With Passive income ideas at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

Are you ready to dive into the world of passive income and explore the endless possibilities it offers? Let’s break down the concept, benefits, and strategies to help you pave your way to financial success.

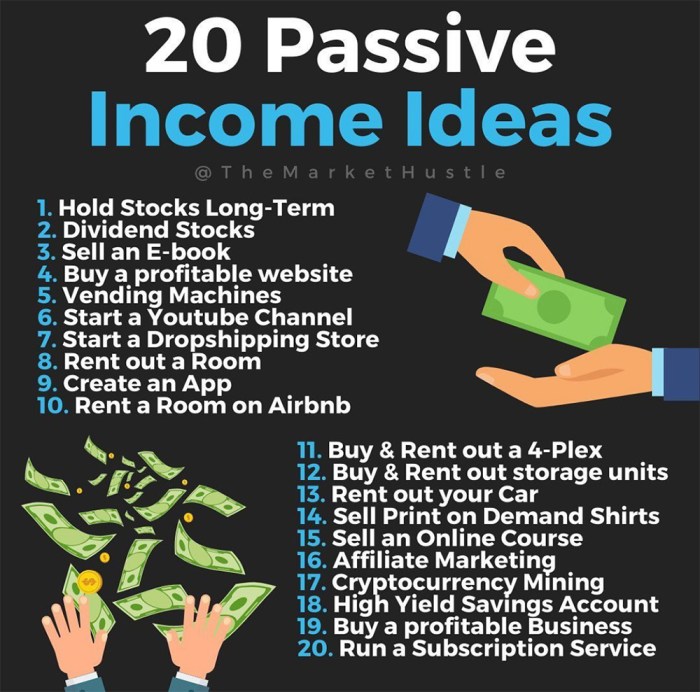

Passive Income Ideas

Passive income refers to earning money regularly with little to no effort on the part of the recipient. It is a source of income that continues to generate revenue after the initial setup.

There are several benefits to having passive income streams. One major advantage is the potential to earn money while you sleep or are not actively working. This can provide financial security and freedom by diversifying your income sources.

Diversifying passive income sources is important because it reduces risk and increases stability. Relying on a single source of passive income can be risky, as any changes to that source could impact your earnings significantly. By having multiple streams, you can spread out the risk and ensure a more consistent flow of income.

The key difference between active and passive income lies in the level of effort required to earn money. Active income is earned through active participation in a job or business, where you are exchanging time and effort for money. On the other hand, passive income is generated with minimal ongoing effort, allowing you to earn money even when you’re not actively working.

Real Estate Investments

Real estate can be a lucrative source of passive income due to the potential for rental income, property appreciation, and tax benefits. Investors can generate passive income through various real estate investment strategies such as rental properties, real estate crowdfunding, real estate investment trusts (REITs), and fix-and-flip properties.

Rental Properties

Owning rental properties is a popular way to generate passive income in real estate. By purchasing residential or commercial properties and renting them out to tenants, investors can receive a steady stream of rental income each month. However, it’s essential to consider the pros and cons of investing in rental properties.

- Pros:

- Steady cash flow from rental income

- Property appreciation over time

- Tax deductions for mortgage interest, property taxes, and depreciation

- Cons:

- Property management responsibilities and tenant issues

- Vacancies leading to loss of rental income

- Market fluctuations affecting property values

Tip: Conduct thorough research on the location, property market, and potential rental income before investing in rental properties.

Real Estate Crowdfunding

Real estate crowdfunding platforms allow investors to pool their resources to invest in properties without directly owning them. Investors can earn passive income through rental profits or property appreciation, depending on the investment structure.

Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-producing real estate across various sectors. Investors can buy shares of REITs to receive dividends and benefit from real estate market performance without owning physical properties.

Fix-and-Flip Properties

Investors can purchase distressed properties, renovate them, and sell them for a profit in a strategy known as fix-and-flip. While this method can generate quick returns, it requires significant time, effort, and expertise in property renovation and market analysis.

Online Business Ventures

In today’s digital age, online business ventures offer a plethora of opportunities to generate passive income. Whether you’re interested in affiliate marketing, dropshipping, or selling digital products, there are various avenues to explore and capitalize on. Building a strong online presence is crucial for attracting customers and establishing credibility in the online space. Here are some tips for scaling your online business for long-term passive income.

Affiliate Marketing

Affiliate marketing involves promoting other companies’ products and earning a commission for every sale made through your referral. It’s a popular passive income stream for those with a strong online presence and a loyal following. Here are some key points to consider:

- Choose reputable companies and products to promote.

- Create valuable and engaging content to drive traffic to your affiliate links.

- Build relationships with your audience to establish trust and credibility.

Dropshipping

Dropshipping is a business model where you sell products to customers without holding any inventory. The supplier fulfills the orders on your behalf, allowing you to focus on marketing and customer service. Here are some key points to consider:

- Find reliable suppliers with quality products and efficient shipping methods.

- Optimize your website for conversions and provide excellent customer service.

- Implement marketing strategies to drive traffic and increase sales.

Selling Digital Products

Selling digital products such as e-books, online courses, or software can be a lucrative passive income stream. Once created, digital products can be sold repeatedly without incurring additional production costs. Here are some key points to consider:

- Identify a niche market and create products that cater to their needs or interests.

- Invest in high-quality content and design to enhance the perceived value of your products.

- Promote your digital products through social media, email marketing, and other channels to reach a wider audience.

Building a Strong Online Presence

Building a strong online presence is essential for attracting customers and growing your online business. Here are some tips to establish a solid online presence:

- Create a professional website with a user-friendly interface and engaging content.

- Utilize social media platforms to connect with your audience and promote your products or services.

- Optimize your website for search engines to improve visibility and attract organic traffic.

Scaling Your Online Business

Scaling your online business is crucial for long-term success and generating passive income. Here are some tips for scaling your online business:

- Automate repetitive tasks to free up time for strategic planning and growth initiatives.

- Invest in marketing strategies to reach a larger audience and drive more sales.

- Diversify your income streams to reduce dependency on any single source of revenue.

Investments in Stocks and Dividends

When it comes to building a passive income stream, investing in stocks and dividends can be a lucrative option. By purchasing shares of companies that pay dividends, investors can earn a regular income without actively working for it. Let’s dive into the world of dividend investing and explore how it can help you achieve financial freedom.

High-Dividend Stocks for Passive Income

- High-dividend stocks are companies that distribute a significant portion of their profits to shareholders in the form of dividends.

- Examples of high-dividend stocks include well-established companies like AT&T, ExxonMobil, and Coca-Cola, which have a history of paying consistent dividends.

- Investors looking to build a passive income portfolio should consider diversifying their holdings across different sectors to minimize risk.

Risks and Benefits of Relying on Dividends

- Benefits of relying on dividends for passive income include the potential for regular cash flow, the opportunity for capital appreciation, and the ability to reinvest dividends for compound growth.

- Risks of relying on dividends include fluctuations in stock prices, economic downturns affecting company profits, and dividend cuts or suspensions by companies.

- It’s important for investors to conduct thorough research and due diligence before investing in high-dividend stocks to mitigate potential risks.

Strategies for Successful Dividend Investing

- One strategy for successful dividend investing is to focus on companies with a history of increasing their dividends year over year, known as dividend growth stocks.

- Another strategy is to reinvest dividends through a dividend reinvestment plan (DRIP) to take advantage of compound growth over time.

- Investors should also pay attention to dividend yield, payout ratio, and company fundamentals when selecting high-dividend stocks for their portfolio.