Get ready to dive deep into the world of loan interest calculation. We’re about to break down the different methods, tackle the simple versus compound interest debate, and explore the factors that affect your loan interest. So buckle up and let’s get started!

From understanding amortization schedules to grasping the impact of changing interest rates, this guide will equip you with all the knowledge you need to navigate the complex world of loan interest calculation.

Loan Interest Calculation Methods

When it comes to calculating loan interest, there are various methods used by lenders to determine the amount borrowers need to pay back. Each method has its own set of advantages and disadvantages that borrowers should be aware of.

Simple Interest

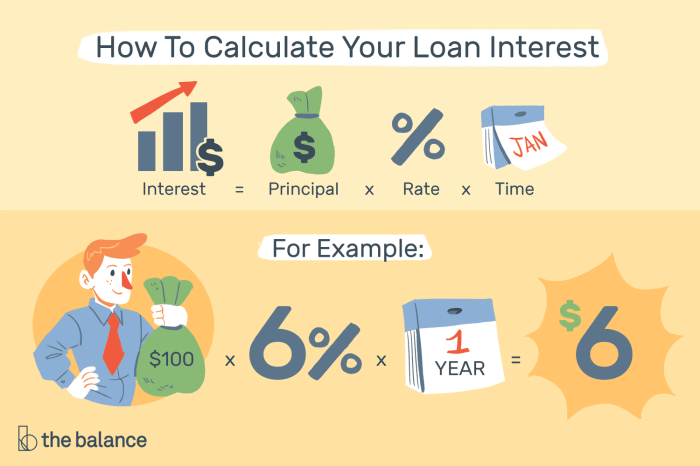

Simple interest is calculated based on the principal amount of the loan and the interest rate. The formula for simple interest is:

Simple Interest = Principal Amount x Interest Rate x Time

Compound Interest

Compound interest takes into account the interest that accrues on both the principal amount and any accumulated interest. The formula for compound interest is:

Compound Interest = P(1 + r/n)^(nt) – P

where:

– P is the principal amount

– r is the annual interest rate

– n is the number of times that interest is compounded per year

– t is the number of years the money is invested for

Flat Interest

Flat interest is calculated on the entire principal amount throughout the loan tenure. It does not consider the reducing principal balance. The formula for flat interest is:

Flat Interest = (Principal Amount x Interest Rate x Loan Tenure) / 100

Advantages and Disadvantages

- Simple Interest:

- Advantages: Easy to understand and calculate.

- Disadvantages: Can end up costing more over the long term compared to compound interest.

- Compound Interest:

- Advantages: Can help grow savings faster due to compounding effect.

- Disadvantages: More complex to calculate and understand compared to simple interest.

- Flat Interest:

- Advantages: Fixed interest amount throughout the loan tenure.

- Disadvantages: Borrowers end up paying more in total interest compared to other methods.

Simple Interest vs. Compound Interest

In the world of loans and interest rates, two key concepts to understand are simple interest and compound interest. These terms refer to how interest is calculated on a loan and can have a significant impact on the total amount repaid.

Simple interest is calculated based on the principal amount of the loan. The interest amount remains constant throughout the loan term and is calculated as a percentage of the principal. The formula for calculating simple interest is straightforward:

Simple Interest = Principal x Rate x Time

On the other hand, compound interest takes into account not only the initial principal amount but also the accumulated interest over time. As interest is added to the principal at regular intervals, the total amount owed grows exponentially. This means that with compound interest, the interest is calculated on both the principal and any interest that has already been added to the loan.

Impact on Loan Repayment

When it comes to loan repayment, the choice between simple interest and compound interest can make a significant difference. With simple interest, borrowers can predict exactly how much they will need to repay each month since the interest remains constant. This can make budgeting and financial planning easier.

However, compound interest can result in borrowers paying significantly more over the life of the loan compared to simple interest. The compounding effect means that interest grows faster, leading to a higher total repayment amount. Borrowers should be aware of this when choosing between loan options and consider the long-term implications of compound interest on their finances.

Factors Affecting Loan Interest

When it comes to calculating loan interest, several key factors play a crucial role in determining the total amount of interest payable. Understanding how factors like the principal amount, interest rate, and loan term impact the overall interest can help borrowers make informed financial decisions.

Principal Amount

The principal amount of a loan refers to the initial sum borrowed. The higher the principal amount, the greater the total interest payable. This is because interest is typically calculated as a percentage of the principal. For example, if you borrow $10,000 at a 5% interest rate for a term of 5 years, you will pay more in total interest compared to borrowing $5,000 for the same interest rate and term.

Interest Rate

The interest rate is a crucial factor that directly affects the amount of interest paid on a loan. A higher interest rate results in a higher total interest cost over the life of the loan. For instance, borrowing $10,000 at a 7% interest rate for 5 years will accumulate more interest compared to borrowing the same amount at a 3% interest rate.

Loan Term

The loan term refers to the duration over which the loan is repaid. The longer the loan term, the more interest will accrue. This is because interest is calculated over a longer period. For example, borrowing $10,000 at a 6% interest rate for 10 years will result in a higher total interest payment compared to borrowing the same amount for 5 years at the same interest rate.

Amortization Schedule

An amortization schedule is a table that shows the breakdown of loan payments over time. It Artikels how each payment is allocated between the principal amount and the interest, helping borrowers understand how their money is being used to pay off the loan.

Importance of Amortization Schedule

Creating an amortization schedule is crucial for borrowers as it provides a clear picture of how their loan will be repaid. By seeing the distribution of each payment towards the principal and interest, borrowers can track their progress in paying off the loan and make informed financial decisions.

- Amortization schedules help borrowers visualize the repayment process and plan their finances accordingly.

- They show the decreasing interest payments and increasing principal payments over time, reflecting progress in loan repayment.

- Understanding the amortization schedule can help borrowers strategize to pay off the loan early and save on interest costs.

Creating an Amortization Schedule

To create an amortization schedule for a loan, follow these steps:

- Start with the loan amount, interest rate, and loan term (duration) in months or years.

- Calculate the monthly payment using the loan amount, interest rate, and loan term with a loan calculator or formula.

- Break down each monthly payment into principal and interest portions based on the loan’s amortization formula.

- Update the loan balance after each payment by subtracting the principal portion from the previous balance.

- Repeat the process for each month until the loan is fully paid off, adjusting the interest calculation based on the remaining balance.