Diving into the world of financial investments, this introduction sets the stage for a fascinating journey through the realms of stocks, bonds, real estate, and more. Get ready to uncover the secrets of building a solid investment portfolio and maximizing your financial growth.

In the following paragraphs, we’ll delve deeper into the specifics of each investment type, from the basics to the intricate details that shape the financial landscape.

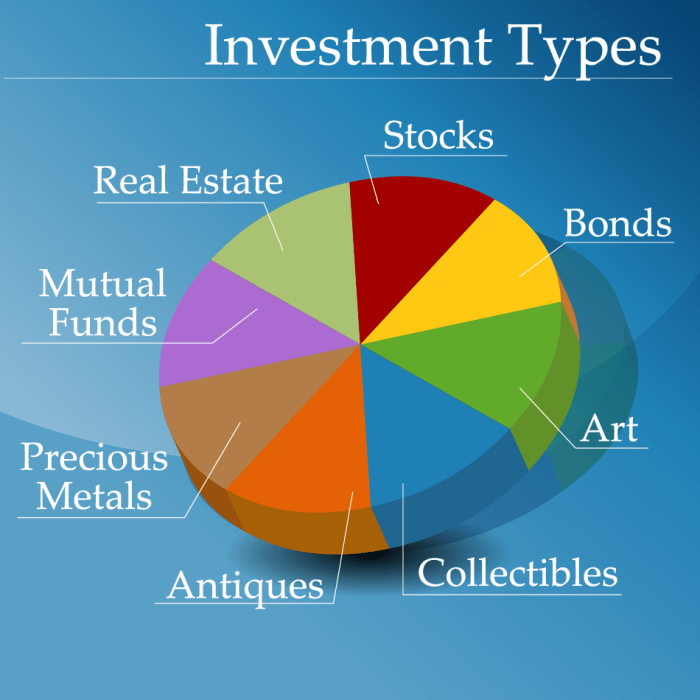

Types of Financial Investments

In the world of personal finance, financial investments play a crucial role in helping individuals grow their wealth over time. By putting money into different investment vehicles, individuals have the opportunity to earn returns and build a secure financial future.

Stocks

Stocks represent ownership in a company and are bought and sold on stock exchanges. Investors can earn returns through capital appreciation (increase in stock price) and dividends (share of company profits).

Bonds

Bonds are debt securities issued by governments or corporations. Investors lend money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

Real Estate

Real estate investments involve buying properties such as residential homes, commercial buildings, or land. Investors can earn returns through rental income and property appreciation.

Commodities

Commodities are physical goods like gold, oil, and agricultural products. Investors can invest in commodities directly or through futures contracts to profit from price fluctuations.

Risk and Return Characteristics

– Stocks generally offer higher returns but come with higher risk due to market volatility.

– Bonds are considered safer investments with lower returns compared to stocks.

– Real estate investments can provide steady income but may be affected by market conditions.

– Commodities are known for their potential to hedge against inflation but can be volatile.

Diversification in Investment Portfolio

Diversification involves spreading investments across different asset classes to reduce risk. By holding a mix of stocks, bonds, real estate, and commodities, investors can minimize the impact of any single investment’s poor performance on their overall portfolio.

Stocks

Stocks represent ownership in a company, where investors purchase shares of a company’s stock and become shareholders. This ownership entitles them to a portion of the company’s assets and profits.

Types of Stocks

- Common Stocks: These are the most common type of stocks that are typically held by individual investors. Common stockholders have voting rights in the company and may receive dividends.

- Preferred Stocks: Preferred stockholders have priority over common stockholders when it comes to dividends and assets in the event of liquidation. However, they usually do not have voting rights.

Stock Prices Determination

Stock prices are determined by the forces of supply and demand in the stock market. When more investors want to buy a stock (demand), its price goes up. Conversely, if more investors want to sell a stock (supply), its price goes down.

Factors Influencing Stock Prices

- Company Performance: Strong financial performance, growth prospects, and profitability can positively influence stock prices.

- Economic Conditions: Factors such as interest rates, inflation, and economic indicators can impact stock prices.

- Market Sentiment: Investor perception, news, and market trends can also influence stock prices, sometimes leading to volatility in the market.

Bonds

When it comes to investing, bonds are a popular choice for many investors. Bonds are essentially loans made by investors to governments or corporations. In return, the borrower agrees to pay back the amount borrowed, known as the principal, along with interest over a specified period of time.

Types of Bonds

- Government Bonds: These are issued by governments to raise funds for various projects or expenses. They are generally considered low-risk investments because governments are unlikely to default on their debt.

- Corporate Bonds: These are issued by corporations to raise capital for their operations. They offer higher returns compared to government bonds but also come with higher risk.

- Municipal Bonds: These are issued by local governments or municipalities to fund public projects like schools, roads, or hospitals. They are exempt from federal taxes and sometimes state taxes, making them attractive to investors in higher tax brackets.

Bond Prices and Interest Rates

When it comes to bonds, there is an inverse relationship between bond prices and interest rates. As interest rates rise, bond prices fall, and vice versa. This is because when interest rates go up, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive, causing their prices to drop.

Remember, bond prices and interest rates move in opposite directions.

Bond Yields and Investor Returns

Bond yields represent the annual return on a bond expressed as a percentage of its current market price. Higher bond yields generally indicate higher risk or longer maturity. Investors use bond yields to assess the potential returns of a bond investment. It’s essential to consider both the yield and the potential risks associated with the bond before making an investment decision.

Real Estate

Investing in real estate offers various opportunities for individuals to grow their wealth and diversify their investment portfolio. Whether it’s through physical properties, Real Estate Investment Trusts (REITs), or real estate crowdfunding, there are different ways to get involved in this lucrative market.

Physical Properties

Investing in physical properties involves buying residential or commercial real estate, either for rental income or potential appreciation. This type of investment requires significant capital upfront and ongoing expenses for maintenance, repairs, and property management.

Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. Investors can buy shares of publicly traded REITs on stock exchanges, providing a more liquid and diversified way to invest in real estate without directly owning properties.

Real Estate Crowdfunding

Real estate crowdfunding platforms allow investors to pool their resources to invest in real estate projects, such as residential or commercial developments. This method provides access to real estate investments with lower capital requirements and potential for higher returns.

Investing in real estate can offer several benefits, including stable rental income, property appreciation over time, and diversification of investment holdings. However, there are risks involved, such as market fluctuations affecting property values, maintenance costs eating into profits, and liquidity issues when trying to sell properties quickly.

To evaluate real estate investment opportunities effectively, investors should conduct thorough due diligence, including assessing the property’s location, market trends, potential rental income, and overall financial performance. By carefully analyzing these factors, investors can make informed decisions and maximize their returns in the real estate market.