Diving into Student loan consolidation, this introduction immerses readers in a unique and compelling narrative, with american high school hip style that is both engaging and thought-provoking from the very first sentence.

Get ready to explore the ins and outs of student loan consolidation, from understanding its purpose to navigating the various types available.

What is Student Loan Consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan with one monthly payment. This can be done through a private lender or a federal loan servicer.

Purpose of Consolidating Student Loans

When you consolidate your student loans, you can potentially lower your monthly payment by extending the repayment term. It can also simplify your finances by having only one loan to manage instead of multiple loans with different due dates and interest rates.

How Student Loan Consolidation Works

- You apply for a consolidation loan through a private lender or the federal government.

- If approved, your new loan pays off your existing student loans, leaving you with one loan and one monthly payment.

- The interest rate on the consolidation loan is determined by taking the weighted average of the interest rates on your current loans.

- You can choose a new repayment term, which can either lower your monthly payment or save you money on interest in the long run.

- It’s important to note that federal and private loans cannot be consolidated together, so they will remain separate loans.

Benefits of Student Loan Consolidation

Consolidating student loans can offer several advantages to borrowers, making it easier to manage debt and potentially save money in the long run.

1. Simplified Repayment Process

- By consolidating multiple student loans into one, borrowers only have to make a single monthly payment, simplifying the repayment process.

- Keeping track of due dates, interest rates, and different loan servicers becomes less complicated, reducing the chances of missing payments.

2. Lower Monthly Payments

- Consolidation can potentially result in lower monthly payments by extending the repayment term, spreading out the total amount due over a longer period.

- Lower monthly payments can provide borrowers with more breathing room in their budget, allowing them to better manage their finances.

- Lower payments may also result from securing a lower interest rate through consolidation, especially if credit scores have improved since the initial loans were taken out.

Types of Student Loan Consolidation

When it comes to student loan consolidation, there are different types available to borrowers. Each type has its own set of terms and conditions, so it’s important to understand the options before making a decision.

Federal Loan Consolidation

Federal loan consolidation is offered by the U.S. Department of Education and allows borrowers to combine multiple federal student loans into one new loan. This new loan comes with a fixed interest rate, which is calculated as the weighted average of the interest rates on the loans being consolidated.

Private Loan Consolidation

Private loan consolidation, on the other hand, is offered by private lenders such as banks, credit unions, and online lenders. With private loan consolidation, borrowers can combine both federal and private student loans into a single loan with a new interest rate and repayment terms.

Lenders and Programs

There are several lenders and programs that offer student loan consolidation, including:

– SoFi

– Earnest

– LendKey

– CommonBond

– Discover

It’s important to research and compare the terms and conditions offered by each lender or program to find the best option that fits your financial situation and goals.

Eligibility and Requirements for Student Loan Consolidation

When it comes to consolidating your student loans, there are certain eligibility criteria and requirements you need to meet in order to qualify for this financial solution. Understanding these guidelines is crucial to determine if consolidation is the right option for you.

Eligibility Criteria for Student Loan Consolidation

- Having federal student loans: To consolidate your loans, they must be federal student loans. Private loans are not eligible for federal consolidation programs.

- Being in the grace period or repayment: You can consolidate your loans during the grace period, repayment, deferment, or forbearance. However, consolidating during grace period may cause you to lose certain benefits.

- No previous consolidation: If you have already consolidated your loans in the past, you may not be eligible for another consolidation unless you have taken out new loans since the last consolidation.

Requirements to Qualify for Student Loan Consolidation

- Completing the application: You will need to fill out the consolidation application, providing details about your existing loans and financial situation.

- Making on-time payments: Having a history of making on-time payments on your current loans is important for eligibility.

- Not in default: If you are in default on any of your federal student loans, you will need to resolve the default before you can consolidate your loans.

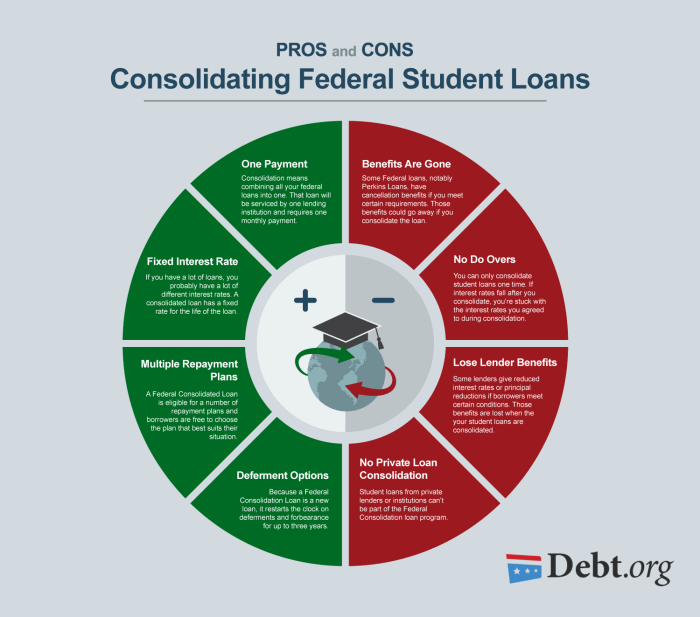

Potential Drawbacks or Limitations to Consolidation

It’s important to consider that while consolidation can simplify your repayment process, it may also extend your repayment term, resulting in more interest paid over time. Additionally, you may lose certain borrower benefits specific to your original loans, such as interest rate discounts or loan forgiveness options.

How to Consolidate Student Loans

Consolidating student loans can be a great way to simplify your finances and potentially save money in the long run. Here is a step-by-step guide on how to consolidate student loans:

Application Process for Student Loan Consolidation

When applying for student loan consolidation, follow these steps:

- Gather all your loan information, including balances and interest rates.

- Decide if you want a federal direct consolidation loan or a private consolidation loan.

- Apply for a consolidation loan through the appropriate channels, whether it’s the U.S. Department of Education for federal loans or a private lender for private loans.

- Submit any required documentation, such as proof of income or employment.

- Review the terms of the new consolidation loan, including the interest rate and repayment options.

- If approved, sign the new loan agreement and begin making payments according to the new terms.

Tips on Navigating the Consolidation Process Successfully

To navigate the consolidation process successfully, consider the following tips:

- Understand the terms of your current loans and compare them to the terms of the consolidation loan to ensure you are making a wise financial decision.

- Explore all available options for consolidation, including federal direct consolidation loans, private consolidation loans, and other refinancing options.

- Seek guidance from a financial advisor or student loan counselor if you are unsure about which consolidation option is best for you.

- Stay organized throughout the application process by keeping track of deadlines, required documents, and communication with lenders.

- Continue making payments on your current loans until the consolidation process is complete to avoid any negative impacts on your credit.

Impact of Student Loan Consolidation on Credit Score

When it comes to consolidating student loans, it is important to consider the potential impact on your credit score. This process can have both positive and negative effects on your credit history and creditworthiness, so it’s crucial to understand how to manage your credit during and after consolidation.

Effects on Credit Score

- Consolidating multiple student loans into a single loan can simplify your payments and make it easier to manage your debt. This can have a positive impact on your credit score as it shows that you are actively working to pay off your loans.

- However, applying for a new loan to consolidate your existing student loans can result in a hard inquiry on your credit report, which may cause a temporary decrease in your credit score.

- On the other hand, if you are able to make timely payments on your consolidated loan, it can help improve your credit score over time by demonstrating responsible borrowing behavior.

Tips for Managing Credit

- Continue making on-time payments on all your debts, including your consolidated student loan, to maintain a positive credit history.

- Avoid taking on new debt while you are in the process of consolidating your student loans to prevent further impact on your credit score.

- Monitor your credit report regularly to ensure that all information is accurate and to identify any potential issues that may affect your credit score.