When it comes to securing your financial future, retirement fund allocation plays a pivotal role. Imagine a world where your money works for you, paving the way for a comfortable retirement filled with endless possibilities. Buckle up as we dive into the realm of retirement planning with a twist of American high school coolness.

In this guide, we’ll explore the importance of proper fund allocation, different types of retirement accounts, strategies for maximizing your investments, and key factors influencing allocation decisions. Get ready to level up your retirement game!

Importance of Retirement Fund Allocation

Retirement fund allocation is a crucial aspect of financial planning as it ensures that individuals have enough savings to support themselves during their retirement years. Proper fund allocation can significantly impact retirement savings by maximizing returns and minimizing risks.

Maximizing Returns

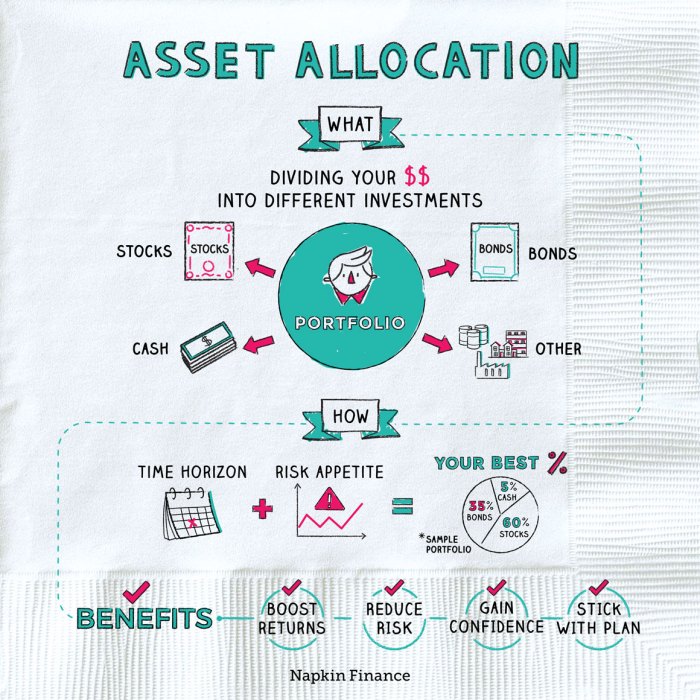

By allocating funds wisely across different investment vehicles such as stocks, bonds, and real estate, individuals can potentially earn higher returns on their retirement savings. Diversification of investments helps spread out risks and increase the chances of achieving financial goals.

Minimizing Risks

Improper or lack of retirement fund allocation can expose individuals to various risks such as inflation, market volatility, and longevity risk. Without proper diversification, a significant market downturn or unexpected expenses can deplete retirement savings quickly, leaving individuals financially vulnerable during retirement.

Types of Retirement Accounts

When it comes to saving for retirement, there are several types of retirement accounts to consider. Each type has its own unique features, eligibility criteria, and contribution limits. Let’s take a closer look at some of the most common retirement accounts available.

401(k)

The 401(k) is a popular retirement account offered by many employers. Employees can contribute a portion of their pre-tax income to their 401(k) account, which can grow tax-deferred until retirement. Some employers also offer matching contributions, up to a certain percentage of the employee’s salary.

IRA (Individual Retirement Account)

An IRA is a retirement account that individuals can open on their own. There are two main types of IRAs: Traditional IRAs and Roth IRAs. With a Traditional IRA, contributions may be tax-deductible, and earnings grow tax-deferred until withdrawal. On the other hand, Roth IRAs are funded with after-tax dollars, and withdrawals in retirement are tax-free.

403(b)

A 403(b) is a retirement account typically offered to employees of non-profit organizations, schools, and certain government entities. Similar to a 401(k), contributions to a 403(b) are made on a pre-tax basis, and earnings grow tax-deferred until withdrawal in retirement.

457(b)

A 457(b) plan is a retirement account available to employees of state and local governments and certain non-profit organizations. Contributions to a 457(b) plan are made on a pre-tax basis, and withdrawals in retirement are taxed at ordinary income tax rates.

Comparison of Features

- 401(k) and 403(b) are employer-sponsored plans, while IRA and Roth IRA are individual accounts.

- Traditional IRAs offer tax-deductible contributions, while Roth IRAs provide tax-free withdrawals in retirement.

- Contribution limits vary by account type and are subject to annual adjustments by the IRS.

Eligibility Criteria and Contribution Limits

- Eligibility for a 401(k) and 403(b) is typically determined by the employer’s plan rules.

- IRAs have income limits for tax-deductible contributions, while Roth IRAs have income limits for contributions altogether.

- Contribution limits for 2021 are $19,500 for 401(k) and 403(b) plans, $6,000 for IRAs, and $6,000 for Roth IRAs (plus $1,000 catch-up contribution for those aged 50 and older).

Strategies for Retirement Fund Allocation

When it comes to allocating your retirement funds, it’s crucial to have a solid strategy in place. Diversifying your investments, considering your risk tolerance, and regularly reviewing and adjusting your allocations are key components of a successful retirement plan.

Diversifying Retirement Fund Investments

Diversification is the practice of spreading your investments across different asset classes to reduce risk. By investing in a mix of stocks, bonds, real estate, and other assets, you can protect your portfolio from market fluctuations. Remember the old saying, “Don’t put all your eggs in one basket!”

Allocating Funds Based on Risk Tolerance and Retirement Goals

It’s important to consider your risk tolerance and retirement goals when allocating your funds. If you have a higher risk tolerance, you may choose to invest more heavily in stocks, which have the potential for higher returns but also come with greater risk. On the other hand, if you have a lower risk tolerance, you may opt for a more conservative approach with a higher allocation to bonds or cash equivalents.

Importance of Periodic Review and Adjustments

Periodically reviewing and adjusting your fund allocation is crucial to ensure that your investments are aligned with your changing financial goals and risk tolerance. As you near retirement, you may want to shift towards more conservative investments to protect your savings. Regularly assessing and rebalancing your portfolio can help you stay on track towards a comfortable retirement.

Factors Influencing Retirement Fund Allocation

When it comes to allocating funds for retirement, several factors play a crucial role in determining the best strategy for an individual. Factors such as age, income level, risk tolerance, and retirement timeline all influence the decisions made when it comes to retirement fund allocation. Additionally, market conditions and economic factors can also impact how funds are allocated for retirement. Seeking guidance from financial advisors can help individuals navigate these various factors to make informed decisions.

Age

Age is a key factor that influences retirement fund allocation. Younger individuals may have a higher risk tolerance and can afford to invest in more aggressive options such as stocks, with a longer time horizon to ride out market fluctuations. On the other hand, older individuals may opt for more conservative investments to protect their savings as they near retirement age.

Income Level

Income level also plays a significant role in retirement fund allocation decisions. Individuals with higher incomes may have more disposable income to contribute to retirement accounts, allowing them to potentially take on more risk or invest in a wider range of assets. Lower-income individuals may need to prioritize saving in more stable, low-risk options to ensure a secure retirement.

Risk Tolerance

Risk tolerance refers to an individual’s willingness to withstand fluctuations in the market. Those with a higher risk tolerance may be more comfortable investing in higher-risk assets that offer the potential for greater returns. Conversely, individuals with a lower risk tolerance may prefer more stable investments to minimize potential losses.

Retirement Timeline

The retirement timeline is another crucial factor in retirement fund allocation. Individuals with a longer time until retirement may choose to allocate more funds to growth-oriented investments, while those closer to retirement may shift towards more conservative options to protect their savings.

Market Conditions and Economic Factors

Market conditions and economic factors can have a significant impact on retirement fund allocation. A volatile market or economic downturn may prompt individuals to reassess their investment strategy and adjust their allocations accordingly. Being aware of these external factors is essential in making informed decisions about retirement fund allocation.

Role of Financial Advisors

Financial advisors play a vital role in guiding individuals through the complexities of retirement fund allocation. They can help assess an individual’s financial situation, risk tolerance, and goals to develop a personalized investment strategy. By providing expertise and tailored advice, financial advisors can assist individuals in making informed decisions that align with their retirement objectives.