Diving into the world of mortgage loan rates today, get ready to discover the ins and outs of this crucial financial topic. From how rates are set to strategies for securing the best deals, we’ve got you covered.

Exploring the factors that influence mortgage loan rates and the importance of staying informed will arm you with the knowledge needed to make wise financial decisions.

Overview of Mortgage Loan Rates Today

Mortgage loan rates play a crucial role in the real estate market, impacting the affordability of buying a home. These rates represent the interest charged by lenders on the amount borrowed for a home purchase.

Lenders determine mortgage loan rates based on various factors, including the borrower’s credit score, loan amount, down payment, and current economic conditions. They also consider the type of loan, whether fixed-rate or adjustable-rate, which can affect the interest rate.

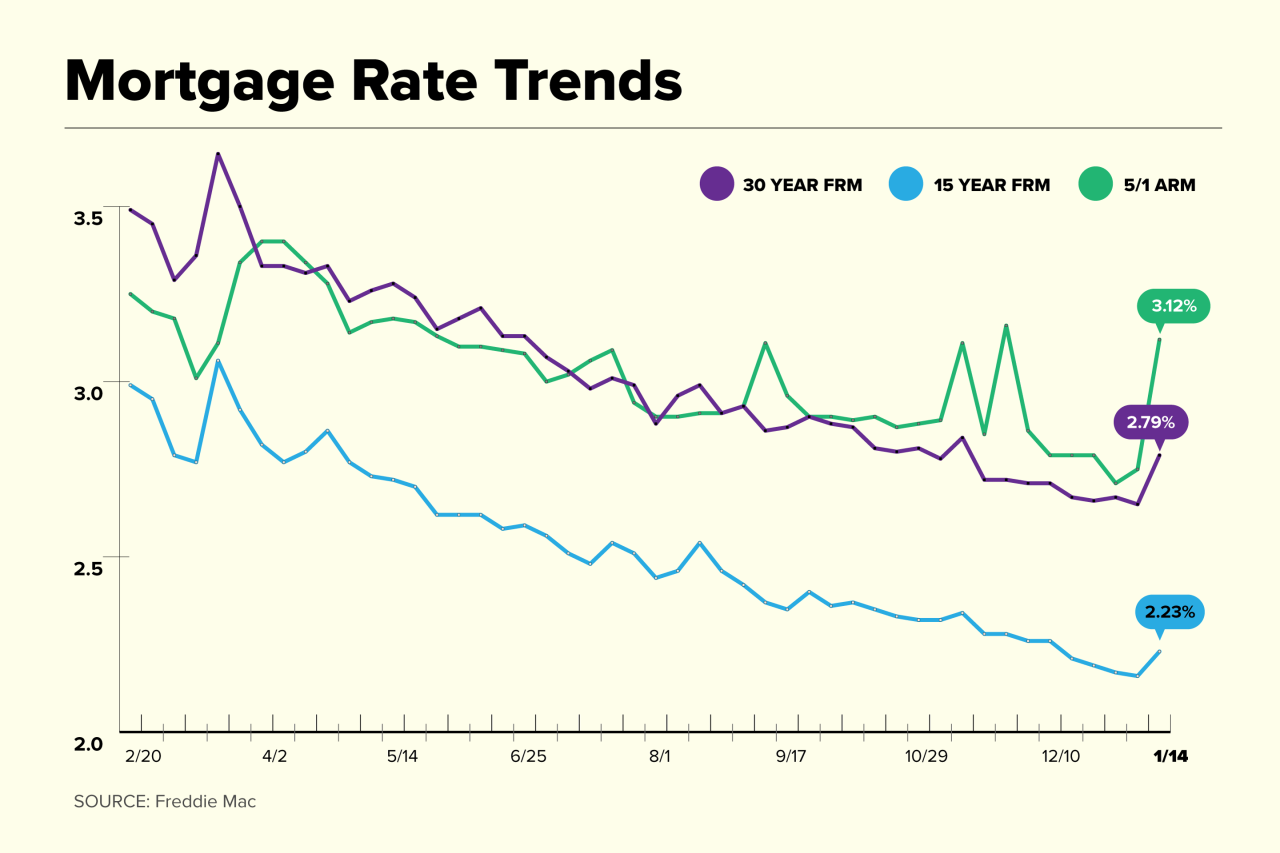

It is essential for potential homebuyers to stay updated with mortgage loan rates as they can fluctuate daily based on market conditions. Even a slight change in rates can significantly impact the overall cost of a mortgage and the monthly payments for the borrower.

Factors Influencing Mortgage Loan Rates Today

In today’s economy, several key factors play a significant role in determining mortgage loan rates. These factors can impact whether rates rise or fall, ultimately affecting the cost of borrowing for potential homeowners.

Fixed-Rate vs. Adjustable-Rate Mortgages

When comparing fixed-rate and adjustable-rate mortgages in relation to current rates, it’s essential to understand the differences between the two. Fixed-rate mortgages offer stable interest rates throughout the loan term, providing predictability for borrowers. On the other hand, adjustable-rate mortgages have rates that can fluctuate based on market conditions, potentially resulting in lower initial rates but higher uncertainty in the long run.

Economic Indicators Impact

Economic indicators such as inflation and employment rates have a direct impact on mortgage loan rates. Inflation can erode the purchasing power of currency, leading to higher interest rates to compensate for the decrease in value. Similarly, employment rates influence consumer confidence and spending, which in turn affects the overall demand for mortgages and interest rates.

Comparison of Mortgage Loan Rates from Different Lenders

When it comes to mortgage loan rates, different lenders offer varying rates based on a variety of factors. It’s important for borrowers to compare rates from multiple lenders to ensure they are getting the best deal possible.

Table Comparing Mortgage Loan Rates

| Lender | 30-Year Fixed Rate | 15-Year Fixed Rate | ARM Rate |

|---|---|---|---|

| Bank A | 3.25% | 2.75% | 2.50% |

| Credit Union B | 3.40% | 2.80% | 2.60% |

| Online Lender C | 3.15% | 2.70% | 2.55% |

Role of Credit Scores in Mortgage Loan Rates

Your credit score plays a significant role in determining the mortgage loan rates you qualify for. Lenders use credit scores to assess the risk of lending to you. A higher credit score typically results in lower interest rates, while a lower credit score may lead to higher rates. It’s essential to maintain a good credit score to secure the best mortgage loan rates available to you.

Strategies for Securing the Best Mortgage Loan Rates Today

When it comes to getting the best mortgage loan rates today, there are a few key strategies that can help you secure a favorable deal. From negotiating with lenders to knowing when to lock in your rates, here are some tips to help you navigate the mortgage market.

Tips for Negotiating Lower Mortgage Loan Rates with Lenders

When negotiating with lenders for lower mortgage loan rates, it’s essential to do your research and come prepared. Start by comparing rates from different lenders and use this information as leverage during negotiations. Highlight your strong credit score and financial stability to show lenders that you are a low-risk borrower deserving of better rates. Don’t be afraid to negotiate and ask for lower rates or additional discounts based on your financial profile.

Best Time to Lock in Mortgage Loan Rates

The best time to lock in mortgage loan rates is when you see a favorable trend in the market. Keep an eye on economic indicators, such as the Federal Reserve’s interest rate decisions and the overall state of the economy. If rates are low and are expected to rise in the future, it might be a good idea to lock in your rates to secure a lower interest rate for the long term.

Refinancing to Take Advantage of Lower Mortgage Loan Rates

Refinancing can be a smart move for homeowners looking to take advantage of lower mortgage loan rates. By refinancing your existing mortgage with a new loan at a lower rate, you can potentially save money on interest payments over the life of the loan. Make sure to calculate the costs associated with refinancing and compare them to the potential savings to determine if it’s the right move for you.