Diving into the world of Investment diversification, we’re about to explore the ins and outs of this financial strategy that can level up your investment game. Get ready to learn how spreading your assets can lead to big rewards!

From understanding the concept to exploring different strategies, this guide has it all. So, buckle up and let’s dive deep into the world of investment diversification.

Importance of Investment Diversification

Investment diversification is like having a buffet of different financial assets in your portfolio instead of putting all your eggs in one basket. It’s a strategy where you spread your investments across various asset classes to reduce risk and optimize returns.

Benefits of Diversifying Investment Portfolios

- Diversification helps spread risk: By investing in different assets like stocks, bonds, real estate, and commodities, you reduce the impact of a single asset’s poor performance on your overall portfolio.

- Minimizes volatility: Different asset classes react differently to market conditions, so when one is down, another may be up, balancing out the overall impact on your investments.

- Potential for higher returns: While diversification may not eliminate all risk, it can increase the chances of capturing gains from different sectors or industries performing well at different times.

Examples of Risk Reduction through Diversification

-

For example, if you only invest in tech stocks and the tech sector experiences a downturn, your entire portfolio could suffer. But if you also have bonds or real estate in your portfolio, the impact of the tech sector’s downturn can be cushioned.

-

Similarly, if you hold international stocks along with domestic ones, you can reduce the risk associated with economic events that may affect one country more than another.

Optimizing Returns in Varying Market Conditions

- During bull markets, stocks may perform well, but in bear markets, bonds or commodities might be more stable. By diversifying across asset classes, you have the opportunity to capture gains in different market environments.

-

For instance, if you have a mix of growth stocks, dividend-paying stocks, and real estate investment trusts (REITs) in your portfolio, you can benefit from both capital appreciation and income generation regardless of market conditions.

Types of Investment Diversification

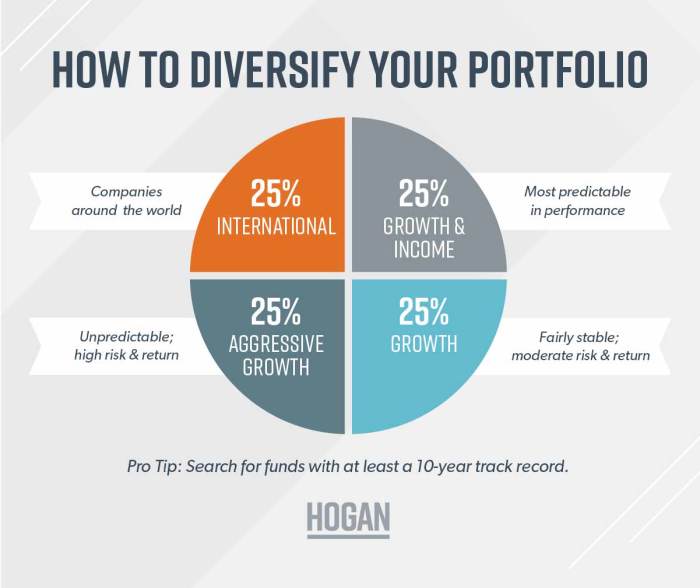

Investment diversification involves spreading your investment across different asset classes to reduce risk. Here are some key types of diversification to consider:

Asset Classes Diversification

Diversifying across different asset classes such as stocks, bonds, and real estate can help reduce the impact of market volatility on your portfolio. Each asset class has its own risk-return profile, so spreading your investments across them can help balance your overall risk.

Geographical Diversification

Geographical diversification involves investing in assets from different countries or regions. This can help protect your investments from country-specific risks such as political instability, economic downturns, or currency fluctuations. By spreading your investments globally, you can reduce the impact of localized events on your portfolio.

Industry Diversification

Industry diversification involves investing in companies across different sectors of the economy. By spreading your investments across industries such as technology, healthcare, and consumer goods, you can reduce the risk of sector-specific events affecting your portfolio. For example, a downturn in one industry may be offset by growth in another, reducing the overall impact on your investments.

Strategies for Investment Diversification

Investment diversification is key to managing risk and optimizing returns in a portfolio. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the impact of market volatility on their overall wealth.

The 1/N Strategy for Equally Distributing Investments

The 1/N strategy involves dividing your investment capital equally among all the assets in your portfolio. This approach ensures that you have exposure to a wide range of investments, reducing the risk associated with any single asset. By following the 1/N strategy, you can achieve a balanced and diversified portfolio that is less susceptible to market fluctuations.

The Core-Satellite Approach to Diversifying Investments

The core-satellite approach combines a diversified core portfolio with additional satellite investments that have the potential to enhance returns. The core portfolio typically consists of low-cost index funds or ETFs that provide broad market exposure, while the satellite investments are more focused and seek to capture specific opportunities. This strategy allows investors to benefit from both the stability of the core holdings and the potential growth of the satellite investments.

The Benefits of Dynamic Asset Allocation for Diversification

Dynamic asset allocation involves adjusting the mix of assets in a portfolio based on changing market conditions and investment objectives. This strategy allows investors to capitalize on opportunities as they arise and protect against downside risk. By actively managing asset allocation, investors can optimize returns and reduce overall portfolio volatility.

The Benefits of Systematic Rebalancing in a Diversified Portfolio

Systematic rebalancing involves periodically adjusting the allocation of assets in a portfolio back to their target weights. This ensures that the portfolio remains aligned with the investor’s risk tolerance and goals. By rebalancing regularly, investors can lock in gains, control risk, and maintain the desired level of diversification in their portfolio.

Risk Management through Investment Diversification

Diversification plays a crucial role in managing risks associated with investments. By spreading out investments across different asset classes and sectors, investors can mitigate unsystematic risks and protect their portfolios.

Correlation between Assets and Portfolio Risk

When assets in a portfolio are positively correlated, they tend to move in the same direction, increasing the overall risk. Conversely, negatively correlated assets move in opposite directions, helping to offset losses in one asset with gains in another.

- Having a mix of assets with low or negative correlation can help reduce the overall volatility of a portfolio.

- For example, during a market downturn, bonds and gold often act as safe havens, protecting the portfolio from significant losses in equities.

Protecting Against Market Volatility

Market volatility can lead to sudden and drastic fluctuations in asset prices, causing significant losses for investors. Diversification can help mitigate these risks by spreading investments across different asset classes with varying levels of sensitivity to market movements.

Diversifying into assets like real estate, commodities, or international markets can provide a buffer against market volatility.

Navigating Economic Downturns

During economic downturns, certain sectors or industries may experience declines while others remain resilient. By diversifying across sectors and asset classes, investors can protect their portfolios from the impact of a downturn in any single sector.

- For instance, technology stocks may be highly volatile during a recession, but investments in healthcare or consumer staples may remain stable.

- Diversification helps investors weather economic storms by reducing dependency on any one sector or asset class.