Get ready to dive into the fascinating world of interest rates! As we explore the ins and outs of Understanding interest rates, prepare to be amazed by the impact they have on our everyday financial decisions. This journey will take you through a rollercoaster of economic factors, risks, and strategies, all presented in a cool and relatable high school hip style.

What are Interest Rates?

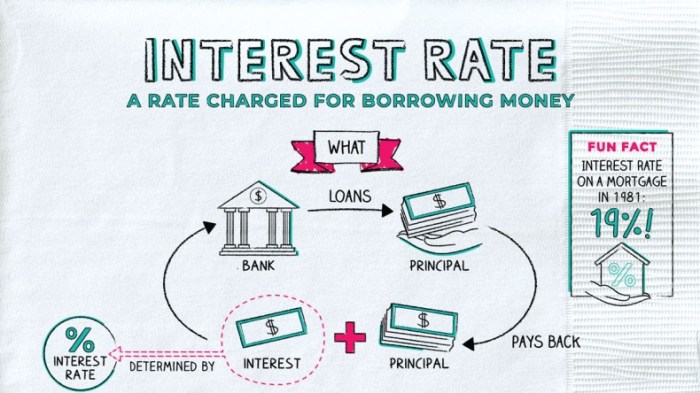

Interest rates refer to the cost of borrowing money or the return on investment. They play a crucial role in the economy as they influence borrowing, spending, and saving decisions. Interest rates are determined by various factors including inflation, economic conditions, central bank policies, and market demand.

Types of Interest Rates

- Fixed Interest Rates: These rates remain constant throughout the term of the loan, providing stability in monthly payments.

- Variable Interest Rates: These rates can fluctuate based on changes in market conditions, impacting the overall cost of borrowing.

- Prime Interest Rates: The interest rates set by banks for their most creditworthy customers, serving as a benchmark for other rates.

- APR (Annual Percentage Rate): This includes the interest rate plus any additional fees, giving a more comprehensive view of the total cost of borrowing.

Factors Affecting Interest Rates

Interest rates are influenced by a variety of economic factors that impact borrowing and lending conditions. These factors play a crucial role in determining the cost of borrowing money and the return on investments.

Economic Factors Influencing Interest Rates

- Supply and Demand: Like any other commodity, the supply and demand for credit can affect interest rates. When there is high demand for loans, interest rates tend to rise. Conversely, when there is a surplus of funds available for lending, interest rates may decrease.

- Government Policy: Fiscal policies, such as government spending and taxation, can impact interest rates indirectly by influencing economic growth and inflation rates. Central banks may adjust interest rates to achieve specific economic goals.

- Market Expectations: Anticipated future economic conditions, such as inflation rates, unemployment levels, and overall economic performance, can influence interest rates. Investors and lenders adjust rates based on their expectations of future economic trends.

Role of Central Banks in Setting Interest Rates

Central banks, such as the Federal Reserve in the United States, play a critical role in setting short-term interest rates. Through monetary policy tools, central banks can influence the money supply, inflation rates, and overall economic growth. Central banks use interest rate adjustments to achieve price stability and promote economic growth. For example, during periods of economic downturn, central banks may lower interest rates to stimulate borrowing and spending, thus boosting economic activity.

Understanding the Impact of Interest Rates

Interest rates play a vital role in shaping the financial landscape, influencing both borrowing and saving decisions. Let’s delve deeper into how interest rates impact various aspects of the economy.

Effect on Borrowing and Saving Decisions

Interest rates directly affect the cost of borrowing money. When interest rates are low, borrowing becomes cheaper, encouraging individuals and businesses to take out loans for various purposes such as buying homes, cars, or expanding businesses. On the flip side, higher interest rates lead to increased borrowing costs, making it less attractive to take on debt.

Conversely, interest rates also impact saving decisions. Higher interest rates provide better returns on savings and investments, incentivizing individuals to save more and potentially earn higher yields on their money. Conversely, lower interest rates may discourage saving as the returns are reduced.

Relationship with Investments

Interest rates have a significant impact on investment decisions. When interest rates are low, borrowing costs decrease, making it cheaper for businesses to fund new projects and investments. This can stimulate economic growth and lead to increased investment in various sectors. Conversely, higher interest rates can deter businesses from borrowing, potentially slowing down investment activities.

Impact on the Housing Market

Changes in interest rates can have a profound effect on the housing market. Lower interest rates typically lead to lower mortgage rates, making homeownership more affordable and increasing demand for housing. This can drive up home prices and stimulate construction activity. On the other hand, higher interest rates can increase the cost of borrowing for homebuyers, potentially dampening demand and slowing down the housing market.

Risks Associated with Interest Rates

Interest rates play a crucial role in the financial world, impacting borrowing costs, investment returns, and overall economic stability. However, they also come with certain risks that individuals and businesses need to be aware of in order to effectively manage their finances.

Identifying Risks Associated with Fluctuating Interest Rates

Fluctuating interest rates can pose several risks, including:

- Interest Rate Risk: The risk that changes in interest rates will affect the value of investments, particularly bonds and other fixed-income securities.

- Refinancing Risk: The risk that rising interest rates will make it more expensive to refinance existing debt or obtain new financing.

- Reinvestment Risk: The risk that proceeds from investments or maturing securities will need to be reinvested at lower interest rates, reducing overall returns.

Strategies to Mitigate Interest Rate Risks

To mitigate interest rate risks, individuals and businesses can employ the following strategies:

- Interest Rate Hedging: Using financial instruments such as interest rate swaps or options to offset the impact of interest rate fluctuations.

- Diversification: Spreading investments across different asset classes to reduce exposure to interest rate changes in a particular sector.

- Monitoring and Analysis: Regularly monitoring interest rate movements and conducting thorough analysis to anticipate potential risks and adjust investment strategies accordingly.

Managing Interest Rate Exposure for Businesses

Businesses can manage interest rate exposure by:

- Setting Clear Policies: Establishing clear policies and guidelines for managing interest rate risks, including limits on exposure and hedging strategies.

- Scenario Planning: Conducting scenario analysis to assess the impact of different interest rate scenarios on the business’s financial performance and developing contingency plans.

- Consulting with Experts: Seeking advice from financial advisors or consultants with expertise in interest rate risk management to develop effective strategies tailored to the business’s specific needs.