Get ready to dive into the world of Student loan consolidation, where financial freedom and smart decisions collide in a whirlwind of options and opportunities. This intro sets the stage for an epic exploration of how students can take control of their loans and pave the way for a brighter future.

In the following paragraphs, we will unravel the mysteries of student loan consolidation, uncovering its benefits, drawbacks, eligibility criteria, and practical steps to make it happen. Stay tuned for a rollercoaster ride of financial wisdom!

What is Student Loan Consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan with one monthly payment. This can help simplify your finances and potentially lower your monthly payment by extending the repayment term.

Benefits of Consolidating Student Loans

- Lower Monthly Payments: By extending the repayment term, you may be able to lower your monthly payment amount.

- Single Payment: Instead of managing multiple loans, you only have to make one payment each month.

- Potential for Lower Interest Rate: Consolidation can also potentially lower your interest rate, saving you money in the long run.

How Student Loan Consolidation Works

When you consolidate your student loans, a new loan is created to pay off your existing loans. This new loan will have a fixed interest rate based on the weighted average of your current loans. You will then make a single monthly payment towards this new loan.

Types of Student Loan Consolidation Programs

- Federal Direct Consolidation Loan: This program allows you to consolidate federal student loans into one new loan with a fixed interest rate.

- Private Student Loan Consolidation: Private lenders also offer consolidation options for both federal and private student loans, with interest rates based on creditworthiness.

- Income-Driven Repayment Plans: These plans can also be considered a form of consolidation, as they base your monthly payment on your income and family size, potentially resulting in lower payments.

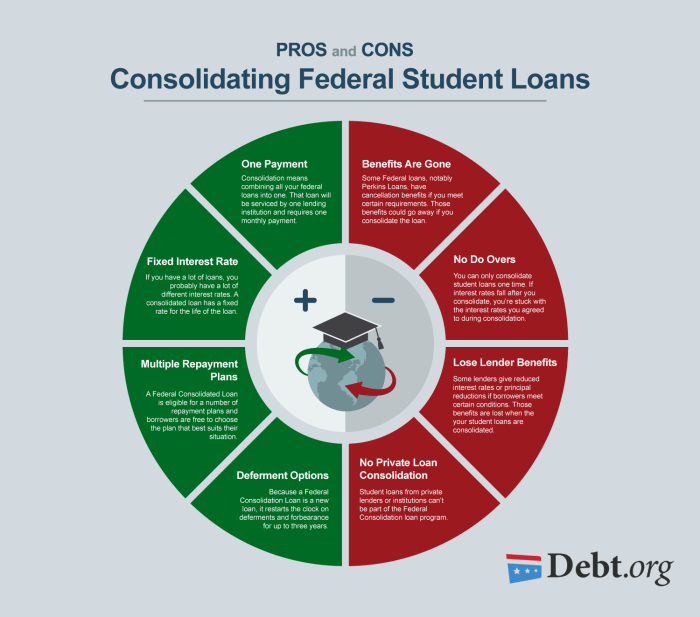

Pros and Cons of Student Loan Consolidation

When it comes to student loan consolidation, there are both advantages and disadvantages to consider. Let’s take a look at the pros and cons to help you make an informed decision.

Advantages of Student Loan Consolidation

- Streamlined Repayment: Consolidating multiple loans into one can simplify the repayment process by combining all your loans into a single monthly payment.

- Potential Lower Interest Rate: With consolidation, you may have the opportunity to secure a lower interest rate, saving you money over the life of the loan.

- Extended Repayment Terms: Consolidation can also offer extended repayment terms, which can lower your monthly payment amount, making it more manageable.

- Fixed Interest Rate: By consolidating your loans, you can lock in a fixed interest rate, providing stability and predictability in your monthly payments.

Disadvantages of Student Loan Consolidation

- Loss of Benefits: Depending on the loans you have, consolidating them may cause you to lose certain benefits such as interest rate discounts, principal rebates, or loan cancellation benefits.

- Potentially Higher Total Interest: While a lower interest rate is possible, extending the repayment term through consolidation can result in paying more interest over time.

- Impact on Credit Score: The consolidation process may result in a temporary dip in your credit score, as it involves opening a new account and closing existing ones.

- Less Flexibility: Once you consolidate your loans, you may lose the flexibility to target higher-interest loans for quicker repayment, as they are all combined into one.

Overall, the decision to consolidate student loans depends on your individual financial situation and goals. It’s important to weigh the benefits and drawbacks carefully before moving forward with consolidation.

Eligibility Criteria for Student Loan Consolidation

To qualify for student loan consolidation, there are certain eligibility requirements that students need to meet. Factors such as loan type, current status, and repayment history can impact eligibility for consolidation. Here are some tips on how students can qualify for student loan consolidation:

Eligibility Requirements

- Must have federal student loans: Only federal student loans are eligible for consolidation. Private loans cannot be included.

- Student must be in grace period or repayment: Borrowers must be in their grace period or actively repaying their loans to qualify.

- No defaulted loans: Students with defaulted loans are not eligible for consolidation unless they have made satisfactory repayment arrangements.

- Minimum loan amount: Typically, there is a minimum loan amount required to qualify for consolidation.

Factors Impacting Eligibility

- Credit score: While not a requirement, a good credit score can make it easier to qualify for certain consolidation programs.

- Loan type: Some types of federal loans may not be eligible for certain consolidation programs.

- Income: Income-based repayment plans may have specific eligibility requirements based on income levels.

Tips to Qualify

- Stay current on payments: Making on-time payments on your loans can improve your eligibility for consolidation.

- Explore income-driven repayment plans: These plans can help lower monthly payments, making it easier to manage your loans.

- Consider loan rehabilitation: If you have defaulted loans, completing a loan rehabilitation program can make you eligible for consolidation.

How to Consolidate Student Loans

Consolidating student loans can be a great way to simplify your finances and potentially lower your monthly payments. Here’s a step-by-step guide on how to consolidate multiple student loans.

Applying for Student Loan Consolidation

- Gather all your loan information: Make a list of all your federal and private student loans, including the loan servicer, balance, and interest rate.

- Choose a consolidation option: Decide whether you want to consolidate federal loans, private loans, or both.

- Apply for consolidation: You can apply for federal loan consolidation through the Department of Education’s website. For private loan consolidation, you’ll need to apply through a private lender.

- Review the terms: Once your consolidation application is approved, review the new loan terms carefully to ensure you understand the changes.

Options for Consolidating Federal and Private Student Loans

- Federal Direct Consolidation Loan: This allows you to combine multiple federal loans into one new loan with a fixed interest rate.

- Private Student Loan Refinancing: Private lenders offer the option to combine both federal and private loans into a single loan with a new interest rate.

Documents Needed for the Consolidation Process

- Personal information: Social Security number, contact information, and driver’s license.

- Loan details: Loan servicer information, current loan balances, and repayment terms.

- Income verification: Pay stubs, tax returns, or other proof of income may be required.

- Any requested forms: Some lenders may require additional forms or documentation as part of the application process.