Yo, peeps! Get ready to dive into the world of international investments where the money moves faster than you can say ‘stock market.’ From understanding the ins and outs of global finance to exploring the risks and rewards, this rollercoaster ride will have you hooked from the get-go.

So, buckle up and let’s explore the exciting realm of international investments together!

Overview of International Investments

International investments play a crucial role in the global economy, allowing investors to diversify their portfolios and access new markets. These investments involve allocating capital across borders to take advantage of opportunities for growth and profit.

Types of International Investments

Foreign Direct Investment (FDI): This type of investment involves establishing business operations or acquiring assets in a foreign country. FDI allows companies to access new markets, resources, and talent, while also promoting economic development in the host country.

Portfolio Investment: Portfolio investments include buying stocks, bonds, or other financial assets in foreign markets. This type of investment offers investors the opportunity to benefit from the growth of international companies and diversify their investment portfolios.

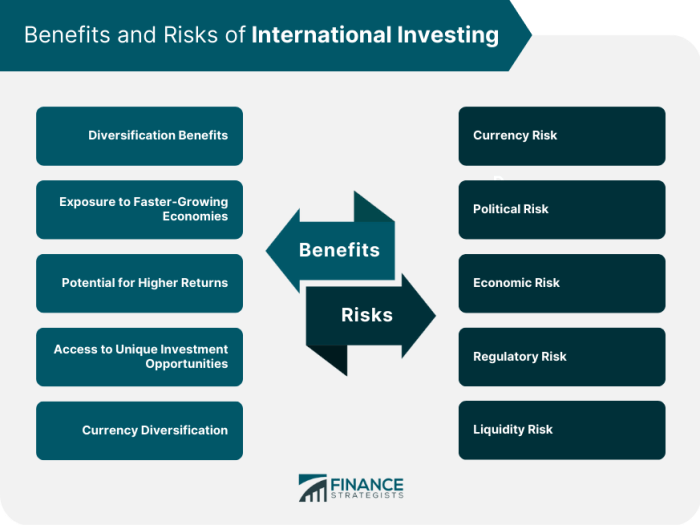

Benefits and Risks of International Investments

- Increased diversification: International investments can help spread risk across different markets and industries, reducing the impact of market fluctuations.

- Potential for higher returns: Investing in rapidly growing economies can offer higher returns compared to domestic investments.

- Access to new opportunities: International investments provide access to new markets, technologies, and resources that may not be available domestically.

- Political and economic instability: Changes in government policies, economic conditions, or social unrest in a foreign country can impact the value of investments.

- Foreign exchange risk: Fluctuations in exchange rates can affect the value of international investments and lead to currency losses.

- Regulatory risks: Differences in regulations and legal frameworks across countries can pose challenges for international investors.

Benefits:

Risks:

Factors Influencing International Investments

When it comes to international investments, there are several key factors that play a crucial role in influencing investment decisions. These factors can range from political stability to economic indicators like GDP growth and inflation rates.

Political Stability vs Instability

Political stability is a major factor that can significantly impact international investments. Countries with stable political environments tend to attract more foreign investors due to reduced risk and uncertainty. On the other hand, countries facing political instability, such as frequent changes in government or civil unrest, may deter investors from committing their funds.

Economic Indicators

Economic indicators like GDP growth and inflation rates also play a vital role in influencing international investments. Countries with strong GDP growth are often seen as attractive investment destinations as they offer potential for high returns. On the other hand, high inflation rates can erode the value of investments over time, making them less appealing to foreign investors.

Overall, a combination of political stability and positive economic indicators is typically seen as favorable for international investments, creating an environment that encourages growth and prosperity for both investors and the host country.

Strategies for International Investments

International investments can be lucrative, but they also come with inherent risks due to the fluctuating nature of global markets. Investors often employ various strategies to mitigate these risks and maximize their returns. Diversification and currency hedging are two common approaches used in international investment portfolios.

Diversification Strategies

Diversification is a key strategy for spreading risk across different assets and markets. By investing in a variety of industries, countries, and asset classes, investors can reduce the impact of negative events in any single investment. For example, an investor may choose to allocate funds across sectors like technology, healthcare, and energy, as well as geographically in regions such as North America, Europe, and Asia.

- Investing in different industries to minimize sector-specific risks.

- Allocating funds across various countries to reduce country-specific risks.

- Including different asset classes like stocks, bonds, and real estate to diversify the investment portfolio.

Currency Hedging in Managing Risks

Currency hedging plays a crucial role in managing risks associated with international investments, especially when dealing with foreign exchange fluctuations. Investors can use hedging techniques to protect their investment returns from adverse currency movements. For instance, a U.S.-based investor with investments in Europe may use currency futures or options to hedge against the euro’s depreciation relative to the dollar.

- Using forward contracts to lock in exchange rates for future transactions.

- Employing currency options to limit downside risk while allowing for potential gains.

- Utilizing currency swaps to exchange cash flows in different currencies at predetermined rates.

Emerging Markets and International Investments

Emerging markets are economies that are transitioning from developing to developed status, offering unique opportunities for international investors. These markets are characterized by rapid growth, expanding middle-class populations, and increasing consumer demand, making them attractive investment destinations.

Opportunities and Challenges of Investing in Emerging Markets

Investing in emerging markets can provide high returns due to their strong growth potential and untapped markets. However, these markets also come with challenges such as political instability, regulatory uncertainties, and currency fluctuations. It is essential for investors to conduct thorough research and due diligence to navigate these risks effectively.

- Opportunities:

- Rapid economic growth leading to high returns on investment

- Expanding consumer base and increasing demand for goods and services

- Access to new markets and diversification of investment portfolios

- Challenges:

- Political instability and regulatory changes impacting investments

- Currency fluctuations affecting returns on investment

- Lack of transparency and corporate governance standards

Risks Associated with Investing in Developed Markets vs Emerging Markets

Investing in developed markets offers stability and established regulatory frameworks, but may have lower growth potential compared to emerging markets. On the other hand, investing in emerging markets can provide higher returns but comes with higher risks due to factors like political instability, currency volatility, and limited infrastructure.

It is crucial for investors to carefully assess the risks and rewards of investing in both developed and emerging markets to create a well-balanced and diversified investment portfolio.

Regulatory Environment for International Investments

Government regulations play a crucial role in shaping international investment flows. These regulations can impact the ease of doing business in a particular country, affecting the attractiveness of that market to foreign investors.

Trade Agreements and Tariffs

Trade agreements and tariffs can have a significant impact on international investments. Trade agreements, such as free trade agreements, can reduce barriers to trade and investment between countries, making it easier for businesses to expand internationally. On the other hand, tariffs can increase the cost of importing goods and services, making it less attractive for investors to enter a certain market.

Tax Laws and International Investment Decisions

Changes in tax laws can also influence international investment decisions. For example, countries that offer tax incentives or preferential tax treatment to foreign investors may attract more investment compared to countries with higher tax rates. Additionally, tax laws can impact the overall profitability of international investments, influencing where companies choose to allocate their resources.