Hey there, ready to dive into the world of Retirement account contributions? Get ready to learn all about the ins and outs of saving for your future in a way that’s both smart and savvy.

Let’s break down the importance of regular contributions, the different types of retirement accounts, strategies for maximizing your savings, tax implications, and even how employer-sponsored plans can play a role in your financial future.

Importance of Retirement Account Contributions

Regular contributions to retirement accounts are crucial for building a secure financial future. By consistently setting aside money for retirement, individuals can ensure they have enough funds to support themselves during their golden years.

Benefits of Contributing to Retirement Accounts

- Compound Interest: Contributing to retirement accounts allows individuals to take advantage of compound interest, where their money grows exponentially over time.

- Tax Advantages: Retirement account contributions often come with tax benefits, such as tax-deferred growth or tax-free withdrawals in retirement.

- Financial Security: Building a substantial retirement fund through contributions provides a safety net for unforeseen expenses or emergencies in the future.

How Retirement Account Contributions Secure a Comfortable Retirement

- Income Replacement: Regular contributions help individuals replace a portion of their pre-retirement income to maintain their lifestyle after retiring.

- Long-Term Planning: Contributing to retirement accounts encourages long-term financial planning, ensuring that individuals have enough savings to sustain themselves throughout retirement.

- Peace of Mind: Knowing that one has diligently contributed to their retirement account can bring peace of mind and reduce financial stress in retirement.

Types of Retirement Accounts

Retirement accounts come in various types, each with its own set of features and eligibility criteria. Let’s explore some of the most common ones:

401(k) Retirement Account

- Employer-sponsored retirement account

- Contributions are typically made through payroll deductions

- Offers tax advantages, such as tax-deferred growth

- Some employees may receive matching contributions from their employer

Individual Retirement Account (IRA)

- Available to individuals, regardless of employer participation

- Contributions may be tax-deductible, depending on income level and other factors

- Various investment options, such as stocks, bonds, and mutual funds

- Penalties for early withdrawals before retirement age

Roth IRA

- Contributions are made with after-tax dollars

- Earnings grow tax-free and withdrawals in retirement are tax-free

- No required minimum distributions during the account holder’s lifetime

- Income limits for eligibility

Simple IRA

- Designed for small businesses with fewer than 100 employees

- Employees can make contributions through salary deferrals

- Employers are required to make either matching or non-elective contributions

- Lower contribution limits compared to a 401(k)

Strategies for Maximizing Contributions

When it comes to maximizing your retirement account contributions, there are several strategies you can implement to ensure you are saving as much as possible for your future financial security.

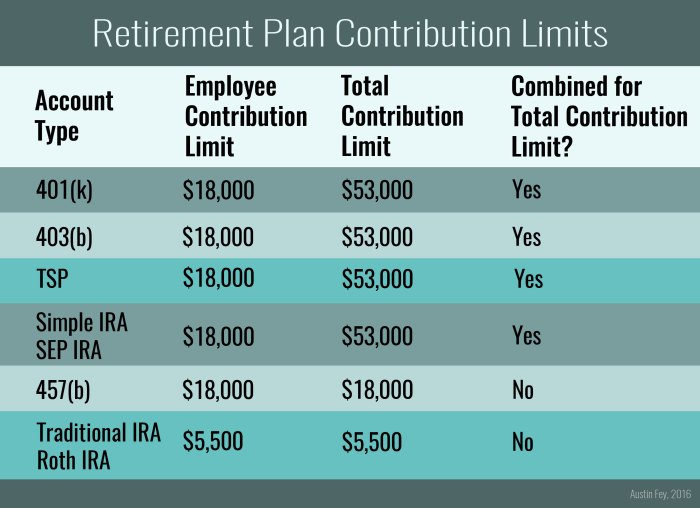

Annual Contribution Limits

- It’s important to be aware of the annual contribution limits set by the IRS for different types of retirement accounts, such as 401(k), IRA, and Roth IRA.

- For 2021, the annual contribution limit for 401(k) accounts is $19,500 for individuals under 50 years old, with an additional catch-up contribution of $6,500 for those 50 and older.

- IRA contribution limits for 2021 are $6,000 for individuals under 50, with a catch-up contribution of $1,000 for those 50 and older.

- Roth IRA contribution limits are the same as traditional IRAs.

Catch-Up Contributions

- For individuals nearing retirement age, catch-up contributions allow them to make additional contributions to their retirement accounts beyond the normal limits.

- This is particularly beneficial for those who may have fallen behind on saving for retirement and need to boost their savings quickly.

- Individuals aged 50 and older can take advantage of catch-up contributions to accelerate their retirement savings and make up for lost time.

Tax Implications of Retirement Account Contributions

When it comes to retirement account contributions, understanding the tax implications is crucial. Let’s dive into how these contributions can impact your tax liabilities and the tax advantages they offer.

Tax Advantages of Contributing to Retirement Accounts

Contributing to retirement accounts can provide significant tax benefits. One major advantage is the ability to reduce your taxable income in the year of contribution. This means that the amount you contribute to your retirement account is deducted from your taxable income, lowering the amount of income subject to taxes. As a result, you may end up paying less in taxes for the year, allowing you to keep more of your hard-earned money.

Differences in Tax Treatment: Traditional vs. Roth Retirement Accounts

Traditional and Roth retirement accounts have different tax treatments that can impact your tax liabilities both now and in the future. In a traditional retirement account, contributions are typically made with pre-tax dollars, meaning you don’t pay taxes on the money you contribute until you withdraw it in retirement. On the other hand, Roth retirement accounts are funded with after-tax dollars, so contributions are not tax-deductible. However, qualified withdrawals in retirement, including earnings, are tax-free. Understanding these tax treatment differences can help you make informed decisions about which type of retirement account is best for your financial goals.

Employer-Sponsored Retirement Plans

Employer-sponsored retirement plans such as 401(k) and 403(b) are valuable tools for saving for retirement. These plans are offered by employers to help employees set aside money for their post-career years.

Employer Matches and Boosting Retirement Savings

Employers may offer matching contributions to an employee’s retirement account, up to a certain percentage of the employee’s salary. This is essentially free money that can significantly boost retirement savings. For example, an employer might match 50% of an employee’s contributions up to 6% of their salary. This means if the employee contributes 6% of their salary, the employer will contribute an additional 3%.

Vesting Schedules and Rollover Options

Vesting schedules determine how long an employee must work for the employer before they fully own the employer’s contributions to their retirement account. There are typically graded vesting schedules where employees gain ownership of a percentage of the employer’s contributions over time. Rollover options allow employees to transfer funds from their employer-sponsored retirement account to another retirement account when changing jobs, preventing the loss of savings and maintaining the tax-deferred status of the funds.