Diving into the world of Understanding mutual fund fees opens up a realm of financial knowledge that can shape your investment decisions. From unraveling the mystery behind various fees to exploring strategies to optimize your returns, this topic delves into the nitty-gritty of mutual fund costs. Get ready to navigate the complex terrain of fees and emerge as a savvy investor.

As we journey through the intricacies of mutual fund fees, you’ll gain valuable insights that can empower you to make informed choices and maximize your investment potential.

Importance of Understanding Mutual Fund Fees

Investors need to have a clear understanding of mutual fund fees to make informed decisions about their investments. These fees can have a significant impact on investment returns and can eat into potential profits over time. By being aware of the various fees associated with mutual funds, investors can better assess the overall cost of investing and choose funds that align with their financial goals.

Types of Mutual Fund Fees

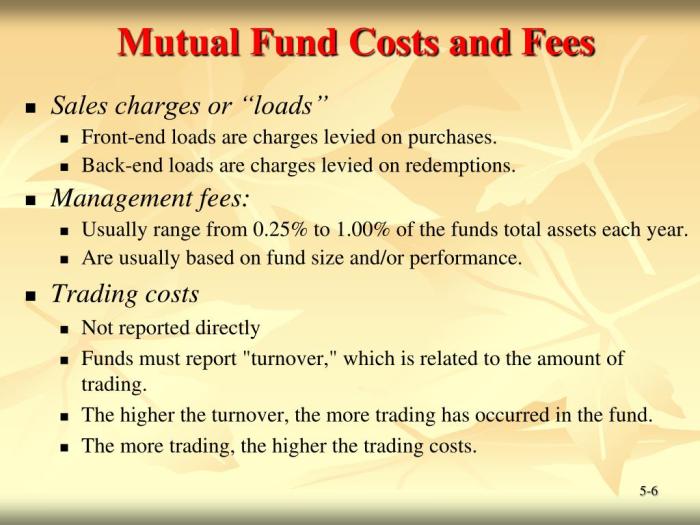

- Management Fees: These are ongoing fees paid to the fund manager for managing the portfolio.

- Expense Ratios: These represent the total annual operating expenses as a percentage of the fund’s average net assets.

- Front-End Load: A sales charge paid when purchasing shares of the fund.

- Back-End Load: A sales charge paid when selling shares of the fund.

Impact on Investment Returns

- High fees can significantly reduce the overall returns on an investment, especially over the long term.

- Even seemingly small differences in fees can add up and have a substantial impact on the final investment value.

- Choosing funds with lower fees can potentially lead to higher returns for investors.

Consequences of Ignoring Mutual Fund Fees

- Investors may end up paying more in fees than necessary, reducing their net returns.

- Higher fees can erode the potential gains from the investment, affecting long-term wealth accumulation.

- Not paying attention to fees can result in a mismatch between the fund’s cost and the investor’s investment objectives.

Types of Mutual Fund Fees

Mutual funds come with various types of fees that investors need to be aware of in order to make informed decisions about their investments. These fees can impact the overall performance and returns of a mutual fund. Let’s explore the different types of fees associated with mutual funds.

Front-End Loads

Front-end loads are fees that investors pay when they purchase shares of a mutual fund. These fees are deducted from the initial investment amount, reducing the total amount of money that actually gets invested in the fund.

Back-End Loads

Back-end loads, also known as deferred sales charges, are fees that investors pay when they sell their shares of a mutual fund. The longer an investor holds onto the shares, the lower the back-end load becomes. These fees are typically higher if the shares are sold within a certain period after purchase.

Annual Expense Ratios

Annual expense ratios represent the ongoing costs of owning a mutual fund. These fees are expressed as a percentage of the fund’s assets under management and cover the fund’s operating expenses, including management fees, administrative costs, and other miscellaneous expenses.

12b-1 Fees

12b-1 fees are marketing and distribution fees charged by some mutual funds to cover the costs of promoting and selling the fund. These fees are included in the fund’s annual expense ratio and can impact the overall returns for investors.

Redemption Fees

Redemption fees are charges imposed on investors when they sell their shares of a mutual fund within a certain time frame. These fees are designed to discourage short-term trading and can vary depending on the fund’s specific redemption policy.

Impact of Management Fees

Management fees are fees paid to the fund’s investment manager for managing the fund’s portfolio. These fees can have a significant impact on the overall performance of a mutual fund, as they directly reduce the fund’s returns. It’s important for investors to consider the management fees in relation to the fund’s performance and compare them with similar funds to determine if they are getting value for the fees paid.

How to Calculate Mutual Fund Fees

When it comes to calculating mutual fund fees, it’s essential to understand the total cost of owning a mutual fund. Let’s break down the steps to accurately calculate these fees and why it’s crucial to consider compound interest in the process.

Step-by-Step Guide

- Start by identifying the different types of fees associated with the mutual fund, such as management fees, administrative fees, and other expenses.

- Calculate the expense ratio by dividing the total expenses of the fund by its average net assets. This will give you a percentage that represents the annual cost of owning the fund.

- Consider any front-end or back-end loads, which are fees charged when buying or selling shares of the fund, respectively.

- Factor in any potential performance fees that the fund may charge based on its performance compared to a benchmark.

Remember to take into account the impact of compound interest on fees, as even small differences in expenses can significantly impact your returns over time.

Importance of Comparing Fees

- Comparing fees across different mutual funds is crucial to ensure you’re getting the best value for your investment.

- Lower fees can lead to higher returns over the long term, so it’s essential to choose funds with competitive fee structures.

- By comparing fees, you can also assess the overall value that a fund provides in relation to its costs, helping you make informed investment decisions.

Formulas and Tools

- Use the formula: Total Cost = Expense Ratio + Front-end Load + Back-end Load + Performance Fees

- Online calculators and tools are available to help investors accurately calculate mutual fund fees based on their specific investment amounts and time horizons.

Strategies to Minimize Mutual Fund Fees

Investors can take several steps to minimize the impact of fees on their investments. Being fee-conscious can lead to significant savings and potentially higher returns in the long run. By choosing low-fee mutual funds and understanding the trade-offs between fees and fund management quality, investors can optimize their investment strategy.

Fee-Conscious Investing

Fee-conscious investing involves actively seeking out mutual funds with lower fees to maximize investment returns. By focusing on minimizing fees, investors can keep more of their investment gains and reduce the drag on their portfolio growth. This approach emphasizes the importance of cost efficiency in achieving long-term financial goals.

- Regularly review and compare expense ratios of different mutual funds to identify lower-cost options.

- Avoid unnecessary fees by staying informed about transaction costs, sales charges, and other hidden expenses.

- Consider investing in passively managed index funds or ETFs, which typically have lower fees compared to actively managed funds.

- Look for funds with no-load fees or front-end load fees to minimize initial costs.

Identifying Low-Fee Mutual Funds

When selecting mutual funds, investors should prioritize funds with lower expense ratios and fees. These funds can help maximize investment returns by reducing the impact of fees on overall performance. Identifying low-fee mutual funds involves researching and comparing expense ratios, loads, and other costs associated with each fund.

- Focus on index funds or ETFs that track major market indices, as they tend to have lower expense ratios compared to actively managed funds.

- Consider no-load mutual funds that do not charge sales commissions, allowing investors to allocate more of their capital towards investments.

- Look for funds with expense ratios below the industry average to minimize ongoing management fees.

- Avoid funds with high turnover ratios, as frequent trading can lead to increased costs that are passed on to investors.

Trade-Offs Between Fees and Fund Management Quality

While minimizing fees is important, investors should also consider the quality of fund management when selecting mutual funds. Lower fees do not always equate to better performance, as fund managers play a crucial role in achieving investment objectives. Understanding the trade-offs between fees and fund management quality can help investors strike a balance between cost efficiency and effective portfolio management.

- Evaluate the track record and expertise of fund managers to assess their ability to deliver consistent returns over time.

- Compare the performance of low-fee funds with similar high-fee funds to determine whether the cost savings justify potential differences in returns.

- Consider the investment strategy and risk management practices of fund managers to ensure alignment with your financial goals and risk tolerance.