Yo, diving into the world of Understanding mutual funds, we’re about to break it down for you in a way that’s as cool as your favorite jam. Get ready to roll with us on this financial journey!

So, you wanna know what the deal is with mutual funds? Well, buckle up because we’re about to take you on a ride that’ll have you hooked in no time.

What are mutual funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors.

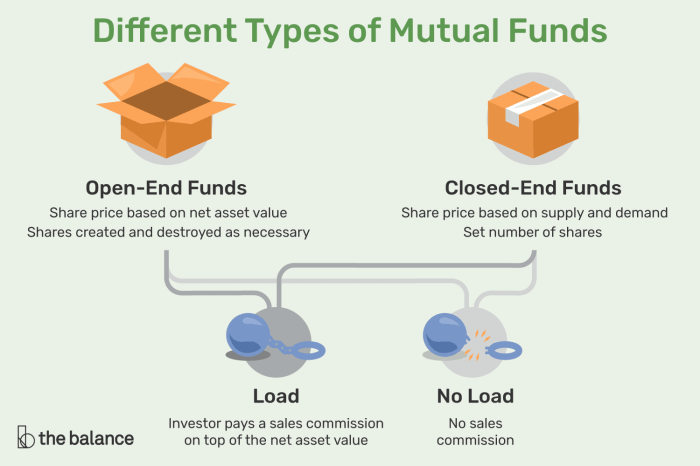

Types of mutual funds

- Equity Funds: These funds primarily invest in stocks of companies, offering high growth potential but also higher risk.

- Bond Funds: These funds invest in fixed-income securities like government or corporate bonds, providing regular income with lower risk.

- Money Market Funds: These funds invest in short-term, low-risk securities like Treasury bills, offering stability and liquidity.

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500, with lower fees.

Comparison with other investment options

- Mutual funds offer diversification by investing in a wide range of securities, reducing individual risk compared to investing in single stocks or bonds.

- Unlike individual stock picking, mutual funds are managed by professionals, providing expertise and research to make investment decisions.

- Compared to ETFs, mutual funds are actively managed, meaning fund managers actively buy and sell securities to achieve the fund’s objectives.

How do mutual funds work?

When it comes to understanding how mutual funds work, it’s important to delve into their structure, the role of fund managers, and how investors can buy and sell mutual fund shares.

Mutual funds are essentially investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, or other assets.

Structure of Mutual Funds

- Mutual funds are managed by professional fund managers who make decisions on buying and selling securities within the fund’s portfolio.

- Investors buy shares of the mutual fund, which represents their ownership in the fund’s assets.

- The value of each share is based on the net asset value (NAV) of the fund, which is calculated at the end of each trading day.

Role of Fund Managers

- Fund managers are responsible for researching and selecting securities to include in the fund’s portfolio.

- They aim to achieve the fund’s investment objectives and maximize returns for investors.

- Fund managers also monitor the performance of the fund and make adjustments to the portfolio as needed.

Buying and Selling Mutual Fund Shares

- Investors can buy mutual fund shares directly from the fund company or through a broker.

- When investors purchase shares, the money is pooled with that of other investors to invest in the fund’s portfolio.

- Similarly, investors can sell their mutual fund shares back to the fund company or on the secondary market.

Benefits of investing in mutual funds

Investing in mutual funds offers several advantages to investors. One of the key benefits is the opportunity for diversification, which helps spread risk across a variety of investments. Additionally, mutual funds have the potential to provide higher returns compared to individual stock investments.

Diversification in mutual funds

One of the main advantages of investing in mutual funds is the built-in diversification they offer. By pooling money from multiple investors to invest in a variety of securities, mutual funds help reduce the risk associated with investing in a single stock. This diversification can help protect investors from significant losses if one particular investment performs poorly.

Potential for higher returns

Mutual funds have the potential to generate higher returns compared to individual stock investments. Since mutual funds invest in a diverse range of securities, they have the ability to capture gains from different asset classes and market sectors. This can lead to better overall returns for investors, especially when compared to the performance of a single stock.

Risks associated with mutual funds

Investing in mutual funds comes with certain risks that investors need to be aware of in order to make informed decisions. Understanding these risks is crucial for managing your investment portfolio effectively.

Market risk

Market risk is the potential for the value of your investment to fluctuate due to changes in the overall stock market. Factors such as economic conditions, political events, and market sentiment can all impact the value of your mutual fund investments. To mitigate market risk, diversification is key. By spreading your investments across different asset classes and sectors, you can help reduce the impact of market fluctuations on your portfolio.

Liquidity risk

Liquidity risk refers to the possibility that you may not be able to sell your mutual fund shares quickly enough at a fair price. This can occur when there is a lack of buyers in the market or when the fund holds investments that are not easily traded. To mitigate liquidity risk, consider investing in mutual funds with high trading volumes and assets that are liquid and easily tradable.

Other potential risks

Aside from market and liquidity risks, there are other risks associated with mutual funds, such as credit risk, interest rate risk, and inflation risk. Credit risk involves the possibility of a bond issuer defaulting on their payments, while interest rate risk refers to the impact of changing interest rates on bond prices. Inflation risk, on the other hand, is the risk that the purchasing power of your investment will be eroded over time due to inflation. To manage these risks, it’s important to carefully evaluate the investment objectives and risk tolerance of the mutual funds you choose to invest in.

Choosing the right mutual fund

When it comes to selecting the right mutual fund, there are several factors that investors should consider. These factors can help determine which mutual fund aligns best with their investment goals and risk tolerance.

Expense Ratios

Expense ratios are crucial when choosing a mutual fund as they directly impact your returns. Lower expense ratios mean more of your money is being invested rather than going towards fees. Look for funds with competitive expense ratios to maximize your returns.

Past Performance

While past performance is not a guarantee of future results, it can still provide valuable insights into how a mutual fund has performed in different market conditions. Analyze the fund’s track record over the years and compare it to its benchmark index to gauge its performance.

Fund Objectives

Understanding the objectives of a mutual fund is essential in aligning it with your investment goals. Different funds have varying objectives, such as growth, income, or a combination of both. Choose a fund that matches your risk tolerance and investment objectives to ensure a suitable fit.

Understanding mutual fund fees

When investing in mutual funds, it’s essential to understand the various fees associated with them. These fees can impact your investment returns, so it’s crucial to be aware of them and know how to minimize costs.

Types of Fees Associated with Mutual Funds

- Management Fees: These fees are charged by the mutual fund company to manage the fund’s investments. They are typically a percentage of the fund’s assets.

- Expense Ratios: This is the annual fee charged by the fund to cover operating expenses. It is expressed as a percentage of the fund’s average net assets.

- Load Fees: These are sales charges either when you buy (front-end load) or sell (back-end load) mutual fund shares.

- Transaction Fees: These fees are charged when you buy or sell shares in a mutual fund. They can vary depending on the type of transaction.

Impact of Fees on Investment Returns

High fees can eat into your investment returns over time. For example, if you have a mutual fund with an expense ratio of 1%, and the fund returns 7% annually, your actual return would be 6% after accounting for fees.

Minimizing fees can significantly increase your overall investment returns in the long run.

Tips to Minimize Costs When Investing in Mutual Funds

- Choose No-Load Funds: Opt for mutual funds that do not charge load fees, as these can significantly reduce your investment returns.

- Look for Low Expense Ratios: Compare expense ratios of different funds and choose ones with lower fees to save on costs.

- Consider Index Funds: Index funds typically have lower fees compared to actively managed funds, making them a cost-effective investment option.

- Regularly Review Your Portfolio: Keep an eye on your mutual fund fees and consider switching to lower-cost alternatives if necessary.