considered a valuable asset for centuries, making it a reliable investment option.

- Stability: Gold prices tend to be less volatile compared to other investments like stocks, providing a sense of security to investors.

- Hedge Against Inflation: Gold is often seen as a hedge against inflation, as its value tends to increase when the purchasing power of currency decreases.

- Diversification: Investing in gold can help diversify a portfolio, reducing overall risk by spreading investments across different asset classes.

Benefits of Investing in Gold

- Long-Term Value: Gold has maintained its value over time, making it a potential store of wealth.

- Liquidity: Gold is a highly liquid asset, meaning it can be easily bought or sold in the market.

- Global Demand: Gold has universal appeal and is in demand worldwide, which can contribute to its value appreciation.

- Portfolio Protection: Gold can act as a safe haven during times of economic instability or geopolitical tensions, providing a buffer for investment portfolios.

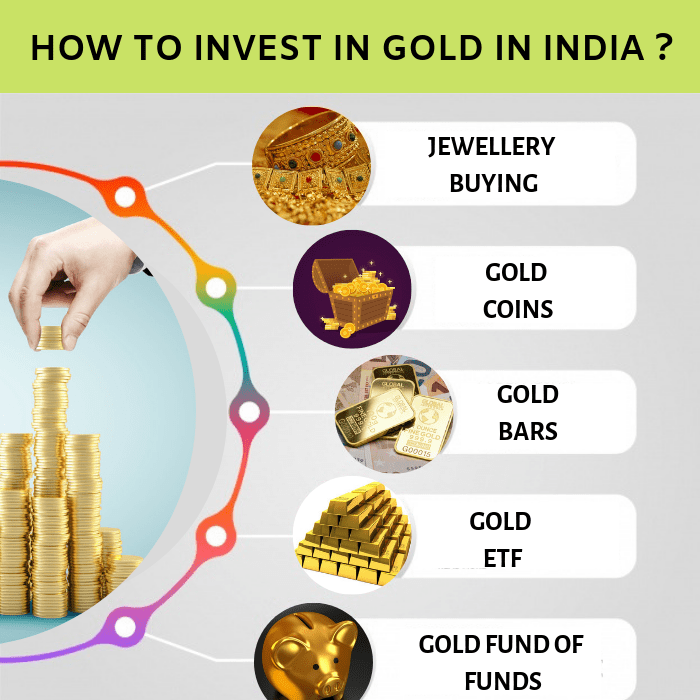

Ways to Invest in Gold

Investing in gold can be done through various methods, each with its own set of pros and cons. Let’s explore some of the most common ways to invest in gold.

Physical Gold

Investing in physical gold involves purchasing gold bars, coins, or jewelry. One of the main advantages of owning physical gold is that you have direct possession of the asset, which can serve as a hedge against economic uncertainty. However, storing and insuring physical gold can be costly, and there may be concerns regarding authenticity and liquidity.

Gold Exchange-Traded Funds (ETFs)

Gold ETFs are investment funds that track the price of gold and are traded on stock exchanges. Investing in gold ETFs provides investors with exposure to the price of gold without the need for physical ownership. One of the main advantages of gold ETFs is the ease of buying and selling, as they can be traded like stocks. However, investors do not have direct ownership of the physical asset, and there are management fees associated with ETFs.

Gold Mining Stocks

Another way to invest in gold is through gold mining stocks. Investing in gold mining companies allows investors to benefit from the potential upside of successful mining operations. However, gold mining stocks are subject to company-specific risks, such as operational challenges and management issues. Additionally, the performance of gold mining stocks may not always correlate with the price of gold.

Reputable Gold Dealers or Platforms

When investing in physical gold, it is important to choose reputable dealers or platforms to ensure the authenticity and quality of the gold. Some well-known gold dealers include APMEX, JM Bullion, and Kitco. For those interested in gold ETFs, popular platforms like SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) offer exposure to the price of gold through ETF investments.

Factors to Consider Before Investing

When it comes to investing in gold, there are several factors that you need to consider before making a decision. These factors can help you make a more informed choice and maximize the potential benefits of your investment.

Market Conditions

- Market conditions play a crucial role in determining the price of gold. Factors such as supply and demand, geopolitical events, and inflation can all impact the value of gold.

- It’s important to stay informed about current market trends and events that could affect the price of gold before making an investment.

Investment Goals

- Before investing in gold, you should clearly define your investment goals. Are you looking for long-term growth, a hedge against inflation, or a safe haven asset during times of economic uncertainty?

- Your investment goals will help you determine the best approach to investing in gold and the amount of risk you are willing to take.

Risk Tolerance

- Understanding your risk tolerance is essential when investing in gold. Gold is known for its price volatility, so it’s important to assess how much risk you are comfortable with.

- Consider how much of your investment portfolio you are willing to allocate to gold and whether you can handle potential fluctuations in the price of gold.

Economic Factors and Diversification

- Economic factors such as interest rates, currency movements, and economic growth can impact the price of gold. It’s crucial to monitor these factors to make informed investment decisions.

- Diversification is key to building a successful gold investment portfolio. By spreading your investments across different asset classes, including gold, you can reduce risk and potentially increase returns.

Risks Associated with Gold Investment

Investing in gold can offer a hedge against inflation and economic uncertainties, but it also comes with its own set of risks. It’s crucial for investors to understand these risks to make informed decisions.

Geopolitical Events and Gold Prices

Geopolitical events play a significant role in influencing the price of gold. Any political instability, conflicts, or economic crises can lead to a surge in gold prices as investors flock to safe-haven assets. However, sudden peace agreements or stable political conditions can cause a drop in gold prices. It’s essential to stay updated on global events to anticipate potential fluctuations in gold prices.

Strategies to Mitigate Risks

To mitigate risks associated with gold investment, consider diversifying your portfolio. Instead of putting all your funds into gold, spread your investments across different asset classes. This strategy can help offset losses in case the price of gold experiences a downturn. Additionally, keep a close eye on market trends and seek advice from financial experts to make well-informed decisions.

Storing and Selling Gold

Investing in gold is not just about buying it; you also need to know how to store it securely and how to sell it when the time comes. Here’s a guide on storing and selling gold investments.

Storing Physical Gold Safely

When it comes to storing physical gold, there are several options to consider:

- Safe Deposit Box: Renting a safe deposit box at a bank is a secure way to store your gold. However, it may come with additional fees.

- Home Safe: Installing a home safe is a convenient option, but make sure it’s fireproof and securely bolted to the floor.

- Professional Storage: Using a professional storage service specializing in precious metals ensures maximum security and insurance coverage.

Always keep your gold investments in a secure and discreet location to minimize the risk of theft.

Selling Gold Investments

Selling your gold investments can be done through various channels:

- Local Dealers: Visit local gold dealers or pawn shops to sell your gold for immediate cash.

- Online Platforms: Utilize online platforms like auction sites or dedicated gold trading websites to reach a broader market.

- Gold Exchanges: Consider selling your gold through established gold exchanges for a transparent and fair transaction process.

Before selling, research the current market price of gold to ensure you’re getting a competitive offer.

Ensuring Authenticity of Gold

To guarantee the authenticity of gold when buying or selling, follow these tips:

- Verify Purity: Look for hallmark stamps indicating the purity of the gold, such as 24K for pure gold.

- Use Reputable Dealers: Only buy and sell gold from reputable dealers with a proven track record.

- Get Certification: Request a certificate of authenticity when purchasing gold to validate its quality and origin.

Performing due diligence and seeking professional advice can help you avoid counterfeit or low-quality gold.