Step into the world of real estate investment strategies where savvy investors make their mark. Get ready for a rollercoaster ride of buy and hold, fix and flip, and other intriguing tactics that shape the market.

Explore the key elements of successful real estate investments and discover the secrets behind seasoned investors’ triumphs.

Real Estate Investment Strategies

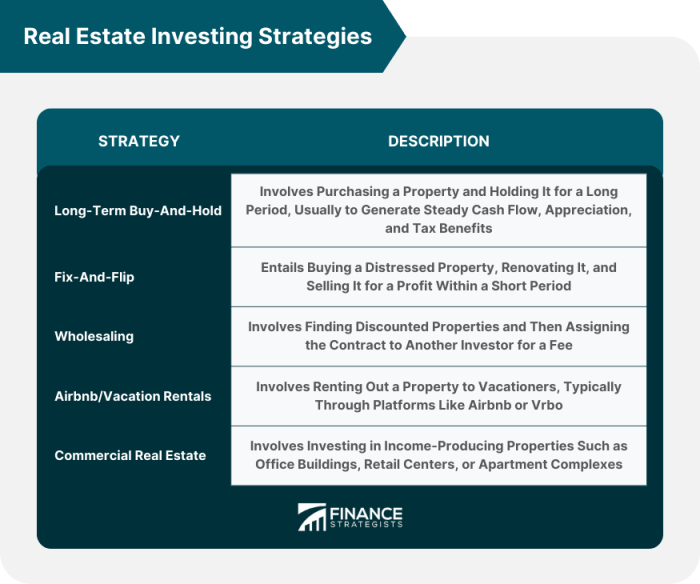

Real estate investment strategies are crucial in the market as they help investors maximize their returns and build wealth over time. These strategies involve various approaches to buying, owning, and selling properties to generate income or profit.

Types of Real Estate Investment Strategies

- Buy and Hold: Investors purchase properties with the intention of holding onto them for an extended period, benefiting from appreciation and rental income.

- Fix and Flip: Investors buy distressed properties, renovate them, and sell them quickly for a profit.

- Rental Properties: Investors acquire properties to rent out to tenants, generating regular rental income.

- REITs (Real Estate Investment Trusts): Investors can invest in publicly traded REITs, which own and manage a portfolio of income-producing properties.

Risks Associated with Real Estate Investment Strategies

- Market Risk: Fluctuations in the real estate market can impact property values and rental income.

- Liquidity Risk: Real estate investments are relatively illiquid compared to stocks or bonds, making it challenging to sell quickly in times of need.

- Operational Risk: Managing rental properties or renovation projects comes with the risk of unexpected expenses or issues.

Examples of Successful Real Estate Investment Strategies

- Warren Buffett’s Buy and Hold Strategy: Buffett has built wealth through long-term investments in real estate, holding onto properties for decades.

- House Flipping Success Stories: Some investors have made significant profits by flipping houses in high-demand markets with strategic renovations.

- REIT Investments: Many investors have benefited from investing in REITs, enjoying the diversification and passive income they provide.

Market Research and Analysis

Conducting thorough market research is crucial before choosing an investment strategy in real estate. This step allows investors to gather essential information about the market trends, property values, and potential opportunities for maximizing returns.

Key Factors for Analyzing Real Estate Market

When analyzing a real estate market for investment opportunities, consider the following key factors:

- Economic indicators such as job growth, GDP, and interest rates

- Demographic trends including population growth and age distribution

- Housing market supply and demand dynamics

- Local market regulations and zoning laws

Methods for Analyzing Market Trends and Property Values

There are different methods to analyze market trends and property values:

- Comparative market analysis (CMA) to evaluate similar properties in the area

- Income approach to estimate property value based on rental income

- Cost approach to determine property value by assessing construction costs

- Online tools and platforms for real-time market data and analytics

Tips for Staying Updated with Market Trends

To stay informed about the latest market trends in real estate, consider these tips:

- Subscribe to industry publications and newsletters

- Attend real estate conferences and networking events

- Utilize online resources and platforms for market research

- Build relationships with local real estate professionals and experts

Financing Options

When it comes to real estate investments, understanding the various financing options available is crucial for success. Whether you’re considering traditional mortgages, hard money loans, or working with private money lenders, each option comes with its own set of pros and cons.

Using Leverage in Real Estate Investments

Leverage can be a powerful tool in real estate investing, allowing you to amplify your returns with borrowed funds. However, it also comes with increased risk, as any downturn in the market can magnify your losses. It’s important to carefully consider the risks and rewards of using leverage in your investment strategy.

Maximizing Returns with Financing Options

To maximize returns on your real estate investments, consider leveraging financing options strategically. By using leverage wisely, you can increase your purchasing power and potentially boost your profits. Just be sure to have a solid plan in place and carefully assess the risks involved.

Managing Cash Flow in Real Estate Investments

Effective cash flow management is essential for long-term success in real estate investing. By carefully monitoring your income and expenses, you can ensure that your investments remain profitable even during market fluctuations. Consider setting aside reserves for unexpected expenses and staying on top of rent collections to maintain a healthy cash flow.

Risk Management

Real estate investments come with their fair share of risks that investors need to be aware of. Understanding these risks and implementing effective risk management strategies is crucial for success in the real estate market.

Common Risks and Mitigation Strategies

- Market Risk: Real estate values can fluctuate due to market conditions. Mitigate this risk by investing in diverse markets and property types.

- Liquidity Risk: Real estate investments are not as liquid as stocks or bonds. Have a contingency plan in place in case you need to sell quickly.

- Interest Rate Risk: Changes in interest rates can impact financing costs. Consider fixed-rate mortgages to protect against rising rates.

- Property Risk: Property damage or unexpected maintenance costs can eat into profits. Conduct thorough inspections and set aside a reserve fund for repairs.

Importance of Diversification

Diversifying your real estate investment portfolio can help spread risk across different assets and markets. By investing in a mix of residential, commercial, and industrial properties, you can reduce the impact of a downturn in any one sector.

Protecting Against Market Fluctuations

- Monitor Market Trends: Stay informed about local market conditions and adjust your investment strategy accordingly.

- Long-Term Approach: Focus on long-term growth and income generation to ride out short-term market fluctuations.

Risk Management Strategies of Successful Investors

Successful real estate investors often use leverage cautiously, conduct thorough due diligence before buying a property, and have a solid risk management plan in place.