As Passive income ideas take the spotlight, get ready to dive into a world of financial possibilities. From real estate investments to online business ventures, this guide will walk you through the ins and outs of generating passive income like a pro.

Whether you’re a novice looking to dip your toes into the passive income pool or a seasoned investor seeking new opportunities, this guide has got you covered.

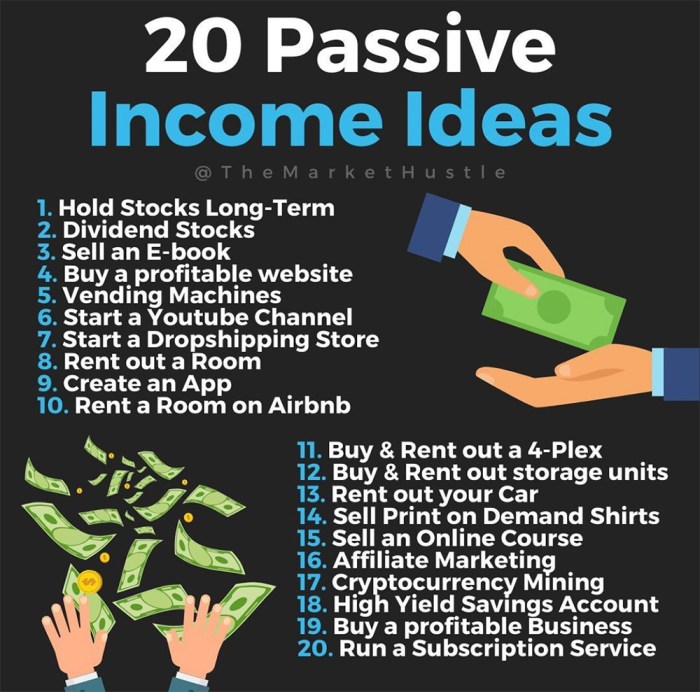

Passive Income Ideas

Passive income is money earned with little to no ongoing effort or work. It plays a crucial role in financial planning as it provides a steady stream of income without the need for constant active involvement. This type of income allows individuals to build wealth, achieve financial freedom, and work towards early retirement.

Benefits of Multiple Streams of Passive Income

Having multiple streams of passive income offers several advantages:

- Diversification: Reduces dependency on a single source of income, providing stability and security.

- Resilience: In case one income stream decreases or stops, others can continue to generate revenue.

- Increased Earnings: Multiple income sources can lead to higher overall earnings compared to relying on a single source.

- Flexibility: Allows individuals to explore different opportunities and pursue various interests.

- Wealth Building: Accelerates wealth accumulation and enables financial goals to be achieved faster.

Difference between Passive and Active Income

Passive income and active income differ in the following ways:

- Active Income: Earned through direct participation in a job or business where time and effort are required continuously to generate income.

- Passive Income: Generated with minimal effort after the initial setup or investment, allowing individuals to earn money without active involvement.

- Active income stops when work stops, while passive income continues to flow even when not actively working.

- Passive income provides more freedom and flexibility as it is not tied to hours worked or location.

Real Estate Investments

Real estate investments have long been a popular choice for generating passive income due to the potential for appreciation and rental income. Investing in real estate can provide a steady stream of cash flow without requiring constant daily involvement.

When it comes to real estate investment strategies for generating passive income, there are various options to consider. From rental properties to real estate crowdfunding, each strategy comes with its own set of pros and cons.

Rental Properties

Investing in rental properties involves purchasing properties and renting them out to tenants. Here are some pros and cons of investing in rental properties for passive income:

- Pros:

- Steady Monthly Income: Rental properties can provide a consistent stream of monthly income from rental payments.

- Property Appreciation: Over time, the value of the property may increase, allowing for potential profits when selling.

- Tax Benefits: Rental property owners can benefit from tax deductions on mortgage interest, property taxes, and other expenses.

- Cons:

- Tenant Management: Dealing with tenants, maintenance issues, and property management can be time-consuming and stressful.

- Market Risk: Real estate markets can fluctuate, affecting property values and rental prices.

- Initial Investment: Acquiring rental properties requires a significant upfront investment, including down payments, closing costs, and potential renovations.

Online Business Ventures

In today’s digital age, online business ventures offer a plethora of opportunities to generate passive income. Whether it’s through e-commerce, affiliate marketing, or online courses, there are various avenues to explore in the online space.

E-commerce

E-commerce is a booming industry that allows individuals to sell products online without the need for a physical storefront. Setting up an e-commerce store can be done through platforms like Shopify, WooCommerce, or Etsy. By dropshipping products or creating your own unique items, you can create a source of passive income through online sales.

Affiliate Marketing

Affiliate marketing involves promoting products or services from other companies and earning a commission for every sale made through your referral. This can be done through websites, blogs, or social media platforms. By creating valuable content and driving traffic to affiliate links, you can generate passive income through affiliate marketing.

Online Courses

Creating and selling online courses is another lucrative way to generate passive income. If you have expertise in a particular field or skill, you can create digital courses and sell them on platforms like Udemy or Teachable. Once the course is created, you can earn passive income whenever someone enrolls in your course.

Scalability of Online Business Models

One of the key advantages of online business ventures for passive income is their scalability. Unlike traditional brick-and-mortar businesses, online businesses have the potential to reach a global audience with minimal overhead costs. This scalability allows for exponential growth and increased passive income potential over time.

Investment Opportunities

Investing in stocks, bonds, or mutual funds can be a lucrative way to generate passive income. By putting your money into these investment vehicles, you can earn dividends, interest, or capital gains without actively working for it.

Risk and Return Comparison

- Stocks: Investing in individual stocks can yield high returns but also come with high risk due to market volatility. It’s essential to research companies thoroughly before investing.

- Bonds: Bonds are considered safer than stocks as they provide a fixed income stream, but the returns are typically lower. They are ideal for conservative investors looking for stable passive income.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer a balanced risk-return profile suitable for passive income generation.

Diversifying Investment Portfolios

Diversification is key to reducing risk in your investment portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can protect your passive income against market fluctuations.

Don’t put all your eggs in one basket. Diversify your investments to minimize risk and maximize returns.