Looking to secure your financial future? Dive into the world of saving money with this ultimate guide. From setting financial goals to smart shopping techniques, this journey will equip you with the tools needed to boost your savings game.

Let’s explore the art of saving money and unleash the secrets to building a solid financial foundation.

Importance of Saving Money

Saving money is crucial for achieving financial stability. It allows individuals to have a safety net in case of emergencies, unexpected expenses, or loss of income. By having savings, people can avoid falling into debt and maintain their quality of life even during tough times.

Benefits of Having Savings for Emergencies

- Quick access to funds in case of medical emergencies or car repairs.

- Peace of mind knowing that you have a financial cushion to fall back on.

- Avoidance of high-interest debt from credit cards or loans.

Examples of How Saving Money Leads to Financial Freedom

- Building an emergency fund of 3-6 months’ worth of expenses can provide a sense of security and freedom to pursue other financial goals.

- Investing a portion of your savings can help grow your wealth and achieve long-term financial independence.

- Saving up for a down payment on a house can lead to homeownership and stability in the long run.

Setting Financial Goals

Setting specific financial goals is crucial when it comes to saving money. It helps provide direction, motivation, and a clear roadmap to achieve financial stability. By setting realistic goals, individuals can better manage their finances and work towards a more secure financial future.

Types of Financial Goals

- Emergency Fund: Setting aside money for unexpected expenses like medical emergencies or car repairs.

- Debt Repayment: Establishing a plan to pay off any outstanding debts, such as credit card debt or student loans.

- Retirement Savings: Planning for the future by contributing to retirement accounts like a 401(k) or IRA.

- Short-Term Savings: Saving up for specific short-term goals like a vacation or a new electronic device.

Importance of Realistic Goals

Setting realistic financial goals is essential for effective money-saving strategies. It ensures that the goals are achievable within a certain timeframe and prevents individuals from feeling overwhelmed or discouraged. By breaking down larger goals into smaller, manageable steps, individuals can track their progress and stay motivated to continue saving money.

Creating a Budget

Budgeting is a crucial step in managing your finances effectively and achieving your savings goals. By creating a budget, you can track your income and expenses, identify areas where you can cut back, and prioritize your spending to save money.

Steps to Create a Budget

Creating a budget involves the following steps:

- List all your sources of income, including wages, freelance work, or any other financial inflows.

- Track all your expenses, categorizing them into fixed (rent, utilities) and variable (entertainment, dining out) costs.

- Calculate your total income and total expenses to determine how much you can save each month.

- Set specific savings goals and allocate a portion of your income towards them.

- Regularly review and adjust your budget to stay on track and make necessary changes.

Significance of Tracking Expenses in a Budget

Tracking expenses allows you to see where your money is going and identify areas where you can cut back. By monitoring your spending habits, you can make informed decisions about where to allocate your funds to maximize savings.

Tips to Stick to a Budget

- Avoid impulse purchases by creating a shopping list before going to the store and sticking to it.

- Use cash or debit cards instead of credit cards to prevent overspending.

- Avoid unnecessary subscription services and regularly review your recurring expenses to eliminate any non-essential costs.

- Reward yourself for sticking to your budget by setting aside a small amount for discretionary spending each month.

- Automate your savings by setting up automatic transfers to your savings account each month.

Cutting Expenses

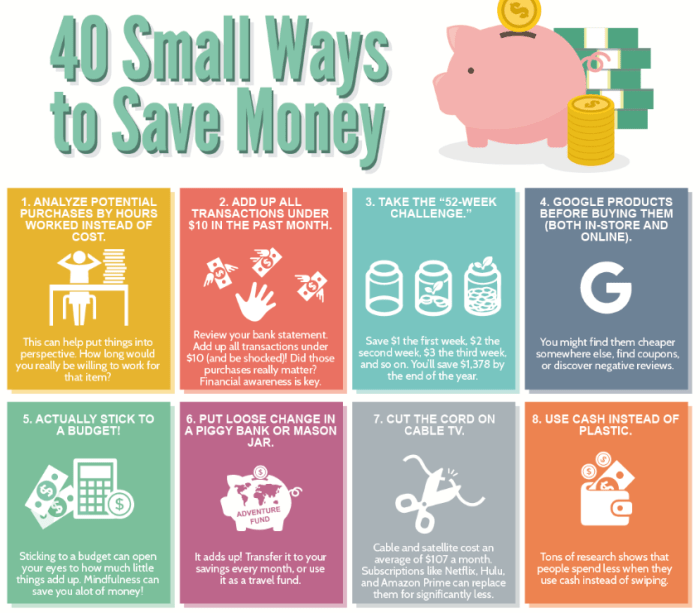

Cutting expenses is a key component of saving money and reaching your financial goals. By identifying and reducing unnecessary expenses, you can free up more money to put towards savings. Here are some common expenses that can be reduced to save money:

Eating Out

- Avoid eating out frequently and opt for cooking meals at home.

- Limit ordering takeout or delivery and pack your lunch for work or school.

- Set a budget for dining out each month to control spending.

Entertainment

- Cancel unused subscriptions for streaming services, magazines, or other entertainment.

- Look for free or low-cost activities in your area instead of expensive outings.

- Consider sharing subscriptions with friends or family to split costs.

Shopping

- Avoid impulse purchases and shop with a list to stick to essentials.

- Comparison shop for better deals and use coupons or discount codes when available.

- Avoid shopping as a form of entertainment and limit unnecessary purchases.

Transportation

- Use public transportation, carpool, or bike instead of driving alone to save on gas and maintenance costs.

- Combine errands to reduce the number of trips and save on time and fuel.

- Consider walking or using ride-sharing services for short distances to save on transportation costs.

By cutting down on daily expenses like eating out, entertainment, shopping, and transportation, you can significantly impact your ability to save money and achieve your financial goals.

Increasing Income Sources

When it comes to saving money, increasing your income is just as important as cutting expenses. By diversifying your income sources, you can not only save more money but also have a more stable financial foundation. Here are some ways to increase your income and tips on how to balance it with saving money:

Side Hustles

- Consider starting a side hustle, such as freelance work, selling handmade crafts, or offering services like tutoring or pet sitting.

- Utilize online platforms like Etsy, Fiverr, or TaskRabbit to showcase your skills and reach a wider audience.

- Set aside a specific amount of time each week to focus on your side hustle to ensure consistency and growth.

Investments

- Explore investment opportunities such as stocks, bonds, real estate, or mutual funds to generate passive income.

- Consult with a financial advisor to understand your risk tolerance and investment options that align with your financial goals.

- Reinvest your earnings to maximize returns and accelerate your wealth-building journey.

Career Development

- Enhance your skills and qualifications through online courses, workshops, or certifications to increase your earning potential in your current job or future opportunities.

- Seek out promotions or new job opportunities that offer higher salaries or benefits to boost your income.

- Network with professionals in your field to discover new career paths and advancement opportunities.

Smart Shopping and Saving Techniques

When it comes to saving money, smart shopping techniques can make a big difference. By using coupons, discounts, and sales effectively, you can stretch your budget and get more for your money. It’s also important to compare prices and shop around to ensure you’re getting the best deals possible. Lastly, distinguishing between needs and wants while shopping can help you prioritize your purchases and avoid unnecessary expenses.

Utilizing Coupons, Discounts, and Sales

- Clip coupons from newspapers, magazines, or online sources to save money on groceries, household items, and more.

- Take advantage of loyalty programs and discount offers from retailers to maximize your savings.

- Shop during sales events like Black Friday or end-of-season clearance sales to score big discounts on items you need.

Comparison Shopping Strategies

- Research prices online before making a purchase to ensure you’re getting the best deal available.

- Visit multiple stores or websites to compare prices and find the most affordable option for the products you need.

- Consider factors like quality, warranty, and return policies in addition to price when comparing products.

Distinguishing Between Needs and Wants

- Make a list of essential items you need before going shopping to avoid impulse purchases.

- Ask yourself if a purchase is necessary or just something you want in the moment before buying it.

- Avoid emotional shopping by taking a moment to consider if an item aligns with your long-term financial goals.

Saving for Retirement

Saving for retirement is crucial for ensuring financial security in your later years. It’s important to start saving early to take advantage of compound interest and grow your nest egg over time.

Different Retirement Saving Options and Benefits

- 401(k): A common employer-sponsored retirement plan that allows you to contribute pre-tax income, with potential employer matching.

- IRA (Individual Retirement Account): A tax-advantaged account that individuals can contribute to independently, offering various investment options.

- Roth IRA: Similar to a traditional IRA, but contributions are made after-tax, allowing for tax-free withdrawals in retirement.

Maximizing contributions to these accounts can help lower your taxable income and grow your retirement savings faster.

Tips on Maximizing Retirement Savings through Investments

- Diversify Investments: Spread your money across different asset classes to reduce risk.

- Consider Target Date Funds: These automatically adjust your investment mix based on your retirement date.

- Regularly Review and Rebalance: Ensure your investments align with your risk tolerance and retirement goals.