Diving deep into the world of credit scores, this introduction will take you on a journey through the ins and outs of this crucial financial metric. Get ready to explore the mysteries of credit scores with a fresh perspective that will leave you enlightened and eager to learn more.

Exploring the factors that influence credit scores, understanding the different score ranges, the importance of monitoring your score, and strategies for improvement, this guide covers it all in a way that’s easy to understand and engaging to read.

What is a credit score?

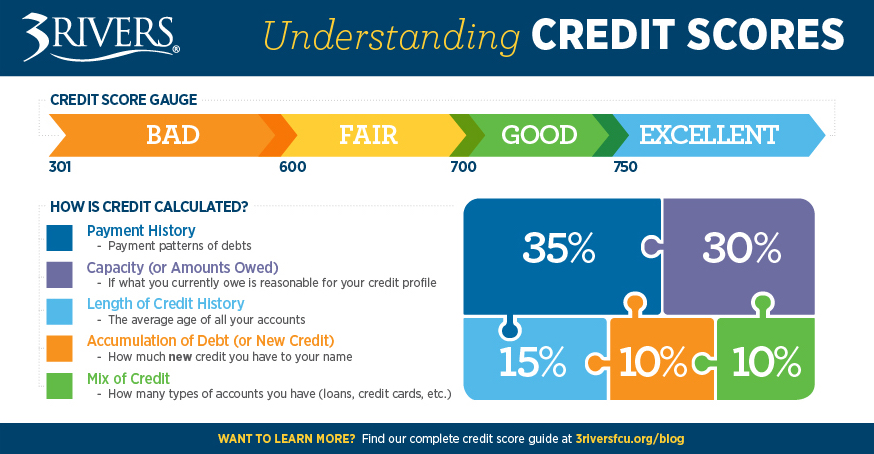

A credit score is a three-digit number that represents an individual’s creditworthiness. It is used by lenders to determine how likely a person is to repay their debts on time. The score is calculated based on various factors such as payment history, credit utilization, length of credit history, new credit accounts, and types of credit used.

How are credit scores calculated?

- Credit scores are calculated using a mathematical algorithm that analyzes the information in a person’s credit report.

- The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850.

- Payment history accounts for 35% of the score, followed by amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

- Factors such as late payments, high credit card balances, and recent credit inquiries can lower a credit score.

Importance of credit scores in financial decisions

- A good credit score can help individuals qualify for loans, credit cards, and other financial products with favorable terms and interest rates.

- Employers, landlords, and insurance companies may also check credit scores to assess risk and make decisions.

- Improving a credit score can lead to lower borrowing costs and better financial opportunities in the future.

Factors affecting credit scores

Understanding the key factors that impact credit scores is essential for managing your financial health and future borrowing opportunities.

Payment history

Your payment history is one of the most significant factors affecting your credit score. It reflects whether you have paid your bills on time and in full. Late payments or defaults can have a negative impact on your credit score, while consistent on-time payments can boost it.

Credit utilization

Credit utilization refers to the amount of available credit you are using. Keeping your credit utilization low, ideally below 30%, shows lenders that you are responsible with credit and can positively impact your credit score. Maxing out credit cards or carrying high balances can lower your score.

Length of credit history

The length of your credit history also plays a role in determining your credit score. Lenders like to see a long credit history with responsible credit usage. Opening new credit accounts can temporarily lower your score due to the average age of accounts decreasing.

Types of credit used

Having a mix of credit types, such as credit cards, installment loans, and mortgages, can positively impact your credit score. It shows that you can manage different types of credit responsibly. However, having too many of one type of credit can have a negative effect.

New credit

Opening multiple new credit accounts within a short period can signal financial distress and may lower your credit score. Lenders may interpret this as a sign of increased risk. Be cautious when applying for new credit, especially if you are planning a major financial transaction like a mortgage or car loan.

Understanding credit score ranges

When it comes to credit scores, there are different ranges that categorize individuals based on their creditworthiness. These ranges can have significant implications on your financial opportunities and the terms you may be offered for loans or credit.

Credit Score Ranges

Credit scores typically range from poor to excellent, with each range representing a different level of creditworthiness. Here is a breakdown of the common credit score ranges:

- Poor (300-579): Individuals in this range may have a difficult time getting approved for credit or loans. They may also face higher interest rates and less favorable terms if they do get approved.

- Fair (580-669): Those in this range may qualify for credit, but they might still face higher interest rates and less favorable terms compared to individuals with higher credit scores.

- Good (670-739): Falling into this range indicates a solid credit history and may lead to more favorable loan terms with lower interest rates.

- Very Good (740-799): Individuals in this range typically receive better loan terms, lower interest rates, and may have access to a wider range of financial products.

- Excellent (800-850): This is the highest credit score range and signifies an exceptional credit history. Individuals in this range are likely to receive the best loan terms and lowest interest rates available.

Implications of Credit Score Ranges

Your credit score range can greatly impact your financial life. Individuals with higher credit scores generally have an easier time getting approved for loans and credit cards, as well as securing better terms and lower interest rates. On the other hand, lower credit scores may limit your borrowing options and lead to higher costs in the long run.

Benefits and Limitations

| Credit Score Range | Benefits | Limitations |

|---|---|---|

| Poor | May still qualify for credit | Higher interest rates, limited options |

| Fair | Access to credit, improving credit | Higher interest rates, limited options |

| Good | Better loan terms, lower interest rates | Not the best rates or terms |

| Very Good | Excellent loan terms, low interest rates | Slightly less favorable than excellent |

| Excellent | Best loan terms, lowest rates | No significant limitations |

Importance of monitoring credit scores

Monitoring your credit score is crucial for various reasons. It allows you to keep track of your financial health, identify any errors or fraudulent activity, and take proactive steps to improve your score.

Tips for Effective Credit Score Monitoring

- Regularly check your credit report from all three major credit bureaus (Equifax, Experian, TransUnion) for accuracy and discrepancies.

- Set up credit monitoring services or alerts to receive notifications of any changes or suspicious activity on your credit report.

- Understand the factors that impact your credit score and take actions to address them, such as making on-time payments and keeping credit card balances low.

- Review your credit score before applying for major loans or credit cards to ensure you qualify for the best interest rates.

Consequences of Not Monitoring Your Credit Score

Failure to monitor your credit score can lead to serious consequences, including:

- Missing errors or inaccuracies on your credit report that could negatively impact your score and result in higher interest rates on loans.

- Becoming a victim of identity theft or fraud without realizing it until significant damage has been done to your credit.

- Being unaware of changes in your credit score that may affect your ability to qualify for loans or credit in the future.

Improving credit scores

Improving your credit score is crucial for opening up better financial opportunities in the future. By implementing certain strategies, you can see positive changes in your credit score over time.

Strategies for improving a credit score

- Pay bills on time: Late payments can significantly impact your credit score, so make sure to pay all your bills on time each month.

- Reduce debt: Lowering your overall debt can improve your credit utilization ratio, which is a key factor in determining your credit score.

- Check credit reports for errors: Regularly review your credit reports to ensure there are no inaccuracies that could be dragging down your score.

- Keep credit card balances low: Try to keep your credit card balances below 30% of your available credit limit to improve your credit score.

Timeline for seeing improvements in a credit score

It typically takes about 30-60 days to see any changes in your credit score after implementing improvements. However, significant changes may take several months to reflect in your score.

Impact of improved credit scores

- Lower interest rates: With a higher credit score, you may qualify for lower interest rates on loans and credit cards, saving you money in the long run.

- Access to better financial products: Improved credit scores can give you access to better credit cards, loans, and other financial products with more favorable terms.

- Rental and job opportunities: Landlords and potential employers may check your credit score, so a higher score can increase your chances of securing a rental or job.